Mergers & Acquisitions Explained: The Role of Investment Banks in M&A Deals

In the modern business environment where business entities are in high competition and striving to achieve faster growth, diversify operations, and enhance market presence, business entities seek Mergers and Acquisitions (M&A) to achieve their objectives. Globalization and aggression among competitors in industries is causing M&A activity to extend across different industries and the size of businesses. Companies seek investment banks to navigate through such complex transactions so as to unlock the maximum value.

These financial institutions play a crucial and often decisive role in executing M&A deals successfully.

What Are Mergers and Acquisitions?

Mergers and Acquisitions (M&A) refer to the process where companies or their key assets are combined through financial transactions. This can happen in several ways:

- Buy and fully absorb another company

- Merge with another company to create a new combined entity

- Acquire some or all of another company’s major assets

- Make a tender offer to purchase the company’s shares directly from shareholders

- It may carry out a hostile takeover, even without the target company’s approval

All these methods fall under M&A activities, as part of broader SME growth strategies, where businesses are combined or restructured. The term M&A also refers to the specialized departments in financial institutions that help plan, advise on, or conduct these transactions.

What Do Investment Banks Do in M&A Deals?

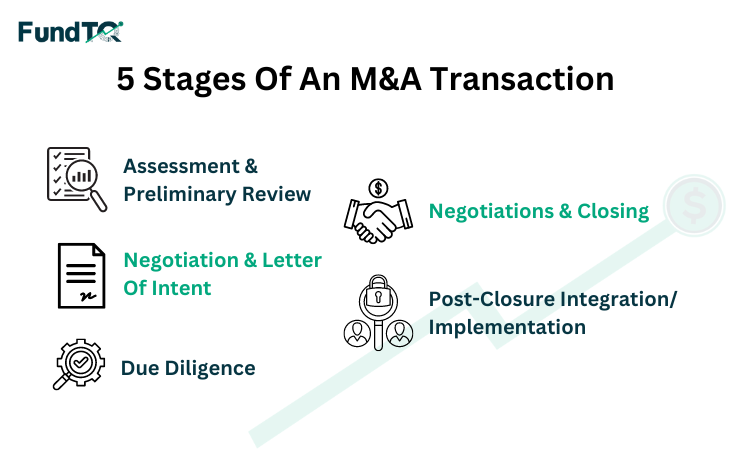

During the stages of M&A, various strategic, financial, legal, and operational issues must be handled. A well-organized, professional structure has been ensured through the involvement of investment banks. These are the roles that are normally executed:

1. Deal Origination and Strategy

Investment banks conduct extensive research on the industry, and through networking, as well as their databases, suitable targets or buyers have been identified. Strategic justification of the deal has also been carried out, such as the identification of synergies and matching them to the long-term corporate interests.

2. Company Valuation

Fair valuations have been determined using financial models and analysis of previous transactions to create precedent and discounted cash flow (DCF) products to determine fair valuations. Valuation services offered through mergers and acquisitions services have helped stakeholders understand both standalone and synergistic values.

3. Diligence Organization

Investment banks have orchestrated due diligence processes that have been financial, legal, tax, commercial, and operational in nature. Outside experts in third-party companies are often called in to do the specialist work, and it has been managed centrally by the bank on matters of coordination and integration of the results.

4. A Deal Plan

Designers structured equity swaps along with asset purchases, stock leveraged buyouts, equity mergers, and stock-for-stock mergers. They considered taxation, regulatory compliance, and future exit routes during the process.

5. Negotiation & Execution

The investment bank has facilitated the discussion of the price, payment terms, representations, warranties, and indemnities. It has also addressed legal documentation, coordination with various parties, including lawyers, accountants, regulators, etc.

At every phase, Strategic insights have always been combined with tactical focus at each step to make sure that there is not only alignment between stakeholders but also an optimal result.

Buy-Side vs. Sell-Side Advisory in M&A

Investment banks can be retained by either party in a transaction. They provide two distinct, yet related, services:

Buy-Side Advisory

On the buy side, the investment bank has worked with companies or investors looking to acquire other businesses. This has involved:

- Initial outreach and maintaining confidentiality.

- Conducting valuation and detailed business project operations.

- Negotiating and ensuring the transaction closes.

- Buy-side engagements are usually sought after by the private equity firms, large enterprises, or multinational companies, looking to acquire to expand.

Sell-Side Advisory

With sell-side engagements, the investment bank has been retained by companies, founders, or institutional shareholders looking to sell either a whole or partial stake in their company. Their responsibilities included:

- Creating investment teasers and information memorandum

- Run competitive bidding processes

- Filtering potential buyers and communicating

- Managing due diligence and closing the transaction

During the sell-side process, keeping information private, working efficiently, and realising value have been the main priorities.

Buy-side modeling vs sell-side modeling :

Investment bankers on the sell-side and private equity professionals on the buy-side build M&A models to estimate transactions. Bankers create models that they share with potential buyers of the business. These models must be highly presentable, easy to understand, and usable by all involved parties. Although this model will be provided to firms on the buy side by the banks, they will usually develop their financial model to have 100 percent assurance in the analysis.

Why Companies Rely on Investment Banks for M&A?

M&A are always a high-stakes transaction. They require financial expertise, industry comprehension, and negotiation skills. Organizations, especially ones with limited internal resources, have relied upon investment banks for:

1. Expertise

All relevant disciplines – finance, the law, tax, and regulation have been roofed under one supplier. They have read market dynamics and the mood of investors to help companies make better decisions.

2. Access

Relationships with types of investors, corporate, and private equity firms have allowed investment banks to develop qualified leads and generate competition in the auction.

3. Confidentiality

Investment banks have handled sensitive information discreetly to prevent speculation in the marketplace and disruption internally. They have consistently enforced NDAs are more importantly controlled who sees the buyers’ list so companies can maintain their strategic opportunities for as long as possible.

4. Efficiency

They have managed the timeline, from documentation all the way through to scheduling and negotiation. We expedited processes that typically take months, reducing the risk of execution

5. Negotiation Power

Effective support for companies during the negotiations has been provided by the bankers as strategic advisors – this added the correct dose of neutrality. This has enabled companies to have the proper level of rational pricing discussions and improved negotiations.

Conclusion:

The world of M&A has been shaped by the shifting markets, changing regulations, and increasing investor movements of the day. In this complicated environment, successful deal results have depended heavily on someone skilled in the advisory role that investment banking services provide.

For businesses, at any stage, whether it’s mergers, acquisitions, or fundraising, an accurate valuation process goes hand-in-hand with effective deal structure and strategy!

Try FundTQ’s free business valuation calculator to get instant insights, industry benchmarks, and investor-ready reports.

Key Takeaways:

- Companies merge through strategic processes, and acquisitions result in changes of ownership carried out deliberately.

- An investment bank is very important in all the processes, such as sourcing, valuation, due diligence, structuring, and execution of the deals.

- Investment banks are advisers on either the buy-side or the sell-side.

- Companies rely on investment banks for their expertise, market access, confidentiality, efficiency, and bargaining power.

FAQs

1. What is the role of investment banks in M&A?

Investment banks recommend mergers, design them, and provide the same. They also give valuation, due diligence coordination, strategic analysis, and due diligence to the negotiations.

2. What does a buy-side value-added investment bank do in M&A?

Added value was brought by them, such as identifying the appropriate acquisition targets, negotiating acceptable terms, and finally seeing that due diligence and the closing of the transaction take place well.

3. Is it just large companies that can avail of M&A services?

Mid-market and emerging companies actively engage mergers and acquisition advisory services to pursue strategic expansion, exit strategies, or reorganisations.

4. What then is the difference between consulting and investment banking when it comes to M&A?

Investment banks specialise in making deals, valuations, and capital structuring. The consulting firms, in turn, are more interested in the post-merger integration and business strategy.

5. Is it possible to use investment banks in cross-border M&A?

Yes. Global investment banks have capabilities of crossing borders, such as compliance knowledge, cultural alignment assistance, and a global network of investors.