How to Raise Series A Funding in India (2025 Guide)

The Raise Series A Funding is an important step in the life of a startup that wants to grow beyond its initial momentum. Although seed funding assists to prove the fit of your product-market, Series A is regarding growth through expansion, gaining more customers, and maintaining sustainability.

The Indian startup ecosystem is also very competitive and data-driven in 2025. The investors are not just focusing on revenue anymore, they desire scale business models, clear unit economics, strong leadership teams, and robust growth strategies.

Composing a detailed FundTQ (one of the leading investment banking and fundraising advisory firms in India) guide takes founders through the preparation process to close off your Series A round, trends, important documents and timelines.

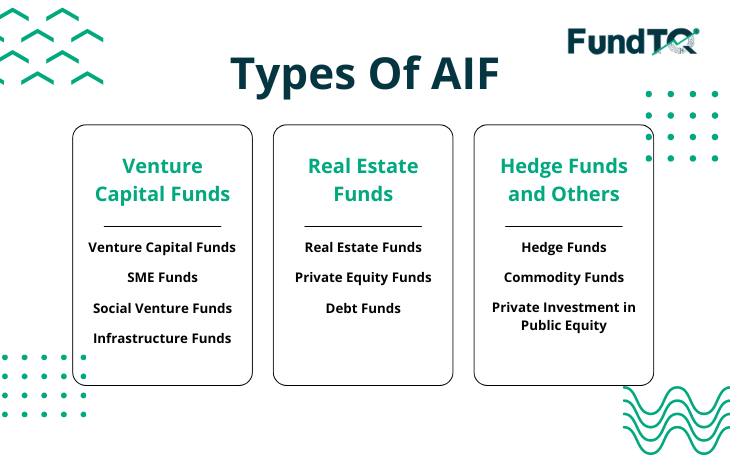

What Is Series A Funding?

The initial major institutional round of venture capital is Series A financing that a start-up company receives following demonstration of a sound concept and momentum.

Investors in Series A expect:

- A clear problem-solution fit

- Existence of market demand and traction.

- A repeatable and scalable business model.

- An effective and creative founding team.

Purpose of Series A funding:

- Hire and scale your team

- Expand products or services

- Enter new markets

- Improve operational abilities.

Concisely, Series A converts an idea that has been tested into a business that is ready to grow.

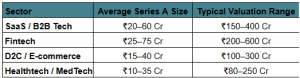

Series A Funding Size and Valuation in India

Series A funding amounts vary by sector, traction, and investor appetite. Typical ranges are:

Tip: FundTQ helps startups determine realistic Raise Series A Funding amounts and optimal valuations using data-driven financial modeling.

Step-by-Step Guide to Raising Series A Funding

Step 1: Strengthen Your Business Foundation

Make sure your fundamentals are good before approaching investors:

- Market Opportunity: Identify your TAM, SAM, and SOM.

- Business Model Clarity: Show how to make money and keep it going.

- Traction Metrics: User growth, revenue, retention rates, CAC, LTV, engagement metrics.

- Unit Economics: Focus on gross margins, burn rate and profitability potential.

FundTQ optimises financial forecasts and business models to fulfil the expectations of investors.

Step 2: Build a Comprehensive Business Plan

Your business plan must narrate the facts about your startup story:

- Executive summary & vision

- Problem-solution analysis

- Market research/competitive environment.

- Business model & revenue plan.

- Financial estimates (35 years)

- Risk analysis & mitigation

- Scaling and expansion road-map.

FundTQ prepares investor-ready business plans that are in line with VC and PE requirements.

Step 3: Create a Winning Pitch Deck

The first thing people see is your pitch deck. Essential slides include:

- Issue and marketing need.

- Solution (product/service)

- Product demo or screenshots

- Traction & milestones

- Market Strategy and Competitive Advantage.

- Financials & projections

- Team and advisors

- Financing needs and expenditure.

The FundTQ produces brief, attractive decks that are compliant with the international VC standards.

Step 4: Identify and Target the Right Investors

Not every investor fits so perfectly. Focus on:

- Venture Capital Firms: Accel, Sequoia, Nexus, Chiratae.

- Corporate Investors: Google for start-ups, Reliance Ventures.

- Family Offices & HNIs: Best in niche and first mover.

- Impact Funds: climate tech, healthtech and education ESG funds.

FundTQ offers selective access to investors in India and elsewhere in the world.

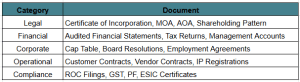

Step 5: Prepare for Due Diligence

Investors will verify:

- Legal documents and registration of the company.

- Tax filing and financial statements.

- Cap table and equity structure.

- IP ownership & customer contracts.

- Regulatory compliance.

In order to facilitate due diligence, FundTQ performs pre-investment audits and establishes a virtual data room to facilitate the audit.

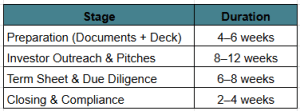

Step 6: Outreach and Investor Meetings

- Provide a brief preview or summary.

- Deliver your pitch deck through safe links.

- Organize schedule and product demos.

- Track follow-ups using a CRM

FundTQ deals with investor outreach and meetings in order to optimize interaction.

Step 7: Term Sheet Negotiation

A term sheet outlines:

- Valuation and dilution of equity.

- Board organization and control.

- Rights & obligations

- Exit terms

FundTQ gets good terms while ensuring that the founders maintain control.

Step 8: Investor-Led Due Diligence

Investors carry out intensive audits:

- Card-related reviews and revenue recognition.

- IP validation and legal audits.

- Customer & vendor references

- Compliance checks

FundTQ manages the coordination of all the teams in smooth due diligence.

Step 9: Closing the Round

Final steps:

- Sign definitive agreements

- Transfer of funds and allocation of shares.

- Regulatory filings

- Public announcement

FundTQ warrants conformity and smooth integration of post-funding.

Key Documents Required for Series A

Timeline to Close Series A

Trends in Series A Funding (2025 & Beyond)

- AI-based Startups: AI and automation have high investor interest.

- Profitability & Sustainable Growth: Healthy unit economics a priority.

- Alternative Financing Models: Equity + Debt or revenue based financing.

- International Investment Preference: US and SE Asian VCs are making more investments in India.

- Corporate Governance & Transparency: Clean cap tables and reporting is compulsory.

Why Partner with FundTQ

FundTQ provides the entire ecosystem of startups in need of funding:

- End-to-end fundraising consultancy (Series A to and past)

- Investment banking services (valuation, deal structuring, due diligence)

- M&A advisory (sell side and buy side)

- Support of pitch deck and financial modeling.

- Investor relations and introductions.

Why FundTQ?

- Successful history of Series A funding.

- Availability of the best investors in India and around the world.

- Professional financial and legal consultation of the closures.

- Evidence-based decision-making and valuation.

FundTQ enables the founders to work on growth and handle the complexities of fundraising.

Ready to Raise Series A Funding?

For founders scaling their business in 2025, FundTQ makes the fundraising journey seamless. From financial modeling and pitch deck creation to curated investor introductions and deal closure, FundTQ provides end-to-end fundraising and investment banking support.