FundTQ Advises StepOut on Successful Fundraise Led by Rainmatter by Zerodha

AI Sports Tech StepOut Funding: FundTQ Advises Rainmatter-Led Round

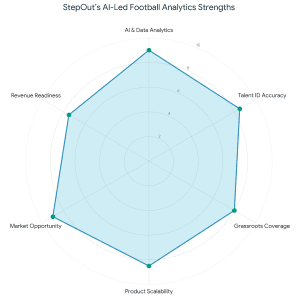

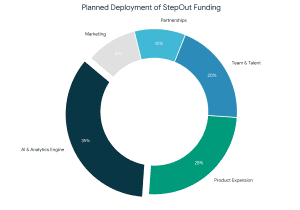

StepOut, an AI-driven sports technology platform redefining football analytics and talent development, has successfully closed its recent funding round led by Rainmatter by Zerodha, with participation from SucSEED Ventures, Misfits Capital, and Marwah Sports Pvt. Ltd. FundTQ acted as the exclusive deal advisor to StepOut, supporting the company across the entire business fundraising process. StepOut is building a data-first football ecosystem using artificial intelligence to enable smarter performance analysis, talent identification, and scouting solutions for academies, clubs, coaches, and athletes. By combining deep football domain knowledge with scalable technology. The platform addresses a critical gap in objective decision-making within grassroots and professional football. The successful fundraise marks a key milestone in StepOut’s growth journey. The newly raised capital will be utilized to strengthen its AI and analytics engine, expand product offerings, scale operations, and build deeper relationships across football academies and leagues. The round also reflects strong investor confidence in StepOut’s fundamentals, market opportunity, and long-term vision—underpinned by disciplined financial planning and robust business valuation frameworks.

During the transaction, FundTQ worked closely with the StepOut founding team on multiple aspects of the raise. Including refining the equity narrative, preparing investor-ready pitch deck templates, validating financial models, and engaging with aligned strategic and institutional investors. The focus remained on building long-term value rather than short-term capital, ensuring the right fit between founders and investors.

During the transaction, FundTQ worked closely with the StepOut founding team on multiple aspects of the raise. Including refining the equity narrative, preparing investor-ready pitch deck templates, validating financial models, and engaging with aligned strategic and institutional investors. The focus remained on building long-term value rather than short-term capital, ensuring the right fit between founders and investors.

The participation of Rainmatter by Zerodha brings strategic depth to StepOut’s cap table. Offering not just capital but also long-term guidance in building scalable, technology-led businesses. The investor consortium is expected to support StepOut. It accelerates product innovation and expands its footprint within India’s rapidly growing sports tech ecosystem.

Stepout Funding Round

Reflecting on the engagement, the FundTQ team shared that their early interactions with StepOut stood out due to the founders’ clarity of purpose, execution discipline, and strong understanding of both technology and the football landscape.

“StepOut represents the next generation of sports technology platforms—deeply analytical, mission-driven, and scalable. Working with founders who are open to feedback, data-oriented, and focused on long-term impact makes the fundraising journey highly collaborative. We are excited to have partnered with StepOut and look forward to seeing the platform transform football analytics and talent development.”

This transaction reinforces the idea that effective fundraising goes beyond capital infusion. It is about trust, alignment, execution quality, and founders who consistently show up to build enduring businesses. With a strong investor base and a clear growth roadmap. StepOut is well-positioned for its next phase of scale and impact.

This transaction reinforces the idea that effective fundraising goes beyond capital infusion. It is about trust, alignment, execution quality, and founders who consistently show up to build enduring businesses. With a strong investor base and a clear growth roadmap. StepOut is well-positioned for its next phase of scale and impact.

About FundTQ

Founded in 2016, FundTQ is a full-service investment banking firm providing a wide range of investment banking services, including M&A advisory, VC/PE syndication, tax advisory, due diligence, and strategic capital raising. The firm follows a founder-first approach, focusing on seamless execution, long-term value creation, and outcome-driven advisory.

Recognized among the Top 10 Investment Banks, FundTQ has advised startups and MSMEs across their lifecycle. From early-stage business fundraising to growth capital, strategic investments, and acquisitions. Backed by deep industry expertise, strong investor relationships, and structured use of financial modeling. Business valuation software frameworks. FundTQ continues to be a trusted partner in high-impact transactions across sectors.