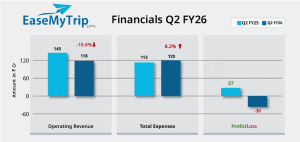

EaseMyTrip (EMT), the online travel agent, experienced a decrease in revenues during Q2 FY26, with ₹118 3 crore in operating revenue and a net loss of 36 3 crore. EaseMyTrip Q2 FY26 results show that the online travel agent (EMT) experienced a decrease in revenues during Q2 FY26, reporting ₹118.3 crore in operating revenue and a net loss of ₹36.3 crore. This marks a sharp contrast to the profit of ₹26.8 crore in the same quarter last year, highlighting the challenges the company faces in its core business amid rising costs.

Image Source: Entrackr

Revenue Decline Driven by Air Ticketing Drop

The air ticketing that generates most of the revenue of EaseMyTrip dropped to 72 crore, a year on year decline of 22 percent. Hotel and holiday packages also added 32 crore which is approximately 27% of the total revenue. The company made more money by other sources but made a total income of 126.5 crores during the quarter which was less than 150 crores in Q2 FY25.

Rising Costs Push Company Into Loss

EaseMyTrip had growth expenses of 67% YoY, largely as a result of increment in employee, service and advertisement costs. Spending on employees went up by a fixed margin of 24% to ₹31.crore. Another exceptional item of the company that also contributed to the quarterly loss was an exceptional item of 51 crore about a General Sales Agent (GSA) agreement with an airline under UDAAN scheme.

Image Source: Entrackr

Image Source: Entrackr

Non-Air and International Business Growth

Although the setback was experienced, certain segments reported encouraging growth:

- Hotel and holiday bookings shot up by 93% YoY, which suggested good momentum with non-air verticals.

- There was a 16 percent growth in the number of bookings of train, bus, and mobility services.

- Global growth, particularly in Dubai, was a strength: gross booking income increased over 3 times to 361.7 decision-making.

This early success can be attributed to the fact that EaseMyTrip is successful in its EMT 2.0 strategy to diversify its revenue collected by flights.

Operational Resilience Shows Through EBITDA

Net profit became negative, EBITDA has increased sequentially by 76.3% to 12.1 crore (with a margin of 9.6). It means that its revenue pressures are not hurting its operational efficiency implying that it will become profitable provided cost management is maintained.

Strategic Moves and Leadership Changes

EaseMyTrip will keep investing in growth and infrastructure:

- Purchased half of a hotel in London and 100 per cent of a Gurugram commercial property.

- Enhanced management that has a new CTO and CMO.

- Consented to a purchase of 514 crore of preferred equity shares by non-promoters.

These activities are in line with the vision of the company to develop a complete stack travel platform to cover hotels, holidays and international markets.

Looking Ahead

The Q2 FY26 performance of EaseMyTrip is a mixed story, with a decline in the core business and one-time losses counterbalanced by an increase in the non-air vertical and international market. In case the company is able to maintain these high-margin segments and control the expenses, the long-term prospects of profitability are still optimistic on the negative note.