As an entrepreneur or founder of any startup, your pitch deck is your ticket to capital. It is not a slide presentation, it is your story, your vision, your business model in 10-15 powerful slides. But what do you do to make a pitch deck that really counts? Each month, investors go through hundreds of decks. A properly formatted investor pitch deck saves time by cutting the noise and conveying your business worth in a few minutes. It assists them to get the idea as to why your idea is important, why your team is capable of doing it, and why it is high time to invest.

This article has it all, the definition of a pitch deck, making pitch decks, the most useful pitch deck templates, and pitch deck examples that have made startups raise millions. We will also relate these insights to the key financial tools such as financial modelling, business valuation and investment banking services that can help you with the fundraising strategy.

What Is a Pitch Deck?

A pitch deck (also called a slide deck) is a brief presentation (typically 10-15 slides) that outlines the narrative, purpose, and fiscal opportunity of your company. It is what you submit to the investors to introduce your startup either in the meeting or in the demo days.

A great pitch deck:

- Easily describes what you are solving.

- Promote your product and solution.

- Determines your market opportunity.

- Demonstrates initial progress and development.

- Exhibits your financial plan.

- Concludes with a powerful call-to-action.

It becomes more than a visual document when used properly, and it is the basis of your fundraising story.

Bonus Tip: You may not be raising funds at the same time but understanding how to make a professional pitch deck can help you iron out your business plan and financial narrative.

Why Pitch Decks Matter to Investors?

The investors do not simply invest in the products but invest in people and potential. A solid investor pitch deck is an indication that you have a feel of your market, your consumers and your road to profitability.

Key Benefits of a Winning Pitch Deck:

- First Impression: It is the introduction of your startup, it has to look professional.

- Investor Clarity: explains complicated concepts in simple and visual forms.

- Decision Driver: Assists the investors in making a decision on whether to take the next meeting.

- Trust builder: Demonstrates transparency, order and business maturity.

Examples of well-known pitch decks such as airbnb, uber, and buffer demonstrate that a compelling story, backed by a minimal design and reasonable data can open the doors worth billions of dollars.

Step-by-Step: How to Create a Pitch Deck for Investors

Let’s build your investor pitch deck step by step.

#1 Start with the Problem

The first thing to do is to identify the actual pain point in the real world that you are solving. Investors must have faith that there is a large-scale problem that should be addressed.

Example:

Small retailers lose one-quarter of sales because of ineffective inventory tracking. On our platform, stock is managed automatically on real-time analytics.Make it straightforward, familiar, and evidence-based. Measure the impact where feasible.

#2 Present Your Solution

Sell your product or service as the hero. Demonstrate that you solve the problem better than current solutions. Include product shots, mini-videos or plain images.

The optimum decks do not tell the worth of the solution but show it.

#3 Define Your Market Opportunity

Investors want scale. Demonstrate that your market is large enough to expand into.

Include:

- TAM (Total Addressable Market) – The total demand in the market.

- SAM (Serviceable Available Market)- Your target market.

- SOM (Serviceable Obtainable Market) – Your attainable realistic reach.

Provide some credible sources of your data. A little confused on how to find your potential, then enter your data into our startup valuation calculator or check out Startup Valuation Without Revenue.

#4 Explain Your Business Model

How will you make money?

Show your revenue streams:

- Subscription or SaaS model

- Marketplace commissions

- There are charges in licensing or advertising.

In this case, visual flowcharts can be used effectively – they allow investors to visualize your money flow immediately.

#5 Show Traction and Proof of Concept

Traction is the only thing that creates confidence.

Include measurable results:

- Revenue growth or pre-orders

- User acquisition stats

- Pilot programs or partnerships.

- Word of mouth or newspaper publicity.

Even early traction validation. It demonstrates that your idea is not a mere theory.

#6 Introduce Your Team

Traction is the only thing that creates confidence. Include measurable results:

- Revenue growth or pre-orders

- User acquisition stats

- Pilot programs or partnerships.

- Word of mouth or newspaper publicity.

Even early traction validation. It demonstrates that your idea is not a mere theory.

#7 Share Financials

Numbers are expected by the investors, realistic numbers. Create your financial model that reflects 3-5 years of projections such as:

- Revenue forecast

- Cost structure

- Profit margins

- Cash flow overview

- Break-even analysis

You can either start with what is financial modeling or look at our Financial Modelling resources, should you be new to this. In the right projections are credible and are also a sign of planning.

#8 Detail Your Funding Ask

Know how much you are raising and how you will spend it.

Example:

Our current fundraising goal is one million dollars to build up our product group, invest more in marketing and enter two new markets. Estimated ROI: 3 times in five years.

Strategic thinking is demonstrated by transparency on how the funds are used (e.g., 40% tech, 30% marketing, 30% operations).

#9 Use Professional Pitch Deck Templates

Design matters. The graphical balance of the layouts is clean and allows investors to concentrate on content. Use the contemporary pitch deck templates or slide deck templates of:

- Canva

- PowerPoint

- Google Slides

These provide drag and drop features and ready to use color palettes in order to achieve professional output. Search investor pitch deck templates that have space to place some visuals, few text and large fonts.

Bonus Tip: Have a background and font color that is similar to create stronger brand recognition.

#10 End with a Call-to-Action

Finish strong. Restate your mission and ask investors to make the next step.

Example:

Become part of the logistic transformation with the help of AI innovation. We can talk about how we can develop together.

This should be the last slide in which you should have:

- Contact details

- Logo

- Website and social links

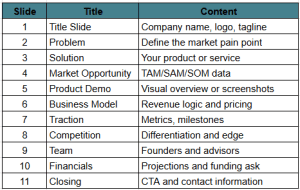

Recommended Investor Pitch Deck Template (Slide Flow)

This proven flow keeps your story cohesive and investor-friendly.

Pitch Deck Examples That Raised Millions

1. Airbnb

- Concentrated on clarity of solutions.

- Uncomplicated graphics and excellent narration.

- Emphasised experience in travelling, not in renting rooms.

2. Uber

- Highlighted scalability and potential to disrupt.

- There are data-based slides on international expansion.

3. LinkedIn

- Centered on network effects and road-map to monetisation.

Learning about pitch deck examples such as the one allows you to know how to organise information and images to manage investor psychology.

Strengthen Your Financial Story

Numbers build trust.

Your data should be supported by appropriate financial modelling and valuation analysis before submitting to investors.

Checklist:

- Test assumptions with market standards.

- Estimate equity value using business valuation calculator.

- Professional or mentor review models.

We may assist you through our investment banking services to narrow-down on models, prepare forecasts and make sure your deck is aligned with the expectations of the investors.

How Investment Banking Services Add Value

Having a strong investment banking team can change your fundraising process.

They help you:

- Work on your investor pitch deck material.

- Construct elaborate financial models.

- Conduct company valuations

- Find strategic investors and partners.

Using professional guidance, your pitch is in line with actual market standards – and more believable in venture capital meetings. Get to know more about our Investment Banking advisory solutions that are oriented towards early stage start up and high growth companies.

Common Pitch Deck Mistakes to Avoid

The following pitfalls should help you to avoid losing investor interest within a few seconds:

- Excessive text or jargon – make slides visual.

- Excessively optimistic models – demonstrate realism.

- Disregarding competition — never forget to always recognize and distinguish.

- No blatant funding request – investors require details.

- Poor visuals- bad designs are inconsistent.

- Minimalism, narration, and data supported will always perform better than crowded decks.

Conclusion: Your Story Is Your Strategy

The perfect pitch deck is not a design masterpiece, but it is one that is well structured, clear and with a compelling story. It informs investors of what you do, why you should do it and how you will win.

When you combine:

- A clear problem and solution

- A viable market potential.

- Evidence-based financial modelling.

- A passionate team story

- And a simple, elegant design —

you make a story which investors would like to join.

It is important to remember that investors do not simply finance ideas, but beliefs. Therefore, make time to polish, practice, and customize your pitch deck. Get professional pitch deck templates, study pitch deck examples, and support your assertions with reputable numbers.

A pitch deck will not only tell a story, but will also make it happen with funding when it is done properly.

Also Read: Financial Model for BPO Company