To open or grow a business, passion alone is not enough but the proper financial aid is needed. Small business funding opportunities are higher than ever before in 2026. Whether it is a new idea or expansion of an already formed business, understanding how to raise funds to start a small business or grow an existing one is the difference between success and failure.

Here in this guide we are going to discuss the most effective methods of acquiring funding of small business, primary sources, government programs, and intelligent methods of obtaining the correct kind of capital to suit your requirements.

Understanding Small Business Funding in 2026

It is important to first define what small business financing is before we plunge into the specific sources of funding.

Small business funding is any financial support to start ups or small business ventures to meet costs including:

- Inventory or product development.

- Hiring employees

- Marketing and technological advancement.

- Current assets or working capital.

As the global startup ecosystem is thriving, the need for funding assistance to small enterprises has never been greater. Governments, banks and individuals who just want to invest their money are all providing resources on how to support small funding to an idea of business that has potential.

Why Funding Matters for Small Businesses?

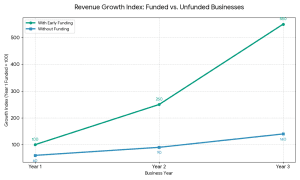

Growth comparison between funded and non-funded small businesses

Securing capital early can:

- Increase cash flow and maintain business.

- Grow faster by making investment in tools, talent and marketing possible.

- Grow popularity among suppliers and customers.

- Less risk through the diversification of sources of financial support.

To put it in a nutshell, the idea of starting a small business can become a successful company with the knowledge of how to raise funds.

Top 10 Ways to Get Funding for Small Business in 2026

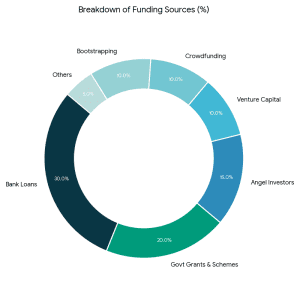

Common sources of small business funding globally in 2026

1. Government Grants and Schemes

Governments of all countries, such as small business or startup funding in India, provide grants, subsidies and low-interest loans to entrepreneurs.

Examples include:

- MSME Loan Schemes in India

- Startup India Seed Fund Scheme (SISFS).

- Pradhan Mantri Mudra Yojana (PMMY) – small business micro-loans.

- Small Business Administration (SBA) Loans of the U.S.

It is among the most suitable funding sources of a small business as it is usually associated with lower repayment.

2. Bank Loans

The traditional banks have still continued to be a trusted provider of loans to the small business.

You can apply for:

- Term loans (used to pay in installments over time).

- Working capital loans (to cover cash flow)

- Equipment financing

To increase approval, a well-developed business plan demonstrating profitability, market analysis, and ability to repay should be prepared.

3. Microfinance and NBFCs

Microfinance institutions and Non-Banking Financial Companies (NBFCs) will provide assistance in the event that you do not have collateral or a good credit history. They issue small financing business loans on flexible conditions, particularly in the developing markets.

This suits those entrepreneurs who want to get financial assistance to develop small businesses in the rural or semi-urban environment.

4. Angel Investors

Angel investors are also individual investors who risk using their personal funds in startups that have potential. By 2026, it is only a few clicks to find investors that focus on your industry by using digital platforms such as LetsVenture, AngelList, and SeedInvest.This is among the most effective small business funding choices in the case of a startup.

5. Venture Capital (VC)

In case your business has high growth potential, VC firms can provide huge funding rounds. They usually invest in the areas of technology, fintech, healthcare, and sustainability.

Although it implies relinquishing part of the ownership, the mentorship and exposure VCs will offer may accelerate the process of growth, and it is one of the most effective methods of obtaining funds to run a small business with scalability in mind.

6. Crowdfunding Platforms

Crowdfunding is a popular alternative source of funding. There are platforms such as Kickstarter, Indiegogo or GoFundMe that enable you to fundraise through the crowd.

You can provide first-time availability of products or benefits to supporters. It is a creative and democratic method of securing small funding business assistance without conventional loans or investors.

7. Business Incubators and Accelerators

There are numerous incubators and accelerators that provide funding assistance to the small business ventures as well as mentoring, network, and space. Cash-based investor programs such as Y Combinator, Techstars, and Startup India Hub are business development programs.

Becoming an accelerator may be a game-changer to startups that want to obtain small business financing and develop.

8. Corporate Partnerships and Mutual Funds

Investment programs or small business mutual funds are managed by some large corporations to foster innovation. As an example, businesses can invest in startups that do not cannibalize their product ecosystem.

Not only can these partnerships provide funding to small businesses, they can also include technical expertise and market access.

9. Trade Credit and Supplier Financing

In case your business is dependent on suppliers, you can enter into a trade credit agreement which will enable you to pay after selling goods. It is a less known but efficient source of small business funds that can be used to handle stock without the initial expenses.

10. Bootstrapping

Bootstrapping refers to funding your business with personal savings / revenue. Though it restricts start-up capital, it provides complete control and eliminates debt.

This is an ideal choice in small business entrepreneurs that would wish to remain lean and autonomous and only seek outside business capital later.

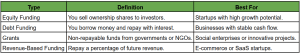

Types of Funding for Small Businesses

Understanding the types of funding for small businesses helps you choose the right one:

Choosing the right type depends on your stage, risk tolerance, and repayment capacity.

How to Prepare Before Applying for Funding?

These are the main steps to follow before you can apply any type of small business funding:

- Develop a powerful business strategy- Prepare your vision, market size, competition and financial predictions.

- Develop your credit history- Good credit increases your loan chances.

- Prepare financial records – Have tax returns, invoices and bank statements on hand.

- Find the appropriate source of funds to use- You cannot use any blindly; you must find what suits you.

- Show traction Evidence of customers, revenue/social proof increases investor confidence.

With proper preparation, you will be the best among the applicants who are in need of business finance to start small businesses.

Small Business Funding in India: 2026 Outlook

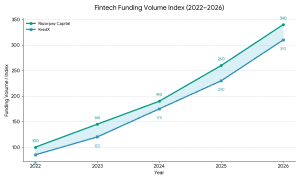

The line graph visualizing the projected funding volume index for fintech lenders like Razorpay Capital and KredX (2022–2026) has been created.

The startup environment in India is still booming amidst a boom in financing small business in India.

Key trends include:

- E-loan services that have immediate approval.

- Innovation grants and seed funds that are supported by the government.

- The emergence of new fintech lenders, such as Razorpay Capital and KredX.

These advancements have rendered funding of small business easier than ever before with or without the conventional banking relations.

Challenges in Securing Funding

The opportunities are high but the entrepreneurs encounter struggles like:

- Limited credit history

- Insufficient collateral

- Strong competition in terms of grants and VC funding.

- Complex documentation

To overcome these, it needs to be persistent, have a network and learn the language of investors. Keep in mind, however, that it is not only about securing funds, but securing the right kind of funds to your small business.

Tips to Increase Funding Success

- Network: Partake business and pitch events.

- Use social proof: Focus on testimonials or awards.

- Small and Big: Firstly get microfunding, and then grow.

- Expand digital capabilities: Razorpay, ClearTax, Khatabook will assist in financial management and credit development.

As much as you might be starting afresh, these tips can help in streamlining your small funding business venture.

Conclusion: Choose Smart, Start Strong

It is not that there is a single best way of funding a small business in 2026; it is all based on what you want to achieve and the industry you are in and the level of risk you are ready to undertake. There are dozens of options of small business funding, starting with government grants and mutual funds and going to crowdfunding and angel investment. It is all about preparation: create a great plan, network, and strategize. And with the proper strategy, you will be able to attract business funding to grow your small business and make your dream of becoming an entrepreneur a real thing.

Learn about 9 Ways of Fundraising for Startups in India.

Key Takeaway

Funding your small business is no longer about luck — it’s about strategy, research, and choosing the right mix of financing sources.

Comments (03)