Spotify Success Story: Growth & Competition

In 2023, Spotify witnessed unprecedented success in both revenue growth and subscriber acquisition, with a record-breaking 31 million premium net adds and a surge of 113 million Monthly Active Users worldwide. Despite operational losses, Spotify plans to enhance profitability in 2024 through focused efforts on efficiency and monetization. While dominating the competitive music streaming landscape, Spotify faces challenges from rivals like Apple Music, prompting legal battles over fair competition. FundTQ’s analysis suggests Spotify may be overvalued, a sentiment echoed by its significant stock surge post Q3 2023 earnings. However, Spotify remains resilient, leveraging its vast music catalogue and user-friendly interface to maintain its leading position amidst industry competition and regulatory hurdles. Explore the Spotify success story with FundTQ’s analysis.

Record-breaking Success: Subscribers & Revenue Soar

One of the Most Important years in the history of Spotify is 2023 with unmatched successes in revenue growth and subscriber acquisition. By reaching a record-breaking 31 million premium net adds, Spotify proved that it could effectively turn free users into premium members, which improved its financial results. An amazing hike in Monthly Active Users (MAUs)—a total of 113 million more worldwide—further fueled this rise. These numbers demonstrate not only Spotify’s broad appeal but also how well it engages users in a variety of markets.

Profitability

Even though Spotify posted a loss in its operational cost in 2023, the company is expected to have improved financial results. In 2024, the corporation plans to sharpen its focus on efficiency and monetization. Spotify intends to increase its revenue through strategic price adjustments. Additionally, it plans to achieve this through the launch of new products. Moreover, it aims to do so through better resource management, building on its strong user base.

Navigating the Streaming Landscape

With a substantial share of the global market, Spotify is the industry leader in music streaming. Competing companies such as YouTube Music, Amazon Music, and Apple Music pose a threat to this dominant position. Each competitor has certain advantages for example, Amazon Music’s connection to Amazon Prime is one advantage. Another advantage is Apple Music’s extensive interaction with iOS devices. Spotify’s large music catalog, easy-to-use interface, and customized playlists enable it to stay ahead of the competition.

Spotify’s Legal Dispute with Apple

Because of Spotify’s complaints about Apple Music’s business methods, Apple is facing an EU lawsuit and a $2 billion fine. Spotify’s main grievance is on Apple’s purported preferential treatment of Apple Music and its dominance over the iOS ecosystem. This lawsuit serves as a reminder of the continuous struggle for honest competition in the field of digital music streaming.

FundTQ’s Analysis

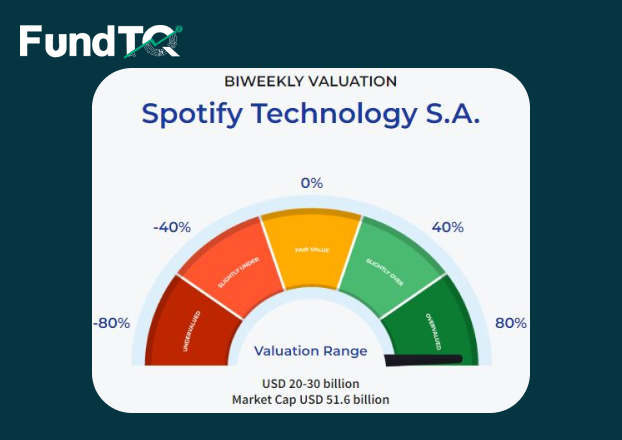

According to FundTQ’s analysis, Spotify might be overpriced. While Trading Comparables suggest a valuation range of USD 16–21 billion, the Discounted Cash Flow (DCF) assessment places Spotify’s value at USD 28.6 billion. Spotify’s stock had a notable upswing after the company revealed surprise earnings in Q32023; in the five months since the data were released, the stock has increased by almost 60%. The market’s jubilant reaction to Spotify’s surprising profitability and an optimistic outlook for the company’s financial future seem to be the root causes of this overvaluation.

Check Your Business Valuation for Free

Conclusion

In 2023, Spotify experienced significant growth in both revenue and subscribers. Nevertheless, a loss in operating cost as a result of strategic investments was also observed.. In order to turn a profit in 2024, the corporation is concentrating on monetization tactics. Spotify is a major participant in the music streaming business, showcasing its Spotify success story amidst competitive challenges.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. None of the information contained herein constitutes a solicitation, offer or recommendation to sell or buy any financial instrument.

Also Read – About Business Valuation