Startup Financial Model from 10+ Fast-Growing Companies

A startup financial model is essential to give a founder and investors an idea of what the business can grow to, how much capital they will require to start, and the profitability associated with the business. It is a well-organized financial model that will give you an idea of revenues, expenses, and cash flows and give you a clear map of how to scale. This guide will discuss startup financial models based on the examples of more than 10 rapidly expanding companies in various industries. We will also discuss such tools as Free Pitch Deck Templates, Financial Modeling in Excel, and the way to make Pitch Decks that will impress investors.

What is a Startup Financial Model?

It is important to know what financial modeling is before delving into illustrations. A financial model is a tool that anticipates the financial performance of a firm based on past data, and assumptions regarding future growth. In the case of startups, it is a mandatory possession of:

- Budgeting and cash flow planning.

- Knowledge of break-even levels.

- Winning investors with achievable estimates.

- Promoting fundraising by means of a catchy pitch deck.

Financial modeling in excel is the most popular one as it still gives enough flexibility to model various scenarios and growth strategies.

Quick access to our best Financial Model Templates:

- Beverage Company Financial Model

- Financial Model for BPO Company

- Financial Model for Car Repairing Company

- Financial Model for K-12 Edtech Company

- Financial Model for Kids Brand

- Financial Model for SaaS Company

- Retail Company Financial Model

- Sample Financial Model of Fintech Startup

- Sample Financial Model of FMCG Brand

- Travel & Tourism Financial Model

- Waste Management Financial Model

These are our best 10+ Startup Financial Model:

1. Beverage Company Financial Model

Beverage Company Financial Model is created to assist the start-up in the beverage industry across the world to predict sales, costs of production, expenditure on marketing, and the efficiency of the distribution channel. As the market of soft drinks worldwide is projected to grow to 1.9 trillion dollars by the year 2027, the model enables founders to predict the trends of demand, price management, and also cope with the seasonal changes in production and sales of the drink. It particularly comes in handy when the startup is releasing niche drinks, craft beverages, or health orientated products.

Industry: Food & Beverage

Business Model: Beverage (retail and wholesale) production and sale.

2. Financial Model for BPO Company

BPO Financial Model offers a model to startups to estimate employee expenses, client payment cycle and income per project. As the worldwide BPO market is estimated to expand to over $350billion by 2028, cost management and scalability are of high importance. The model assists founders to maximize labour utilization, monitor client profitability, and long-term expansion in service-based companies.

Industry: Business Process Outsourcing (BPO).

Business Model: Business Outsourcing.

3. Financial Model for Car Repairing Company

Car Repairing Company Financial Model helps in the startup predicting labor, parts inventory and service revenue. With the rising number of cars and cars getting old, the automotive repair industry is a global market worth almost 450 billion dollars in revenue. This model suits best to shops that seek to expand operations, implement subscription maintenance packages, or the multi-location services.

Industry: Automobile / Services.

Business Model: Car repair and maintenance services.

4. Financial Model for K-12 Edtech Company

4. Financial Model for K-12 Edtech Company

K-12 Edtech Financial Model is concerned with subscription revenues, acquisition costs of students, and the profitability of courses. Online learning and hybrid classrooms will propel the global EdTech market to exceed 500 billion by 2030. The model can be used by startups to forecast student growth, retention, and lifetime value and direct investments in marketing and content development.

Industry: EdTech / Education

Business Model: Online K-12 business model.

5. Financial Model for Kids Brand

The Kids Brand Financial Model is designed to meet the needs of a start up that sells children products, predicts inventory, seasonal demand, and returns on marketing. The children products market in the world is estimated to reach 400 billion and the knowledge on unit economics is crucial towards competing with the already established brands. The model assists founders in the scaling of the product lines, supply chain management and pricing strategy optimization.

Market: Kids/ Consumer Products.

Business Model: Children toys, clothing and accessories.

6. Financial Model for SaaS Company

The SaaS Financial Model helps startups to monitor recurring revenues, churn, customer acquisition cost (CAC), and lifetime value (LTV). As the global SaaS market is estimated to amount to 307 billion dollars in 2026, subscription-based software enterprises must have precise forecasts to satisfy investors and achieve growth in the most efficient way. The model is critical in scenario planning, pricing strategies and presentation to investors.

Industry: Software / SaaS

Business Model: Software solutions, based on subscription.

7. Retail Company Financial Model

7. Retail Company Financial Model

The Retail Company Financial Model enables startups to estimate the sales of a store, e-commerce sales, inventory, and the cost of operations. The retail market in the world will be higher than 30 trillion in the year 2030, hence effective financial planning is essential. The model assists startups to handle multi-channel business, plan store wideness, and control inventory among others to enhance cash flow and profitability.

Industry: Retail / E-commerce

Business Model: Online and brick and mortar retailing.

8. Sample Financial Model of Fintech Startup

The Fintech Financial Model estimates the volume of transactions, interest, and operating costs, which startups can use to realize the extent of scalability and profitability. As the global fintech market is estimated at 300 billion and continues to expand at a very high pace, proper financial modeling is necessary to navigate between regulatory compliance, operational expenses and investment opportunities.

Industry: FinTech / Finance

Business Model: Digital financial services and banking.

9. Sample Financial Model of FMCG Brand

FMCG Financial Model emphasizes on sales quantity of high volume, efficiency of the supply chain and ROI of the marketing. The global FMCG market is estimated to attain a size of above 15 trillion in the year 2027 and thus proper forecasting of production costs, distribution margins, and promotional expenditures is of paramount importance to new entrants intending to compete at the global level.

Industry: FMCG / Consumer Goods.

Business Model: Producing and selling of consumer goods.

10. Travel & Tourism Financial Model

10. Travel & Tourism Financial Model

The Travel & Tourism Financial Model is used to enable startups to estimate the booking volumes, seasons and partner revenues. The global travel and tourism market has a value of over 9 trillion and when the pandemic is over, there are opportunities of recovery and growth. The model aids in making decisions based on pricing, marketing, and capacity management of a startup that provides bookings, experience, or a travel package.

Industry: Travel & Tourism

Business Model: Travel booking and experiences.

11. Waste Management Financial Model

The Waste Management Financial Model is aimed at predicting logistics, equipment and investment, operational expenses and revenue of recycling waste management. As the global waste management market is estimated to be worth 530 billion by 2028, this model assists the startups to plan sustainable operations, routes, and analyse profitability on various service lines.

Industry: Waste and Environmental Management Industry.

Business Model: The collection, recycling and disposal of waste.

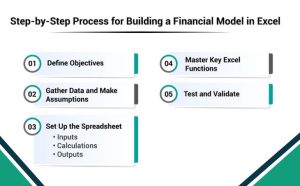

How to Build a Startup Financial Model

How to Build a Startup Financial Model

Creating a financial model may seem daunting and it does not have to be. Focus on these steps:

- Gather Past Data (where possible): revenues, costs and customer statistics of previous operations.

- Define Assumptions: Growth rates, pricing, unit economics, market trends.

- Construct Revenue Projections: Dis-aggregate by product, service or subscription plan.

- Estimate Costs: This entails fixed, variable, and semi-variable costs.

- Computing Cash Flow: It is important to always have the amount of money at hand to operate.

- Add KPIs: KPIs such as CAC, LTV, gross margin, and burn rate to demonstrate startup health.

- Scenario Planning: Develop various scenarios (best scenario, worst scenario, expected scenario) in order to predict risks.

Common FAQs About Startup Financial Models

1. What is a startup financial model?

It is a systematic tool that presents the financial performance of a company in terms of assumptions and data. It assists the founders in planning growth and investors assessing risk.

2. Why do startups need a financial model?

Financial models:

- Display the profitability and cash flow.

- Fundraising activities.

- Budgeting and scaling assistance.

- Give measures to monitor the performance.

3. How detailed should it be?

It must be comprehensive enough to provide confidence to the investors but easy enough to read immediately. Target important indicators, revenue, expenses, and cash flow.

4. Can I use templates?

Yes! Free Excel templates or pre-built models for specific industries (like SaaS, Retail, Edtech) can save time. You can customize assumptions to match your startup.

Why a Financial Model Matters

A strong financial model:

- Make investors trust your forecasts.

- Assists in strategist expansion.

- Expects gaps in cash flow and financing requirements.

- As a guide to your business milestones.

Takeaway

It does not require any major scramble to construct a startup financial model. In Beverages, SaaS, Retail, Edtech, or Waste Management, the correct model with the assistance of Free Pitch Deck Templates and Excel financial modeling can assist you in planning the growth, finding investors, and expanding your start-up successfully.

With knowledge gained via 10+ fast-growing companies, you can build a financial roadmap that is realistic and appealing enough to your business.

7. Retail Company Financial Model

7. Retail Company Financial Model