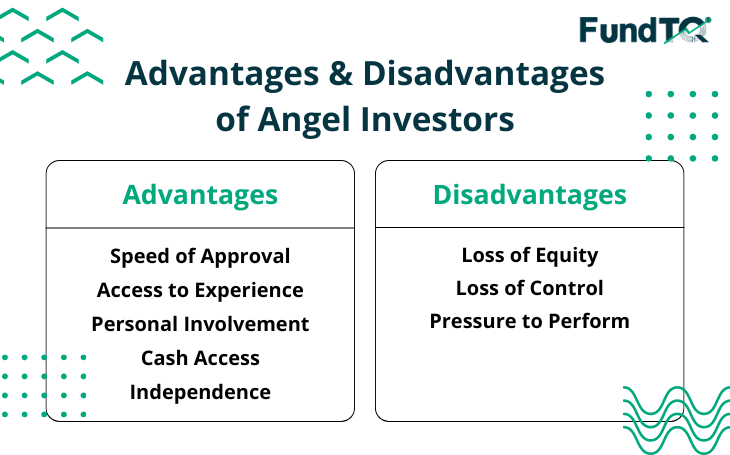

Angel investors typically consist of affluent professionals or seasoned entrepreneurs who offer financial backing, often directed towards startups due to their potential for high returns. Many startups rely on angel investment, with 41 percent of technology sector startups in the US crediting angel investors for assistance, with an average deal size of $350,000.Angel investors are not exclusive to Silicon Valley; they invest in businesses aligned with their understanding of products or market sectors, emphasizing the significance of a strong business team alongside a compelling proposition. Lets explore the advantages and disadvantages of angel investors

Advantages Of Angel Investors

Following are the advantages of Angel Investors:

1. Speed of Approval

Angel funding offers a swift approval process, unencumbered by the bureaucracy and institutional constraints faced by other funding sources. With fewer layers of decision-makers, angel investors can quickly navigate through approval and due diligence stages, providing entrepreneurs with timely access to crucial capital for their ventures.

2. Access to Experience

Access to experience is a key advantage of angel funding. Investors willing to fund a business often bring valuable industry knowledge and insights. This hands-on experience allows entrepreneurs to benefit from mentorship, strategic guidance, and practical advice, enhancing the overall success and growth of their ventures.

3. Personal Involvement

Personal involvement is a distinctive advantage of angel funding. Unlike some other investors, angel investors are personally vested in the success of the business as they contribute their own money. This level of engagement motivates them to actively support and advise entrepreneurs, fostering a collaborative and mutually beneficial relationship for long-term business success.

4. Cash Access

Angel funding provides entrepreneurs with direct and immediate access to cash. Unlike some funding models that involve staggered disbursements, angel investors often inject a lump sum of capital into the business. This quick infusion of funds is advantageous for entrepreneurs seeking rapid growth or addressing urgent financial needs within their ventures.

5. Independence

Independence is a significant advantage of angel funding. Angel investors typically seek straightforward arrangements, exchanging capital for equity without requiring excessive control over the business. Unlike venture capital investors, angels are often more ‘hands-off,’ allowing entrepreneurs greater autonomy in decision-making and operational control, providing a balance between financial support and business independence.

Are you a startup looking to raise funds but unsure of your business value?

FFundTQ’s business valuation software gives you accurate valuations in minutes, helping you confidently raise funds. Plus, get a Pitch Deck Template – Pitchbook for fundraising to present your startup in the best light!

Disadvantages Of Angel Investors

Following are the disadvantages of Angel Investors

1. Loss of Equity

One notable disadvantage of angel funding is the potential loss of equity for entrepreneurs. In exchange for the financial support provided by angel investors, entrepreneurs may be required to relinquish a portion of ownership in their business. This loss of equity can impact decision-making authority and future profit-sharing, emphasizing the importance of careful negotiation and consideration during the funding process.

2. Loss of Control

Another drawback of angel funding is the risk of losing some control over the business. While angel investors may not exert as much influence as venture capitalists, entrepreneurs may still experience a reduction in decision-making authority. In extreme cases, the investor could even remove the entrepreneur from a leadership role, highlighting the need for clear terms and agreements in the funding arrangement.

3. Pressure to Perform

Angel funding comes with the disadvantage of heightened pressure to perform. Since angel investors invest their own money with the expectation of returns, entrepreneurs can expect increased scrutiny and a demand for positive business outcomes. This pressure can be a motivating force, but it also necessitates thorough planning and a commitment to meeting the investor’s expectations for business growth and success.

Choosing The Right Angel

Selecting an angel investor aligned with your business is crucial:

1. Thoroughly check references.

2. Ensure they aren’t investing in direct competitors.

3. Assess compatibility and potential working relationships.

4. Investigate the success or failure of their previous investments.

5. Evaluate their level of business involvement and commitment.

Making The Deal

Important considerations during negotiations:

1. Perfect your presentation, articulating your business plan clearly.

2. Specify the required funding amount and its purpose.

3. Be transparent, as angel investors appreciate honesty about potential challenges.

4. Be prepared for thorough scrutiny during due diligence.

5. Negotiate terms carefully, balancing business vision with necessary compromises.

6. Seek professional advice for structuring funding contracts.

7. Conduct a final ‘sanity check’ with legal and financial experts before committing.

Conclusion

In conclusion, the advantages and disadvantages of angel investors must be carefully considered by entrepreneurs. While angel investors offer essential funding, mentorship, and networking opportunities, they may also require significant equity and influence over business decisions. It’s crucial for startups to evaluate these factors to ensure that partnering with an angel investor aligns with their long-term goals and vision.

Also Read: Angel Investors vs Venture Capital