Investment Memorandum: A Guide for Startup Founders

The path from ground-breaking concepts to successful fundraising rounds can be intimidating for many business founders. The investment memorandum is a crucial document that forms the basis of this journey. This document is a powerful instrument that informs investors about the potential of your startup and presents a strong case for their investment in your vision; it is not just a formality.

What Is An Investment Memorandum?

An investment memorandum is a document prepared by a start-up company targeting potential investors and outlines the main aspects of the business and the investment opportunity. It is a detailed introduction to your company and provides an overview of your market, product, team and finances. It’s a narrative that highlights your business’s potential for expansion and success by fusing data, analytics, and its own story.

Role And Importance Of Investment Bonds

Investment bonds play a key role in the investment decision making process. They help investors understand the nature of your business, the problem you are solving, and how you plan to earn a return on your investment. A well-crafted note can set your startup apart from the competition, highlight your strengths, and address potential issues. This is an opportunity to generate investor interest and lay the groundwork for in-depth discussions and due diligence.

Main Audiences For Investment Memorandum

Investment memorandum serve a wider audience, even if their primary target audience is potential investors like angel and private equity investors. Advisory boards, possible partners, and even important staff members who wish to know the startup’s financial situation and strategic orientation may find them helpful. You can make sure your pitch resonates with these audiences and achieves its goals of obtaining money and assisting your startup’s growth demands by customizing it for them.

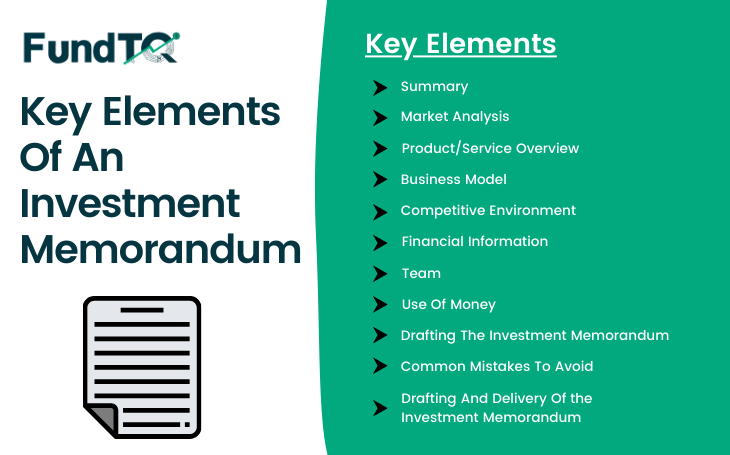

Key Elements Of An Effective Investment Memorandum

Creating an investment memorandum that describes the nature of your startup and attracts potential investors requires careful consideration of its content. Here’s what to add to make your note stand out.

1. Summary

The summary is your first (and sometimes only) chance to get an investor interested.It should precisely outline the value proposition, primary goal, and distinctive solution that your startup provides through its goods or services. Make sure you convey the potential for development and profit, and emphasize the market opportunity and your plan for taking advantage of it.

2. Market Analysis

A thorough market analysis shows that you understand the market you are entering. This should include the size of your target market, growth trajectory and key trends supported by reliable data. This section is crucial to convince investors of the significant opportunity your startup is ready to take advantage of.

3. Product/Service Overview

Find out what the startup provides, what issues it resolves, and why it performs better than current options. Provide details regarding the level of development, intellectual property, and any traction or client feedback obtained. This section shows the profitability and scalability of your product or service.

4. Business Model

Your business model describes how your startup plans to make money. Describe your revenue streams, pricing strategy, sales and distribution channels, and partnerships that drive your business forward. The clear and logical explanations presented here will convince investors of the sustainability and profitability of your company.

5. Competitive Environment

Understanding your competition is just as important as knowing your business. Analyze your competitors, their strengths and weaknesses, and how the startup differentiates itself. Highlighting your competitive advantage shows investors why your startup is a better bet.

6. Financial Information

Provide a clear picture of your financial situation and projections. Include current financial data, when available, and detailed projections showing revenue, costs and profitability over time. This section should also explain the assumptions behind your projections and provide a realistic view of your financial planning.

7. Team

Investors invest in both people and ideas. Introduce your team by highlighting their backgrounds, expertise and roles within the startup. Demonstrating a strong and competent team will increase investors’ confidence in your startup’s ability to execute its business plan.

8. Use Of Money

Clearly indicate how you intend to use the investment. Learn how finances drive growth by determining how much to allocate to product development, marketing, sales and other critical areas. Clear and well-founded plans for the use of money can significantly strengthen your desire to invest.

9. Drafting The Investment Memorandum

With the components in mind, it is time to draft the memorandum. The goal is clarity, brevity and impact. Investors are busy; your note should adopt them quickly and strongly support your startup. Use images such as charts and graphs to complement your story, making complex information easy to digest. Above all, tell a compelling story that connects with the reader emotionally and financially.

10. Common Mistakes To Avoid

Avoid common pitfalls such as neglecting the story, underestimating the competition or providing unclear financial information. Each part of your note should build on the last and create a cohesive and compelling argument for the success of your startup.

11. Drafting And Delivery Of the Investment Memorandum

Before drafting the memorandum, seek feedback from mentors, advisors and colleagues. Tailor your pitch to your audience and understand that different investors may prioritize different aspects of your business. When presenting, include a confident verbal or visual presentation in the memo that reinforces your key messages.

Summary

An investment memorandum is more than just a document; it’s a strategic tool that can catalyze your startup’s growth by securing critical funding. By understanding its importance, focusing on the most important parts and avoiding common mistakes, you can create an attractive note that stands out in the eyes of investors. Remember that the goal is to inform, persuade and instil confidence in your vision and your team.

Check out some of our Information Memorandum Templates