Hello founders, entrepreneurs and startup enthusiasts! It probably means that you are here on the search to find a free pitch deck template, pitch deck template free download, or pitch deck templates free on Google Slides. You may also be considering pitch deck template PPT free download, or just a free pitch deck template download next time you need to raise new capital in India. Fortunately, you are at the right place.

In this all-inclusive guide you will find:

- Why a free pitch deck template is a good idea (and what to be wary of).

- What are some of the important slides and format of your pitch (so that your deck matches what the investors would want)

- Where to find the quality of free pitch deck templates (including Google Slides / PPT variations)

- The way the deck connects to the business fundraising services, investment banking services, and the overall startup funding in India.

- Ideas and advice to make your free template personal so that you do not simply download the so-called nice slide but create a powerful story to the investor.

How a free pitch deck template fits into the startup fundraising journey in India

Let’s dive in.

Why Use Free Pitch Deck Templates?

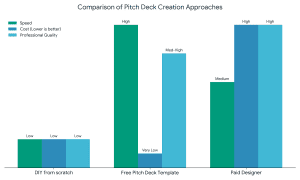

bar chart comparing free pitch deck template vs paid designer vs DIY pitch deck

#1 Speed & Professionalism

Time is money when it comes to a start-up. The presence of a pitch deck template free or a free pitch deck template gives you the freedom to start your presentation with a pitch deck template. Effective slide layouts, uniform colour scheme and investor friendly structure is already implicated in good templates.

In the case of early stage founders in particular, this allows you to invest in content (story, traction, financials) instead of design.

#2 Cost-Effective

In different parts of the world such as India where most of the startups are bootstrapped or at an early stage, it is not always possible to spend large amounts of money on design. Granting free access to good design can be done using a free pitch deck template download or free pitch deck template Google Slides version where the money saved can be allocated to other important things (tech, staff, marketing).

#3 Investor Expectations Congruence.

Structures embedded in templates provided by experienced providers tend to be the ones that meet the expectations of the investors. For example, what is going to slide, storytelling, displaying the size of the market, problem/solution, traction etc. With a good template you increase your odds of your deck being investor-ready and not just pretty.

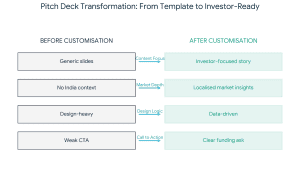

#4 Risk of Over-Reliance

But, there is a catch, though — applying a free template does not imply that the work is over. You still need to be able to make the existing content about your startup, your market in India (or wherever you are operating), your funding request, your metrics. When you just plunk your numbers in a standard format and hope, it will not work. One investor in a forum said:

A deck is meant to arrange a face-to-face meeting, it is not your complete resume.

Then select a template carefully, then personalise intensively.

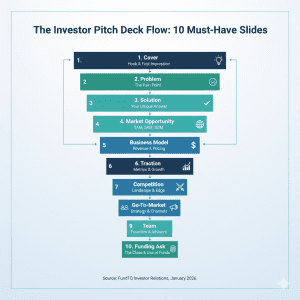

What Should Your Pitch Deck Contain?

When the pitch deck free template or pitch deck free startup template is in use, ensure it contains the essential items that investors would require more so considering the environment of investing in India and dealing with business fundraising or investment banking services.

The major slides/sections are the following with a short explanation:

1. Cover / Introduction

- Startup name, tagline, logo.

- A single sentence value proposition that simply tells what you do, to whom, and why it is important.

- First, ensure that your opening slide is powerful. Additionally, the initial slide should tell the story of the business in easily comprehended, straightforward language, as highlighted in one of the articles.

2. Problem

- What is the pain/need in the market?

- Who suffers from it? How big is the issue?

- It is preferable to use actual stories or data.

3. Solution

- What your product/service solves the problem.

- Use images or screenshots where necessary.

- Why is your solution unique?

4. Market Opportunity / Size

- What is the Total Addressable Market (TAM), Serviceable Available Market (SAM), Serviceable Obtainable Market (SOM)?

- In India, it assists in localising the numbers (India TAM + global provided you have global ambition).

- Investors are interested in determining that the opportunity mattered.

5. Business Model

- How you make money.

- Sources of revenue, prices, channels of sale.

- Connect this to actual measurements, not a we will charge it later.

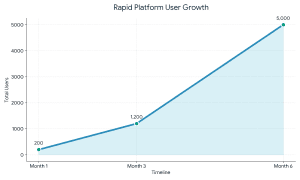

6. Traction / Metrics

- What you have already accomplished: users, revenue, growth rate, partnerships.

- At least when you are still in the early stages, demonstrate something (pilot results, customer testimonials, etc).

- One of the founders of Reddit pointed out:

Demand some evidence that you are going the right way… No vanity metrics.”

7. Competitive Landscape

7. Competitive Landscape

- Who does the same? How do you compare?

- Showcase your strengths (team, technology, go-to-market, cost structure).

- Competition that is not discussed can be a cause of concern: “Unless other people are doing it, is the market there?

8. Go-To-Market Strategy

- What will be your strategy of getting customers?

- What are your marketing/sales channels? What are the costs?

- Local context (distribution, regulation, partnerships) is useful to outline, particularly in India.

9. Team

- Who are the founders? Their background. Why are they the right team?

- Mention key advisors (let go lost) in case you have an advisory board.

10. Funding Ask & Financial Projections.

- Level 3-5 years projection: sales, expenses, profitability (or trend).

- Upon funding request: what you require, how you will utilise it (milestones).

- When it comes to investors, this is what they want to know: how you are going to use the money, when it will be the next milestone.

11. Closing / Call to Action

- Thanks slide, contact details, action plan.

- Keep it crisp.

Where to Find the Best Free Pitch Deck Templates

When looking to find a free pitch deck template, pitch deck template free download, or free Google Slides pitch deck templates, these are effective ways to find one:

- Sites where PPT/Google Slides can be downloaded (verify that licence is free).

- Specific startup / fundraising templates. As an example, the cited resources include 35+ best pitch deck startups + free PDF downloads.

- Make sure the template has layouts that can be edited, content and designed.

Tips when choosing:

- Find PPT + Google Slides (then you can edit in Google Drive, in case you want to).

- Make sure that the number of slides is not too many (10-20 slides is a typical case) but not too many.

- Ensure that the style of design is professional but not complicated (not too many details, few words, clear images).

- Ensure that the call to action or funding ask slide is present (significant in preparing investors).

- Check that the template is easily customised to your brand (colours, logo, fonts).

- Do not use templates that appear too generic or badly free in appearance – investors can detect this.

How This Links to Investment Banking Services & Business Fundraising Services in India

When you are in India and considering raising funds to start your startup, it is worth knowing how your free pitch deck templates fit in the larger ecosystem.

Investment Banking Services Role.

Although we tend to think of investment banking services to be offered to large companies, in the case of most startups the services encompass: preparing the investor materials, valuation advice, fund round structuring, institutional investor/VC introduction, due diligence support. Having a good pitch deck (created using a free pitch deck template but modified), puts you in a better position when undertaking such processes.

For instance:

- Your deck leads to the first investor outreach (the teaser).

- Investment banking advisors can refreeze the deck, rehearse you, polish the numbers, structure the task.

- They can assist in wrapping your fundraising proposal in a way that would be attractive to the local Indian investors as well as foreign investors.

- Therefore: you start with a powerful free pitch deck template; you can add value to that by using professional fundraising services.

Business Fundraising Services

Same concept: various start-ups request agencies or consultants to assist in business fundraising (preparing financial models, investor presentations, term sheets, etc). The pitch deck is the key element of that material set. Therefore: the more the better you tailor your free startup pitch deck template, the easier your fundraising is.

Startup Funding in India

When in the Indian context, you should make your deck reflect market realities: regulatory environment (fintech, edtech etc), distribution and logistics issues, domestic costs of user acquisition, domestic competition (India vs global). When you are downloading a business pitch deck template free, you should make it an Indian one: state Indian market size, Indian case studies or pilots, your India-specific go-to-market. That will be well received by investors in India.

Free download of pitch deck templates will allow you to concentrate on the Indian content and not the design. So, when you are looking to fund (seed, angel, Series A), your deck will be next to term sheets, communication to your investors: therefore you want templates that are clean, flexible, and transformer friendly.

Best Free Pitch Deck Templates: What to Look For

When comparing several pitch deck templates that are free:

- Is it investor-centric (problem 2 solution market business model traction team ask)?

- Can it be edited in Google Slides (to work collaboratively) and PowerPoint?

- Does it have a visual appearance of modernity, simplicity and legibility (on screen and PDF)?

- Does it have specific financial and funding ask slides (not generic)?

- Is the template too generic to be adapted but too specific to be pointless (not 100 slides of fluff)?

- Is it easy to export (PDF, share link) since most Indian investors demand PDF decks?

When selecting the best free pitch deck templates you can compare a few; the one you can customise easily, you can make your story clear and the one that does not draw attention to itself.

Step-by-Step: Using a Free Pitch Deck Template

It has a simple workflow of how to download a free pitch deck template, making it a mission-ready investor deck.

1. Download & Review the Template

Select a nice free pitch deck template or free Google Slides pitch deck templates version. Open it, review all slides. Add or delete slides according to the needs of your business.

2. Customise Branding & Style

Insert blanked out logo, use your brand colours (where applicable). Make fonts readable on-screen and off.

3. Craft the Story Content

- Issue: applicable to your target market (India/global).

- Problem: what you make, how it is special.

- Market: TAM/SAM/SOM (Include Indian context where relevant).

- Business Model: the way you make a profit.

- Traction: measurements, initial users, collaborations.

- Team: emphasize founder credibility.

- Questions: Amount raised, fund use, milestones.

Make every slide have one-line titles to ensure even when an investor is in a hurry to look through the presentation, he/she understands the message.

4. Visuals & Data

Use charts, icons, screenshots where possible. Effort to demonstrate actual data or be what you say. Avoid large blocks of text. As referenced by the guide:

“Be straightforward… Prioritise story over stats. Pitch decks should be short and informative.

5. Customize to your Audience/ Market.

When you are trying to raise money in India, make sure that the deck has references to Indian market size, local regulatory or competitive environment, Indian go-to-market plan. Also note how your startup is or will be linked or utilize local talent, cost structure, distribution, etc.

6. Collaborate & Iterate

Send the deck to mentors or advisors (or your business fundraising / investment banking services team). Get feedback, iterate, refine. You can use the initial investor surveys to enhance it significantly.

7. Export & Prepare for Presentation

Complete layout, export to PDF and retain editable version (Google Slides or PPT). Check all fonts, graphics are good. Ready to make it part of your fundraising package (in addition to the executive summary, business plan, term sheet), to investors in India or overseas.

8. Rehearse the Pitch

Your pitch is facilitated by the deck. It should be able to be presented within approximately 10-15 minutes, which should focus on the key slides and tell the story as opposed to slide reading. As one article pointed out: Various investors operate in various structures … What you need to be trying to do is to make the investor believe that some of his money needs to be invested in your business because it will multiply…

FAQs & Common Mistakes to Avoid

Q: Is it possible to use any free pitch deck template?

A: Yes, but make sure that it matches your business stage (seed, angel, Series A), and your market (India/global). Other templates are generic; they will still need to be customised on a profound level.

Q: How many slides is too many?

A: There is no strict guideline, but most investors would like it to be between 10-20 slides. Longer decks will be dilutive to concentration. One of the sources suggests that there might be enough slides (12).

Medium

Q: Is detailed financial modelling required?

A: Add top-level projections and important measures; you will not need 100 pages of spreadsheet in the pitch deck, but you must be ready to provide detailed models as needed.

Q: What are the errors founders commit?

A: Some common ones:

- Overloading the slides with text, rendering it illegible.

- Applying a generic template without personalising it to their story.

- Lacking Indian sensitivity in bringing up in India (or local market)Failure to specify funding seek and milestones.

- Lacking traction or plausible figures.

Q: What is the relationship between this and business fundraising or investment banking services?

A: Your deck is the main document you are going to use in fundraising. If you use professional services (such as business fundraising or investment banking), then they will analyse, polish, and match your deck with investor market expectations—whether in India or globally. Therefore, visualise the deck as your ticket to investor meetings. Moreover, the more beautiful and polished it is, the more likely you are to get into meetings with quality investors and, consequently, get good terms.

Summary

To conclude: no matter how many times you have sought free pitch deck templates, pitch deck template PPT free download, free Google Slides pitch deck templates or even a pitch deck free template to raise funding on your startup in India, the trick here is to pick a robust template, tailor it to your narrative and market, match it with investor expectations, and back it up with good content, numbers and visuals. In this way, you will fit seamlessly into the larger fundraising ecosystem. For example, by documenting in front of your future investors and by using business fundraising services or investment banking services to structure your round. Moreover, use the deck to clearly answer why your startup, why now, why you, and why me (the investor). Then you have the base of the next step, outreach, negotiations, closing.

To conclude: no matter how many times you have sought free pitch deck templates, pitch deck template PPT free download, free Google Slides pitch deck templates or even a pitch deck free template to raise funding on your startup in India, the trick here is to pick a robust template, tailor it to your narrative and market, match it with investor expectations, and back it up with good content, numbers and visuals. In this way, you will fit seamlessly into the larger fundraising ecosystem. For example, by documenting in front of your future investors and by using business fundraising services or investment banking services to structure your round. Moreover, use the deck to clearly answer why your startup, why now, why you, and why me (the investor). Then you have the base of the next step, outreach, negotiations, closing.

Ready to get started? I can also point you to some of the best free pitch deck templates (Google Slides + PPT) on the market today, and can even go as far as to customise one to your Indian-startup situation.

Image Source: Entrackr

Image Source: Entrackr

7. Retail Company Financial Model

7. Retail Company Financial Model

7. Competitive Landscape

7. Competitive Landscape

To conclude: no matter how many times you have sought free pitch deck templates, pitch deck template PPT free download, free Google Slides pitch deck templates or even a pitch deck free template to raise funding on your startup in India, the trick here is to pick a robust template, tailor it to your narrative and market, match it with investor expectations, and back it up with good content, numbers and visuals. In this way, you will fit seamlessly into the larger fundraising ecosystem. For example, by documenting in front of your future investors and by using business fundraising services or investment banking services to structure your round. Moreover, use the deck to clearly answer why your startup, why now, why you, and why me (the investor). Then you have the base of the next step, outreach, negotiations, closing.

To conclude: no matter how many times you have sought free pitch deck templates, pitch deck template PPT free download, free Google Slides pitch deck templates or even a pitch deck free template to raise funding on your startup in India, the trick here is to pick a robust template, tailor it to your narrative and market, match it with investor expectations, and back it up with good content, numbers and visuals. In this way, you will fit seamlessly into the larger fundraising ecosystem. For example, by documenting in front of your future investors and by using business fundraising services or investment banking services to structure your round. Moreover, use the deck to clearly answer why your startup, why now, why you, and why me (the investor). Then you have the base of the next step, outreach, negotiations, closing.