Startup founders often encounter a common challenge: while possessing a compelling idea with genuine potential, a budding team, and a solid roadmap for market entry, they grapple with certain obstacles. These may include securing adequate funding, navigating regulatory hurdles, and establishing a robust customer base. Addressing these challenges effectively is pivotal for startups to realize their vision and thrive in the competitive business landscape, especially when seeking seed capital for startup growth.

What is Seed Funding?

Seed funding refers to the initial capital raised by a startup during its earliest stages of development. This funding is typically utilized to cover initial expenses such as market research, product development, and building a team. Seed funding is crucial for startups to validate their business idea, create a prototype, and attract further investment from venture capitalists or angel investors. It’s often sourced from friends and family, angel investors, or early-stage venture capital firms. Seed funding sets the foundation for a startup’s growth and eventual success by providing the resources needed to bring their vision to life.

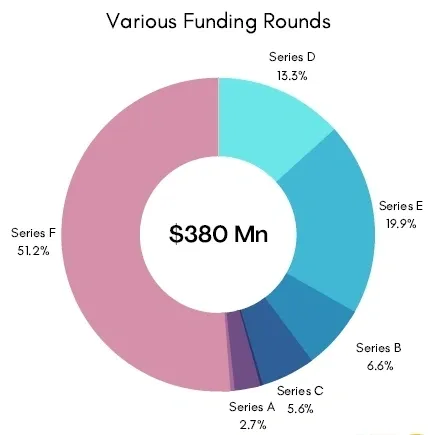

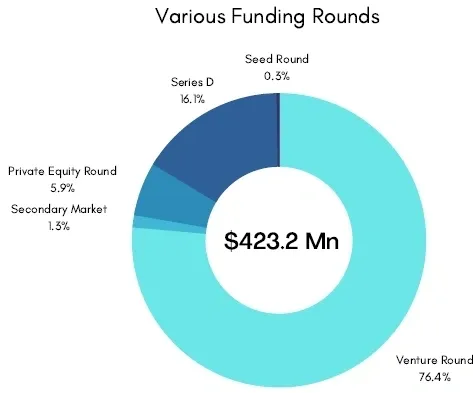

Startup Funding Stages

Startup funding stages refer to the various rounds of investment a startup goes through as it progresses from conception to maturity. These stages typically include seed funding, where initial capital is raised to develop the idea or prototype. This is followed by early-stage funding, often from angel investors or venture capital firms, to support product development and market validation. As the startup grows, it may seek further funding through Series A, B, and C rounds to scale operations and expand market reach. Each funding stage represents a milestone in the startup’s growth trajectory, providing capital for different phases of development.

Why Should You Raise Seed Capital?

Many startups encounter challenges reaching a stage where their product is market-ready without significant financial backing. Costs associated with product development, employee salaries, and infrastructure expenses accumulate swiftly, often amounting to hundreds of thousands of dollars before a viable product is ready for sale.

Seed capital for startups plays a critical role in funding essential developmental stages for startups. It provides the necessary capital for product development, marketing initiatives, public relations efforts, and hiring key personnel such as a VP of Product or CTO. This initial infusion of funds is instrumental in laying the groundwork for a successful business launch.

Moreover, seed funding enables startups to invest in building a competent sales team, a crucial component for driving revenue growth and expanding market reach. By providing resources for vital operational aspects, seed funding empowers founders to focus on scaling their business and achieving long-term success in the competitive market landscape.

How is Seed Funding Different From Series A and Pre-Seed Funding?

Series A, B, and C rounds progress in a clear sequence, but the placement of seed and pre-seed funding may be less apparent. Pre-seed funding precedes seed funding, which in turn precedes Series A investment. Therefore, the order typically unfolds as follows: Pre-seed, Seed, Series A, and subsequently Series B, among others. Variations between these rounds primarily involve the investment size, company valuation, and the developmental phase of the business.

Here’s a breakdown of the key differences between pre-seed, seed, and Series A funding rounds:

1. Pre-seed Funding:

Funding Amount: Typically ranges from $50k to $250k.

Company Stage: At this stage, the startup has developed a minimum viable product (MVP) and identified a clear target market.

Typical Company Valuation: Valuations range from $1m to $3m.

Most Common Investors: Investors at this stage often include friends, family, and accelerators.

2. Seed Funding:

Funding Amount: Ranges from $500k to $2m.

Company Stage: Startups in this stage have established product-market fit and are building their team.

Typical Company Valuation: Valuations typically fall between $5m to $15m.

Most Common Investors: Angel investors and some venture capitalists are prevalent in seed funding rounds.

3. Series A Funding:

Funding Amount: Typically falls between $2m to $15m.

Company Stage: Startups at this stage have an established user base, consistent revenue growth, and have validated some market assumptions.

Typical Company Valuation: Valuations vary more widely, with an average valuation of around $24m.

Most Common Investors: Series A funding rounds are primarily backed by venture capitalists (VCs).

How to Get Seed Funding

Securing seed funding involves various steps, including identifying the appropriate funding type, determining the required funding amount, crafting a compelling pitch deck, engaging with potential investors, and ultimately reaching an agreement. Now, let’s delve deeper into each of these essential steps.

1. Make Sure The Timing Is Right

Your initial step in the funding process is to assess whether the timing aligns with your needs and if seeking seed funding is necessary. This decision hinges on two key aspects:

Willingness to relinquish a portion of company ownership.

Ability to meet investor expectations and present a compelling case for investment.

The initial choice is deeply personal, as it’s ultimately your decision whether you’re comfortable sacrificing equity for funding. However, in many cases, this is necessary for ventures requiring substantial capital to progress.

To attract potential investors, you must substantiate:

- Product: Having an MVP is essential, along with evidence of initial customer adoption and product growth.

- Market: Demonstrating significant market potential and how your product fulfills a pressing market need.

- Team: Convincing investors of your team’s ability to execute and scale the business effectively.

If these criteria are met, the timing for seeking funding is appropriate.

2. Choose Your Funding Source

Various avenues exist to secure seed funding, each with its own advantages and disadvantages.

Venture Capitalists:

Venture Capitalists (VCs) are specialized firms dedicated to funding businesses. They represent the conventional funding route, especially for Series A funding and beyond. While some VCs offer seed funding, the process typically involves rigorous scrutiny, multiple meetings, and engagement of various stakeholders.

Angel Investors:

Angel investors constitute another common source of seed capital for startups. These affluent individuals invest personal funds in early-stage startups. Unlike VCs, angels expect a faster funding process with less due diligence, albeit in exchange for a larger equity stake.

Now the question is how to find the perfect angel investor for your startup.

Friends and Family:

Many startups secure seed funding from close acquaintances or family members, offering some flexibility in terms (e.g., treating it as a loan). However, this approach risks blurring personal and professional boundaries, potentially leading to complications.

Crowdfunding:

Platforms like Kickstarter have popularized crowdfunding as an alternative. Startups create campaigns based on product pre-sales, persuading numerous donors to invest before the product launch. Successful campaigns enable the development and delivery of products to initial investors.

Accelerators and Incubators:

Entities like Y Combinator aid founders in launching and expanding their ventures. They may request equity in exchange for support and occasionally offer seed capital for startups.

Bootstrap:

Some startups thrive without external funding, relying on personal investment or business profits for growth. Although rare, successful bootstrapped companies like Facebook and Apple exist, highlighting alternative paths to success.

3. Determine How Much Seed Money You Need

We’ve established that the average seed investment ranges from $500k to $2m, providing a rough estimate. However, investors prefer precise figures, so it’s essential to specify the exact amount of funding you require.

Ideally, the funding should be adequate to achieve profitability. For software startups, this is feasible since product development costs are relatively low. Even with a simplified version of the final product, you can expand market share and revenue.

Physical product startups may find it challenging to attain profitability with seed funding alone due to higher production costs. In such cases, the objective is to secure funding to reach the next milestone, typically within 12-18 months.

Calculating the required funding involves determining the number of months of operation needed. For instance, if funding is required for 12 months and involves six engineers costing $15k monthly, the total needed would be $1,080,000 (approximately $1m).

4. Get Prepared To Approach Investors

Investors seek assurance of prospective success before committing funds to your startup. While some of their judgement may be based on subjective factors, such as their perception of you and your team’s capability to execute the vision, the majority hinges on concrete strategies and financial projections.

In essence, does it appear promising in documentation? You must be equipped with an executive summary and pitch deck encompassing:

- Company identity: name, logo, tagline

- Vision statement: long-term purpose

- Problem statement: addressed by your product

- Customer profile: characteristics of your target audience

- Solution overview: product details and timing relevance

- Market analysis: size, trends, competition

- Traction: current progress and projected growth

- Business model: revenue generation from customers

- Financial forecasts: revenue, expenses, profits

- Expense breakdown: including utilities, salaries, rent

- Long-term strategy: future product development and financial planning

- Team introduction: roles and expertise

- Fundraising status: previous funds secured and funding requirements.

- Build A List of Potential Investors: Securing seed funding can be an arduous journey, often involving numerous engagements with potential investors. A strategic approach akin to a sales funnel can streamline this process.

At the top of the “investor funnel,” cast a wide net by identifying and reaching out to a broad array of potential investors. This initial outreach serves to generate interest and awareness about your startup and its investment opportunity.

As you move further down the funnel, focus on nurturing relationships with investors who have expressed genuine interest. Provide them with detailed information about your venture, addressing their inquiries and concerns effectively.

Ultimately, the goal is to guide investors through the funnel, converting their interest into concrete investment commitments. By adopting a systematic and targeted approach, you can maximize your chances of securing the seed funding needed to propel your startup forward.

5. Meet With Interested Seed Investors

Refining the art of meeting with investors is a skill that develops with practice. Fortunately, you’ll likely engage with numerous investors before finalizing a deal, allowing you to gain valuable experience swiftly.

When interacting with potential seed investors, adhere to several crucial guidelines:

- Understand your audience by researching their investment preferences and rationale.

- Keep your pitch concise and focused on essential details.

- Demonstrate active listening to show respect, learn, and foster trust.

- Present your ambitious vision while substantiating it with factual evidence.

- Strike a balance between confidence and humility to convey belief in your idea without appearing arrogant.

6. Negotiate The Final Deal

Negotiating can be challenging for many startup founders, especially when dealing with experienced venture capitalists or angel investors. Given their familiarity with such discussions, founders often find themselves at a disadvantage. It’s wise not to engage in real-time negotiations but instead take the time to carefully consider the terms being offered. While it’s essential to avoid wasting time, founders should explore opportunities to negotiate factors like equity compensation to ensure a fair deal.

It’s crucial to recognize the long-term implications of the terms being negotiated. Even small adjustments in equity percentages can have significant ramifications for the company’s future valuation and the founders’ ownership stakes. Therefore, founders should weigh these considerations carefully before reaching an agreement with investors.

Ultimately, the primary objective is to secure the investment needed to fuel the startup’s growth. Once mutually agreeable terms have been reached, founders should promptly proceed to finalize the paperwork and close the deal. While it’s important to advocate for favorable terms, it’s equally vital not to let negotiations drag on to the detriment of the overall funding process.

Also Read: When Should Startup Look For Fundraising