Having worked as an investment banker for more than 15 years, I’ve managed a lot of fundraising initiatives and have learned a lot about what makes a pitch deck compelling enough to get money. Knowing the difficulties that budding business owners have, I am aware of how important it is to develop a polished investor pitch deck in order to realize creative ideas.

In order to assist you in creating an engaging fundraising pitch deck to impress investors, I hope to provide you with some useful tips and tactics that I have collected from successful fundraisers and industry insiders. This guide is designed for you if you’re a visionary entrepreneur with a game-changing idea, a motivated team eager to take your project to the next level, or a budding firm looking for funding to expand.

let’s go on this life-changing adventure as we explore the eleven most perceptive, captivating, and frequently ignored suggestions for creating an fundraising pitch deck.

What Are Investors Seeking In A Pitch?

Let’s unlock the secrets to what investors crave in a pitch to secure your next big investment.

a. The Strength of Your Idea:

A captivating and unique concept is paramount. Ideas that stand out from the competition and have the potential to have a big market effect are what investors look for.

b. Unique Selling Proposition (USP):

Highlight what sets your offering apart from the competition. Emphasize distinct features, benefits, or advantages that make your product or service stand out.

c. Market Potential:

Showcase the size, growth potential, and opportunities of your target market using interesting statistics and insights. Draw in investors by showcasing the substantial benefits your company can offer the sector.

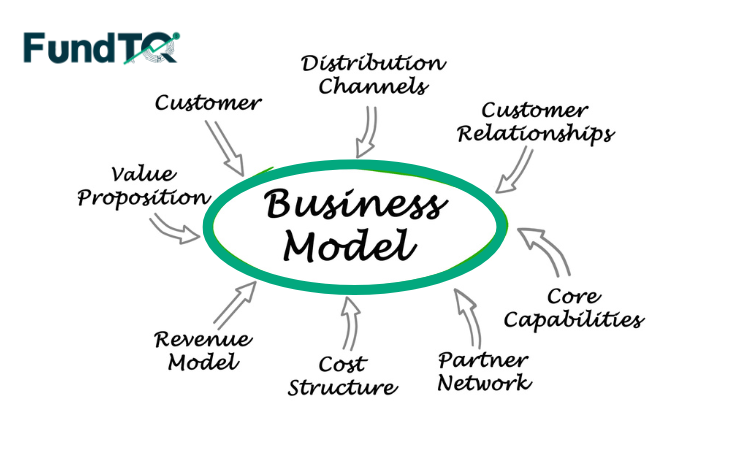

d. Business Model:

Simplify your revenue generation strategy for investors. To explain the process, use visual aids like pricing charts and flowcharts. To highlight the distinctive value proposition of your business, discuss price, cost of products sold, sales and distribution, target client segments, and competitive advantages.

e. Market Understanding:

Highlight your understanding of the target market’s dynamics, growth trends, and potential customer adoption rates. Craft a compelling narrative around how your product or service addresses critical needs or pain points within the market.

f. Team Competence:

Your group is essential to your success. Emphasize each team member’s knowledge and skills while highlighting their relevant accomplishments and credentials. Give investors the impression that your business can carry out the suggested strategies successfully.

1. Develop A Clear And Succinct Concept

When presenting your business idea to investors, it’s vital not to presume their interest. The success of your fundraising pitch deck hinges on guiding them to grasp the market’s scope and your product’s unique potential. It all commences with crafting a clear and concise concept that grabs their attention and highlights the value you offer.

The following important information will help you create an engaging elevator pitch and successfully communicate your idea:

a. Clarity In Thought, Clarity In Expression:

To captivate investors, it’s imperative to have a lucid understanding of your idea and its fundamental purpose. Give a clear, concise explanation of your idea while eliminating any ambiguity. Remember that confidence comes from clarity. Developing an idea that is both clear and succinct draws in investors and establishes the foundation for an engaging pitch deck. It is important to express your notion with confidence and clarity because investors may lose interest if your idea is unclear at this point.

b. Problem Identification:

Describe the particular problems that your target audience is facing. What difficulties do they face, and what effects do they experience? This is a critical step in demonstrating your understanding of the market and the problem you are trying to solve.

Note that investors are looking for creative, scalable concepts that address real issues that people encounter on a daily basis. For example:

Issue: The traditional job boards are uniform in their presentation of job postings and candidates. It is difficult to determine someone’s genuine identity from resumes and plain text alone.

Solution: Using vibrant images and photos to create engaging candidate profiles, FirstJob transforms the job search process. The portal offers thorough details into hiring organizations, including culture, rewards, and office environments, and appeals to young prospects.

2. Unveiling The Problem Your Solution Addresses

Illustrate how the existing problem is presently tackled and emphasize the deficiencies of the current solution. Follow these steps to identify the problem and elucidate it clearly in your investor pitch deck:

a. Engage directly with your target demographic through surveys, interviews, focus groups, or online platforms. Pose open-ended queries to unveil the specific challenges they face and the repercussions on their personal or business endeavors.

b. Collect insights from current patrons or early adopters of akin products or services. Pay heed to their encounters, grievances, and recommendations to detect recurring themes and prevalent pain points.

c. Step into the shoes of your prospective clientele and observe their daily rituals, work processes, and decision-making methods. This firsthand observation may unveil latent pain points or inefficiencies not discernible via conventional research approaches.

d. Analyze current competitors and other solutions available in the market. Determine the areas in which they fall short of the target demographic’s requirements as well as their strengths and limitations.

This aids in positioning your solution as a superior alternative.

e. Based on your scrutiny and analysis, pinpoint the lacunae and prospects present in the market. Identify underserved customer segments, unmet requirements, or areas where current solutions fall short.

f. Validate your suppositions and discoveries by seeking validation from specialists, industry insiders, or potential patrons. This guarantees that the identified problem is not only pertinent but also resonates with your target audience.

g. Highlight how the identified problem aligns with contemporary market trends and requisites. Demonstrate that your solution addresses a timely and pertinent issue, thereby enhancing its market viability.

3. Introduce Your Solution

During this phase, it’s imperative to persuade investors that your solution effectively alleviates the pain points of your target demographic.

a. Emphasize The Unique Advantages.

A startup pitch deck should illustrate how your solution distinguishes itself from competitors and the specific benefits it offers your target audience. Spotlight the key features, functionalities, or innovations that set your product or service apart. Clearly elucidate how these distinctive aspects directly address the problems of your target audience.

b. Provide Evidence Of Efficacy.

Substantiate your assertions with evidence, such as case studies, user endorsements, or data demonstrating successful implementation or outcomes. Presenting tangible proof of how your solution has previously resolved issues for others fosters trust and credibility with investors.

c. Address Scalability And Future Expansion.

Exceptional pitch decks should always outline your strategies for scalability and growth, showcasing how your solution can adjust and progress to meet the evolving needs of your target audience. Highlight potential collaborations or strategic initiatives to further fortify your solution’s market position.

4. Identify the Right Audience

When crafting fundraising pitch deck, offer investors a clear insight into your target demographic and the market scale you’re targeting. Consider the following:

a. Define Your Ideal Clientele.

Delve into the specifics of your target demographic, spotlighting their demographics, behaviors, and preferences. Explicitly delineate who your clientele are and the issues they encounter, underscoring how your product or service provides a resolution.

b. Segment Your Market.

If applicable to your enterprise, contemplate segmenting your market into sectors that can be approached with distinct marketing strategies or product offerings. This demonstrates a thoughtful approach to capturing diverse clienteles and maximizing market penetration.

Keep in mind that, at this stage, you’re also appealing to investors. To increase the chances of building a genuine relationship with possible investors, adapt your language and answer their concerns.

c. Conduct Thorough Research:

Delve extensively into your target market to identify the types of investors most likely to exhibit interest in your sector and business model. Grasp their investment focus, prior investments, and performance track record.

5. Evaluate Market Opportunities

Thoroughly analyzing market opportunities and effectively conveying them in your pitch deck demonstrate your company’s readiness to thrive in a lucrative market. This entails assessing industry trends, growth potential, and market size.

a. It is imperative to amass pertinent data and statistics that bolster your assertions and lend credibility to your claims. When presenting this information, consider incorporating links or citations to the sources from which the data is derived. Because of this transparency, investors can independently confirm the correctness and dependability of the information, which builds confidence in your proposal. You may emphasize your commitment to doing extensive research and make your proposal more compelling by supporting your claims with solid evidence and citing your sources.

b. Stay abreast of industry trends, emerging technologies, and consumer preferences. Highlight any trends that present opportunities for your business and elucidate how your product or service capitalizes on these trends.

c. Assess the size of the identified market niche in terms of its customer base and potential revenue. Understanding the size of the market segment provides information about its profitability and room for expansion. Understanding the size of the market niche you are targeting is very important to investors since it indicates the possible market share and income your company may achieve.

Furnishing data and statistics on the volume of the market niche bolsters the credibility and reliability of your fundraising pitch deck.

d. Undertake a competitive analysis to identify existing market players and evaluate their strengths, weaknesses, and market positioning. Set your business apart by accentuating your unique value proposition and competitive edge.

e. Describe your plan of attack for entering the market and gaining market share. Provide specifics on your distribution methods, marketing and sales plans, and any alliances or partnerships that provide you a competitive edge.

6. Develop a Robust Business Model

To present a robust business model, adhere to these guidelines for crafting successful startup pitch decks:

a. Outline Your Revenue Streams.

Describe in detail how your startup makes money. Describe in detail how your startup makes money. Determine the different revenue streams, including advertising, subscriptions, product sales, and license fees. Provide a thorough explanation of your pricing strategy and how it relates to consumer demand and market conditions.

b. Elucidate Your Cost Structure.

Define your operational expenditures, encompassing production, marketing, distribution, and overhead costs. Demonstrate a profound comprehension of your financials and illustrate how your cost structure facilitates sustainable growth. Explicitly delineate your pricing strategy and the parties responsible for financial obligations. Determine whether users directly pay for your product or if alternative revenue streams, like advertising or partnerships, contribute to your revenue.

c. Present Financial Projections.

Offer pragmatic and data-driven financial projections, incorporating revenue growth, profit margins, and key performance indicators (KPIs). Leverage market research, industry benchmarks, and historical data (if available) to substantiate your projections. Investors seek a clear path to profitability and a comprehensive grasp of your financial forecast.

7. Assess The Competitive Landscape

Even in unfamiliar markets, it’s vital to acknowledge that potential customers currently utilize other alternatives to address their needs. Your business concept may not be novel, but it can become the premier choice in the market.

To underscore your competitive advantage and craft successful fundraising pitch deck, endeavor to:

a. Conduct a competitive analysis to identify existing market participants and assess their strengths, weaknesses, and market positioning. Set your business apart by spotlighting your unique value proposition and competitive strengths.

b. Clearly define your startup’s market position and accentuate how you differentiate yourself from competitors and alternatives. Identify your key advantages or distinctive “secret sauce” that distinguishes you from the competition.

c. Articulate precisely how your offering stands out and why customers would opt for your solution over others. Emphasize the specific benefits and unique value that your product or service brings to the forefront.

d. Evaluate the competitive landscape and how your pricing strategy aligns with market dynamics. Determine whether you position your offering as a premium, high-priced option or a budget-friendly alternative that disrupts existing solutions.

Additionally, consider integrating the following components into your startup pitch deck to bolster your competitive analysis:

- Highlight any enduring advantages possessed by your startup, such as intellectual property, proprietary technology, or exclusive partnerships. Emphasize how these factors confer a sustainable competitive edge and contribute to the enduring success of your venture.

- Showcase your adaptability and innovation in response to evolving market dynamics. Spotlight any ongoing research and development endeavors or prospective product enhancements that further differentiate your offering.

8. Present Social Validation And Momentum

If you’re in the phase of seeking pre-seed funding for your existing solution, it’s crucial to prioritize building credibility and showcasing the strides your startup has made. Investors seek evidence that your solution is effective and that your business model is gaining traction.

a. Quantify Achievements:

Wherever feasible, quantify the impact and outcomes your startup has accomplished. Employ metrics, data, and key performance indicators to elucidate the positive outcomes of your solution. This enables investors to assess the scalability and financial viability of your venture.

b. Spotlight Collaborations:

Exhibit any strategic partnerships or alliances you’ve forged. These partnerships indicate that esteemed entities recognize the value of your startup, enhancing the credibility of your business model.

c. Highlight Early Adopters:

Share favorable experiences and the impact of your product or service on early adopters. This validates the market and underscores the potential for widespread adoption.

d. Showcase Milestones And Progress:

Emphasize significant milestones attained by your startup, such as revenue growth, user acquisition, or product development achievements. These milestones denote progress and momentum, underscoring your capability to execute and yield tangible results.

9. Harness Team Expertise

Investors aren’t just backing your idea or product; they’re investing in the collective capabilities of your team—seasoned and astute individuals. Maximize your team’s proficiency on the team slide:

a. Team Introduction:

Present key team members, offering succinct backgrounds that underscore their relevant experience and achievements. Highlight how their distinct skills and expertise align with your startup’s needs, positioning them as invaluable assets.

b. Roles And Responsibilities:

Define each team member’s roles and duties, emphasizing how their expertise contributes to the venture’s overall success. Spotlight any exceptional skills or industry knowledge that distinguishes your team.

c. Track Record And Accomplishments:

Showcase the team’s past victories and accomplishments, especially those pertinent to your startup’s industry or target audience. Display notable accolades, awards, or previous ventures as evidence of their capabilities.

d. Advisory Board Or Mentors:

If applicable, mention esteemed industry figures or advisors supporting your startup. Their involvement enhances credibility and illustrates your venture’s reputation and respect within the industry.

10. Communicate Funding Needs For Expansion

It’s critical at this point to clearly explain to potential investors the funds required to support the expansion of your firm and the financial requirements.

a. Allocation of Funds:

Break down how the funds will be utilized on the team slide, outlining the specific areas of your business requiring financial backing. Provide a detailed breakdown of the allocation of the investment between product development, sales and marketing, operational costs, and team growth. This shows how to manage resources strategically and purposefully.

b. Return on Investment:

Articulate the potential return on investment for potential investors, emphasizing the value they stand to gain by supporting your startup. Emphasize how your company’s development potential, competitive advantage, and market opportunity make it an appealing investment possibility.

Key Slides For Your Fundraising Pitch Deck

Improve your chances of getting funding by creating a well-organized pitch deck. Together, we can incorporate the previously mentioned processes and add the necessary slides to successfully communicate your vision, market potential, and growth strategy:

a. Problem Statement:

Define the problem that your target audience has in detail so that you may introduce your solution with confidence.

b. Solution:

Present your distinctive solution to the identified problem, elucidating how it addresses pain points and adds value to customers.

c. Market Analysis:

Provide a thorough summary of the market that includes its size, growth potential, and important trends to demonstrate your in-depth knowledge of the dynamics of your target market.

d. Competitive Landscape:

Evaluate competitors and delineate your competitive edge, spotlighting what distinguishes your business and why customers would prefer your solution.

e. Business Model:

Talk about your pricing strategy, income streams, and cost structure as you outline your revenue creation and sustainability in terms of profitability.

f. Go-to-Market Strategy:

Present your marketing and sales approach, including target audience, distribution channels, and customer acquisition strategy.

g. Team And Expertise:

Present the key members of your team, highlighting their relevant background and abilities, and explain why they are well-positioned to carry out the plan.

h. Financial Projections:

Provide realistic financial forecasts that are backed by reliable facts and assumptions. These should include revenue estimates, spending estimates, and growth projections.

i. Milestones And Timeline:

List your primary achievements and benchmarks, together with a timeline for reaching them, to describe your route and development.

j. Funding Requirements:

Clearly state the amount of financing that is being requested and how it will be allocated to promoting business growth, emphasizing how the investment will help you reach important benchmarks.

In Conclusion

That’s it, You should be able to create fundraising pitch deck that are convincing with your newly acquired knowledge and confidence. Always keep in mind that your primary focus should be on comprehending your target market and clearly conveying how your company meets their wants.

Give special attention to the advantages of your product or service and how it may solve particular problems. Craft an engaging story that is both relatable and compelling to your audience. Finally, express your passion and belief in the value proposition of your company by delivering your pitch with unshakeable confidence.

a. Start With A Captivating Hook:

Start your pitch with a compelling opening line that highlights the issue your concept attempts to solve.

b. Spotlight Uniqueness:

Stress what makes your idea distinct from existing solutions or competitors. Concentrate on the innovative features, technology, or approach that sets your startup pitch deck apart.

c. Convey The Value:

Clearly state the advantages that clients will receive from your product or service. In what ways does it improve their life, save time, or increase output? Write the value proposition clearly, concisely, and convincingly.

d. Utilize Visual Helps:

Integrate visual elements like infographics or diagrams to help investors visualize your concept. This can improve the engagement of your pitch and successfully communicate difficult concepts.

e. Keep It Concise:

Don’t confuse investors with too much information. Aim for conciseness and clarity while concentrating on the most important facets of your concept and its value proposition.

Don’t Forget These Crucial Points:

- Utilize Visuals: Elevate your pitch’s impact with infographics, charts, or graphs showcasing your startup’s progress visually. Visual elements enhance information comprehension and stick in investors’ minds.

- Financial Projections: Present realistic, data-backed financial forecasts demonstrating potential ROI. To verify scalability and profitability, support your estimates with market research, industry benchmarks, and historical data.

- Growth Strategy: Clearly articulate your strategic growth plan and how funding will be utilized to achieve key milestones. Develop a concise roadmap highlighting the value and outcomes of proposed investments.

Check Out Our Fundraising Pitch Deck Templates