Expert Investment Banking Services in Mumbai for Growing Businesses [2026]

When growth is no longer optional but essential, choosing the right Investment Banking Firm in Mumbai can redefine your company’s trajectory. Whether you’re a high-growth startup, an established SME, or a mid-market enterprise preparing for expansion, structured capital advisory and strategic financial planning are critical. Mumbai, being the financial capital of India, is home to some of the most sophisticated deal-makers, institutional investors, private equity firms, venture capital networks, and corporate strategists. But real value lies not in access — it lies in execution.

As professionals with 8+ years of experience in investment banking advisory, capital structuring, and transaction execution, we understand what investors evaluate, how valuations are negotiated, and what makes a deal close successfully.

Why Choose an Investment Banking Firm in Mumbai?

A well known Investment Banking Firm in Mumbai has much more than fundraising to offer. It delivers:

- Strategic capital advisory

- Organisational investor access.

- Transaction structuring

- Compliance and regulatory advice.

- Support of risk mitigation and due diligence.

- Correlation of long-term financial strategies.

In the current competitive funding environment, founders and promoters require more than introductions, they require positioning, credibility and bargaining skills.

Comprehensive Investment Banking Services

Modern businesses require multidimensional advisory. Our structured investment banking services.

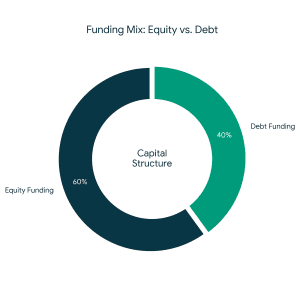

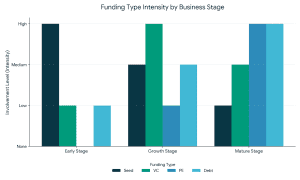

1. Capital Raising (Equity & Debt)

We help businesses secure:

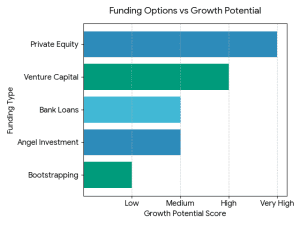

- Venture Capital funding

- Private Equity investments

- Growth capital

- Structured debt

- Mezzanine financing

- Bridge funding

It is not only about pitching in capital raising.

It involves:

- Investor targeting strategy.

- Financial modelling

- Valuation positioning

- Negotiation management

- Term sheet structuring

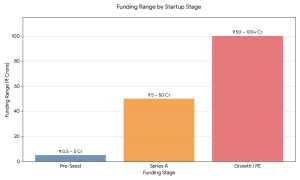

2. Startup Fundraising Advisory

2. Startup Fundraising Advisory

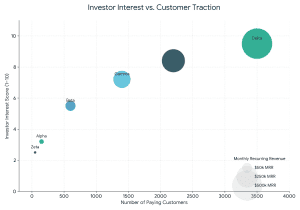

The Mumbai startup ecosystem is thriving in the fintech, SaaS, healthtech, D2C, and manufacturing fields. Startup fundraising under professional advice will secure:

- Powerful financial narration.

- Investor-ready documentation

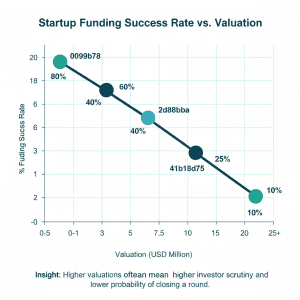

- Moderate expectations on valuation.

- Clean cap table structuring

- Data room preparation

Investors do not finance ideas, business they finance are scalable, defensible and well positioned.

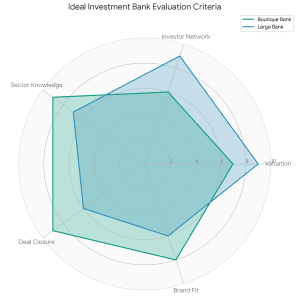

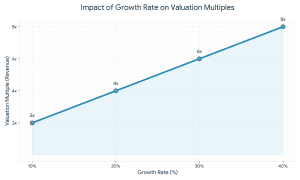

3. Business Valuation & Financial Modeling

A reliable business valuation generates credibility and confidence in the process of negotiation. We apply globally methods:

- Discounted Cash Flow (DCF)

- Similar Company Analysis.

- Precedent Transactions

- Asset-based valuation

- Multiple bench-marking of revenue.

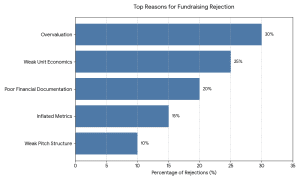

Valuation is science and strategy. Overvaluation kills deals. Under-valuation watered down founders. Precision matters.

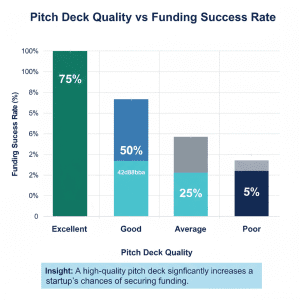

4. Investor-Ready Pitch Deck Strategy

4. Investor-Ready Pitch Deck Strategy

The investor presentation will be a deciding factor as to whether you have a second meeting. Professionally created pitch deck designs. And traditional storytelling models assist in the expression of:

- Market opportunity

- Unique value proposition

- Financial projections

- Competitive advantage

- Scalability roadmap

- Exit strategy

Transparency generates investor confidence.

Mumbai Advantage: Strategic Financial Hub

The Investment Banking Firm is based in Mumbai and is an operating organisation:

- Close access to institutional investors.

- Direct access to the entities that are regulated by SEBI.

- Strong PE & VC networks

- M&A advisory ecosystem

- Corporate legal expertise

Mumbai is not a place, it is a competitive edge.

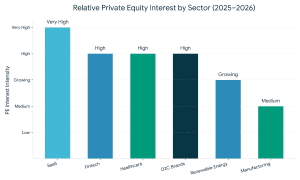

Industries We Serve

We work with high-growth sectors including:

- Fintech & NBFC

- SaaS & Technology

- Healthcare & Pharma

- Manufacturing & Engineering

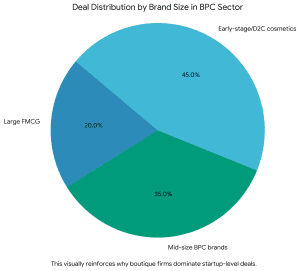

- Consumer Brands & D2C

- Infrastructure & Real Estate

- Renewable Energy

Each sector demands specialized financial structuring, risk assessment, and investor mapping.

Each sector demands specialized financial structuring, risk assessment, and investor mapping.

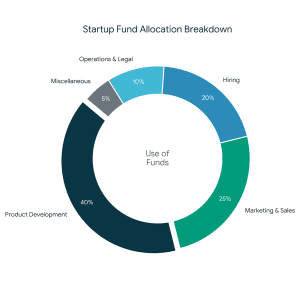

Our Capital Raising Process

Our approach is characterized by transparency and structure:

1: Strategic Assessment

We assess business model feasibility, scalability, and financial preparedness.

2: Financial Structuring

Valuation modeling, capital structuring and projections.

3: Documentation and Data Room.

Investment memo, pitch deck, financial model and compliance documents.

4: Investor Outreach

Specific focus on harmonized investors.

5: Negotiation & Closure

Review of term sheet, valuation adjustment, management of due diligence, and closing of deals.

The implementation discipline divides between successful and unsuccessful raises.

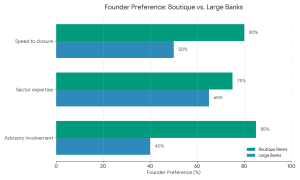

What Makes Us a Leading Investment Banking Firm in Mumbai?

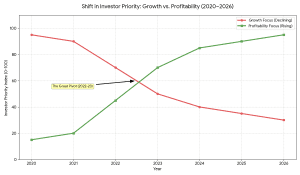

- Deep Market Insight

Knowing the investor psychology and capital trends. - Transaction Experience

Practical implementation at primorial, growth and pre-IPO financing - Structured Approach

Evidence-based, risk-handicapped guidance. - Long-Term Strategic Thinking.

We focus funding strategy on a 3 to 5 year vision of growth. - E-E-A-T Driven Advisory

The buzzwords do not include Experience, Expertise, Authoritativeness or Trustworthiness but they are deal-critical.

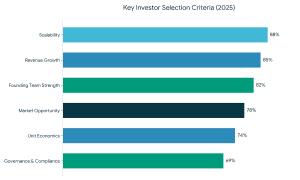

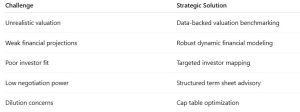

Common Challenges in Fundraising (And How We Solve Them)

Capital raising is not transactional — it is transformational.

When Should You Approach an Investment Banking Firm?

Advisory support should be considered when:

- Series A / Series B funding planning.

- Diversifying operations across India or the world.

- Getting ready to fund with private equity.

- Assessing mergers or acquisitions.

- Restructuring debt

- Preparing for IPO roadmap

Planning ahead will go a long way in enhancing funding performance.

Future of Investment Banking in Mumbai

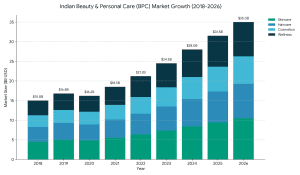

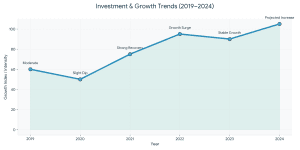

As India emerges as a global growth powerhouse, the financial ecosystem of Mumbai is experiencing:

- Increase in international transactions.

- More inflows of private equity.

- Growth of the ecosystem of startups.

- Venture funds that are sector-oriented.

- Strategic M&A consolidation

It will not be any ordinary Investment Banking Firm in Mumbai that will simply raise capital, but will instead place your business in a position to achieve long-term enterprise value creation.

It will not be any ordinary Investment Banking Firm in Mumbai that will simply raise capital, but will instead place your business in a position to achieve long-term enterprise value creation.

Final Thoughts

Growth capital is fuel — but strategic advisory is the engine.

By having an established Investment Banking Firm in Mumbai, you are not merely raising money, but creating valuation, good governance and scaling up in the long term. When you are about to plan your next round of growth, institutional financing, or strategic growth, then it is the correct moment to plan your capital journey in a professional manner.

Need more capital, or want to value your business? Collaborate with specialists with number, negotiating, and creating long-term value expertise.

Frequently Asked Questions (FAQs)

1. What does an Investment Banking Firm in Mumbai actually do?

A Mumbai based Investment Banking Firm assists businesses to raise capital (equity or debt), manage mergers and acquisitions, business valuation, structure deals and introduce businesses to institutional investors such as VCs, PE funds and NBFCs.

2. When should I hire an investment banking firm?

When you are planning, you ought to hire one:

- Startup fundraising

- Growth capital raise

- Private equity funding

- Debt restructuring

- M&A transactions

- Pre-IPO preparation

Pre-due diligence enhances the negotiation and valuation.

3. How long does it take to raise funds?

Normally 3-6 months, based on:

- Business readiness

- Financial documentation

- Valuation expectations

- Market conditions

- Investor alignment

Estimates with timelines that have been properly prepared are also a large saving of time.

4. How is business valuation calculated?

The methods used in professional business valuation include:

- Discounted Cash Flow (DCF)

- Similar analysis of the company.

- Revenue or EBITDA multiples

- Asset-based valuation

Valuation will be based on the potential to grow, profitability, industry standards, and the risk factors.

5. What documents are required for fundraising?

Key documents include:

- Financial forecast (3-5 years)

- Investor-ready pitch deck

- Cap table

- Compliance records

- Detailed business plan

- Data room documentation

Well-organized documentation develops trust in the investors.

2. Startup Fundraising Advisory

2. Startup Fundraising Advisory 4. Investor-Ready Pitch Deck Strategy

4. Investor-Ready Pitch Deck Strategy

The education technology market in India has reached a disciplined development level. Following aggressive growth by competitors such as:

The education technology market in India has reached a disciplined development level. Following aggressive growth by competitors such as: Early Stage (Pre-seed / Seed)

Early Stage (Pre-seed / Seed) Investors assess:

Investors assess: How to Prepare a Winning Pitch Deck for EdTech Funding

How to Prepare a Winning Pitch Deck for EdTech Funding

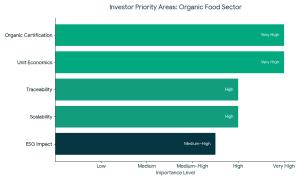

Why the Food Sector Attracts Strategic Investors

Why the Food Sector Attracts Strategic Investors What Is Strategic Funding For The Food Sector?

What Is Strategic Funding For The Food Sector? As an adviser to food startups, investors are interested in:

As an adviser to food startups, investors are interested in: Even the most effective startup fundraising will not work without a powerful grip on these numbers.

Even the most effective startup fundraising will not work without a powerful grip on these numbers.

What Is the Best Way to Fund a Clothing Brand?

What Is the Best Way to Fund a Clothing Brand? It does not have a single, universal answer. The optimal financing source will be based on:

It does not have a single, universal answer. The optimal financing source will be based on:

2. Financial Modeling & Projections

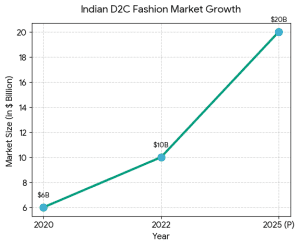

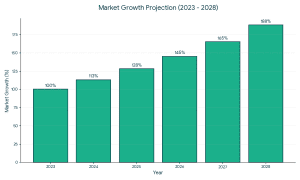

2. Financial Modeling & Projections The Indian fashion and D2C market is growing because:

The Indian fashion and D2C market is growing because:

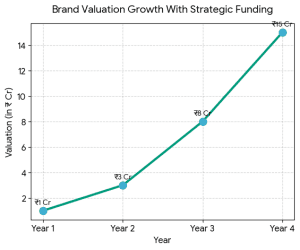

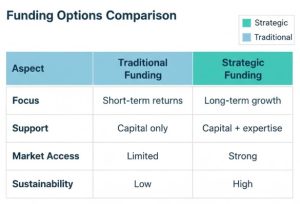

Why Strategic Funding Is Better Than Just Capital

Why Strategic Funding Is Better Than Just Capital

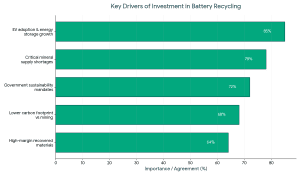

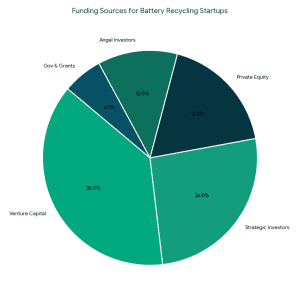

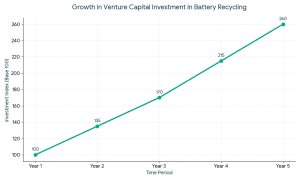

Consequently, the investment in battery recycling startups has taken precedence in clean-tech centric funds and ESG investors, as well as industry actors with a strategic agenda.

Consequently, the investment in battery recycling startups has taken precedence in clean-tech centric funds and ESG investors, as well as industry actors with a strategic agenda.

1. Angel Investors for Battery Recycling

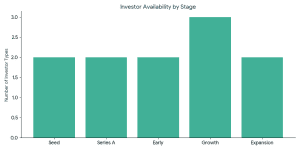

1. Angel Investors for Battery Recycling VCs typically invest when:

VCs typically invest when: The ideal investors in battery recycling startups usually have the following characteristics:

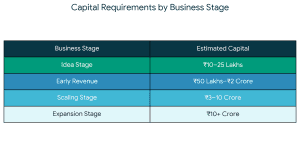

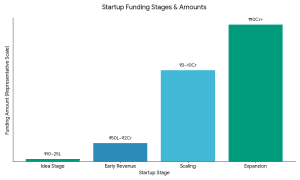

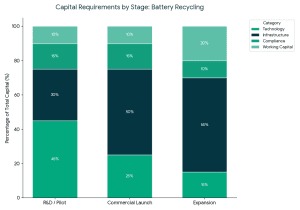

The ideal investors in battery recycling startups usually have the following characteristics: Capital requirements vary by stage:

Capital requirements vary by stage:

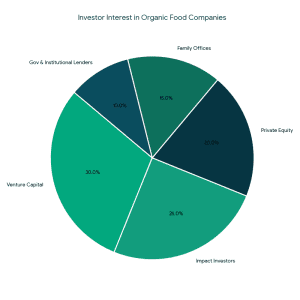

Strong market fundamentals are leading to increased support of organic and clean-label food brands by investors.

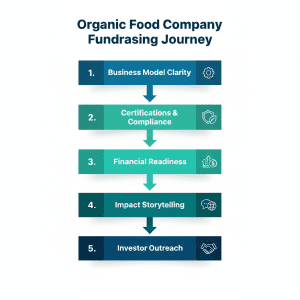

Strong market fundamentals are leading to increased support of organic and clean-label food brands by investors. Types of Funding Available for Organic Food Companies

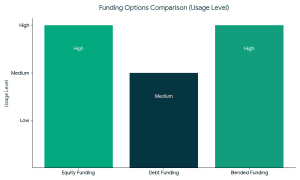

Types of Funding Available for Organic Food Companies 1. Equity Funding

1. Equity Funding The founders should meet the expectations of the investors to raise funds successfully in organic food companies.

The founders should meet the expectations of the investors to raise funds successfully in organic food companies. Preparation is the biggest differentiation between funded and unfunded companies.

Preparation is the biggest differentiation between funded and unfunded companies. Not all capital is equal.

Not all capital is equal.

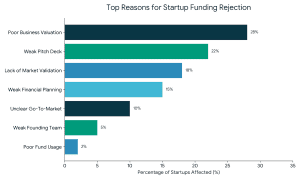

2. Weak or Incomplete Pitch Deck

2. Weak or Incomplete Pitch Deck 3. Lack of Market Validation

3. Lack of Market Validation 4. Weak Financial Planning and Projections

4. Weak Financial Planning and Projections 8. Not Investor-Ready or Poor Timing

8. Not Investor-Ready or Poor Timing

During the transaction, FundTQ worked closely with the

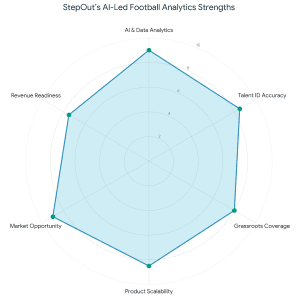

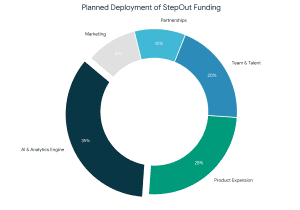

During the transaction, FundTQ worked closely with the  This transaction reinforces the idea that effective fundraising goes beyond capital infusion. It is about trust, alignment, execution quality, and founders who consistently show up to build enduring businesses. With a strong investor base and a clear growth roadmap. StepOut is well-positioned for its next phase of scale and impact.

This transaction reinforces the idea that effective fundraising goes beyond capital infusion. It is about trust, alignment, execution quality, and founders who consistently show up to build enduring businesses. With a strong investor base and a clear growth roadmap. StepOut is well-positioned for its next phase of scale and impact.