Retail firms do not fail due to bad ideas but they fail due to the pressure of cash flow and lack of growth capital. Increasing rent, inventory expenses, marketing expenses, and expansion plans require financing that conventional loans are usually incapable of financing.

Equity funding of the retail business comes into play here.

Rather than worrying about EMIs, equity funding enables retail founders to attract strategic investors who invest to grow the business, distribute risk, and can commonly accelerate the brand growth. This is the guide that will guide you through the process of getting the funding to grow your small business without debt in a step-by-step manner.

What Is Equity Funding for Retail Business?

Equity funding refers to selling a part of retail business ownership to investors. You are not repaying a loan, instead you share in future profits and growth.

Key Highlights:

- No monthly repayments

- Reduced financial cost than loans.

- Availability of investor experience and relationships.

- Perfect for growth in retail companies.

Investment banking services and fundraising advisory services usually aid the equity funding by matching the retail founders to the appropriate investors.

Why Do Retail Businesses Choose Equity Funding?

Retail is capital-intensive. Inventory, rentals, marketing and staff costs increase rapidly. Numerous founders prefer equity financing since equity financing is associated with long-term expansion and not short-term survival.

Benefits of Equity Funding:

- Small business funding is provided.

- Enables faster expansion

- Enhances the stability of cash flow.

- Establishes a reputation with business associates and suppliers.

When Is Equity Funding the Right Choice?

Equity funding is suitable where:

- You have consistent revenue

- Your business model can be scaled.

- You are expanding (new stores, omnichannel, franchising)

- You do not require money only, but strategic investors.

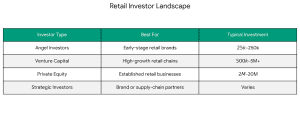

Types of Equity Investors for Retail Businesses

This is where business fundraising expertise becomes crucial—matching your retail brand with the right investor type.

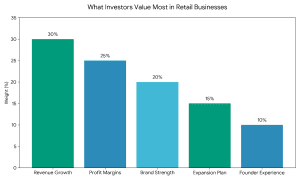

What Investors Look for in Retail Businesses?

Investors do not just finance ideas, they finance implementation.

Core Evaluation Criteria:

- Strong revenue traction

- Healthy gross margins

- Repeat customers

- Clear expansion strategy

- Experienced founding team

- Unit economics (store level profitability)

Step-by-Step Process to Get Equity Funding for Retail Business:

Step 1: Get Your Business Investment Ready.

- Clean financial statements

- Clear growth roadmap

- Defined use of funds

Step 2: Develop a Retail-Centric Pitch Deck.

Include:

- Business overview

- Market opportunity

- Store economics

- Growth strategy

- Financial projections

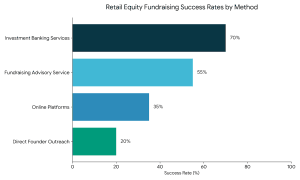

Step 3:Select the Appropriate Fundraising Path.

You can:

- Get to the investors directly.

- Experience with fundraising advisory services.

- Formal deals should be done using investment banking services.

The professional advisors play a significant role in increasing the success rates of funding.

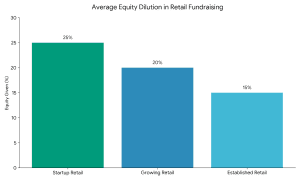

How Much Equity Should You Give Away?

The usual methods of raising capital used by most retail businesses include:

- 10%–25% equity in early rounds

- 15%–30% equity in growth stages

The idea is to make an adequate amount of capital without losing control.

Common Mistakes Retail Founders Make

- Overvaluing the business

- Weak financial reporting.

- No clear expansion plan

- Selecting the wrong investors.

- Bypassing professional advice on fundraising.

This is the reason why most successful founders use business fundraising agencies and investment banks.

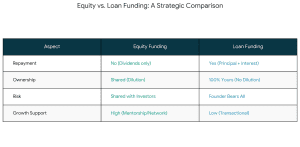

Equity Funding vs Loan Funding (Quick Comparison)

Final Thoughts:

Equity funding of retail business can be the most cunning decision to make in case you want to grow faster, build a strong brand, and remove the financial pressure. Having the appropriate plan, definite figures, and the assistance of a reliable fundraising consultancy, you will easily have funds to develop small businesses and create value over time.

Quick FAQ [Frequently Asked Questions]

Q: Will small retail businesses receive equity funding?

Yes. Numerous investors make active investments in small retail outlets that have good unit economics and grow.

Q: Am I required to make profits to raise equity funding?

Not always. What is more important is revenue traction and scalability.

Q: Is the employment of a fundraising advisor justified?

Yes. Statistics indicate a lot more success with professional advisory support.