Supermarket business is no longer about shelves and check counters. The modern-day supermarkets are information-based retail companies that operate on AI demand prediction, robotic inventory management, analytics of loyalty, and multichannel selling. Simple equity financing of supermarkets is increasingly the financing method of choice among many founders and retail chains to scale quickly without the burden of debt—investors in supermarkets provide capital in exchange for a share in ownership as opposed to requiring (monthly) repayments. This guide reveals all the details of how to equity funding for supermarket, what investors seek, equity amount to provide, and how to create a bankable startup financial overview that will help to impress investors.

What Is Equity Funding for a Supermarket?

Equity funding of supermarket business involves raising funds by selling a share of the business to:

- Angel investors

- Venture capital firms

- Private equity funds

- The strategic retail or technology investors.

Unlike loans, equity funding:

- Has no EMI or interest

- Sustains the growth in the long run.

- Brings in a strategic skill and belief.

Why Are Investors Actively Funding Supermarkets?

Types of Equity Funding for Retail & Supermarkets

1. Angel Investors

- Early-stage capital

- In many cases retail or FMCG professionals.

- Invest ₹50L–₹5Cr

2. Venture Capital (VC)

- Growth-focused

- Show interest in AI-enabled supermarkets.

- Funding AI startups is often overlapping.

3. Private Equity (PE)

- Middle to late-stage supermarket chains.

- Target profitability and growth.

4. Strategic Retail Investors

- Logistics firms

- FMCG brands

- Retail tech platforms

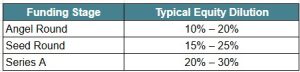

How Much Equity Should You Give Away?

Industry Benchmark

Over-dilution early is a red flag. Investors prefer founders with long-term control.

What Investors Look for in Supermarket Equity Funding

1. Strong Unit Economics

- Gross margins (18%–35%)

- Shrinkage control

- Vendor credit cycles

2. AI & Technology Adoption

- Demand forecasting

- Smart inventory management

- Analytics of customer behavior.

This is where AI startup-style thinking funding provides supermarkets with a competitive advantage.

3. Clear Expansion Strategy

- Store rollout plan

- Franchise-company owned model.

- Dark stores and fast commerce preparedness.

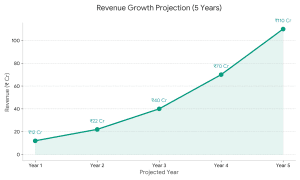

How to Build a Winning Startup Financial Model

Equity funding cannot be provided without the use of a professional start-up financial model.

Must-Have Sheets:

- Profit & Loss (5 years)

- Cash Flow Statement

- Balance Sheet

- Store-level unit economics

- Break-even analysis

- Investor IRR & exit scenarios

Tools Used by Professionals

- Financial modeling in Excel

- Scenario analysis, sensitivity analysis.

- Automated dashboards

Majority of the rejections occur as a result of poor financial models rather than the poor ideas.

Pitch Deck That Converts Investors

The questions your pitch deck will answer are:

- Why supermarkets now?

- Why your brand?

- How do you scale profitably?

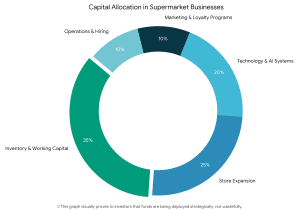

- Where will the equity funding be applied?

- Opportunities of exit by investors.

👉 Free pitch deck templates are a starting point with no avenue of customisation.

Role of Investment Banking Advisory Services

Professional investment bank advisory services highly enhance the success of business funding by:

- Organizing the correct equity deal

- Understanding how to appreciate your supermarket.

- Finding of strategic investors.

- Negotiating and term sheets management.

In the case of tech-enabled supermarkets, technology investment banking service can be seen as a middle ground between retail investors and AI investors.

Common Mistakes to Avoid

- Fundraising without a financial model.

- Over-/under-valuing the business.

- Negligence in governance and compliance.

- Selling it more like a kirana shop than a retailing business that can be scaled.

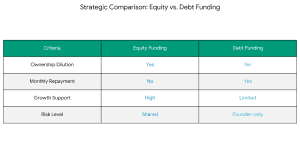

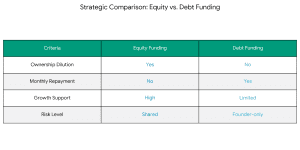

Equity Funding vs Debt Funding for Supermarkets

For fast expansion, equity funding for retail business is superior.

For fast expansion, equity funding for retail business is superior.

Frequently Asked Questions (FAQ)

Q. Is equity financing suitable in supermarkets?

Yes. The cash flow is predictable in supermarkets and therefore, this makes them attractive to the equity investors, as the operations are not strained by debt.

Q. Are supermarkets able to obtain business funding like AI startups?

Yes. AI inventory, pricing, and personification by Supermarkets tend to be a draw to AI startup-oriented investors.

Q. What are the documents needed in equity financing?

- Financial model

- Pitch deck

- Business plan

- Cap table

- Compliance documents

Final Thoughts:

If your supermarket is:

- Scalable

- Tech-enabled

- Financially disciplined

- Expansion-ready

Equity financing of supermarkets is therefore amongst the most effective growth strategies that can be used today. Through an appropriate financial model of startup, pitch deck and advisory services, the supermarkets are able to raise capital just like tech-driven businesses of today.