Starting up an AI company might be akin to attempting to scale Everest without a rope. You only possess an innovative idea, a vision, no connections, no network, and zero funds. The good news? You can find funding of AI startups, even when you are starting with nothing.

We interviewed 50 leading investors in the field of venture capital, technology investment banking services, and fintech investment banking. Their advice showed trends, approaches, and untapped opportunities that can significantly transform your success in raising funds.

Understanding the Funding Landscape for AI Startups

It is important to know how AI startups are funded before immersing into the strategies:

- Seed Funding: Capital to be used in the initial stages to develop prototypes or test the market.

- Venture Capital: Greater funding of startups with scale and momentum.

- Strategic Investors: Investors are corporations and fintech companies seeking to invest in emerging AI technology.

- Government Grants and Incubators: This is often neglected but this type of funding may be non-dilute.

Hint: The use of technology investment banking services and fintech investment banking expertise can be used to offer a road-map on how to structure deals and find investors effectively.

7 Proven Ways ot Get Funding for Your AI Startup With Zero Connections

7 Proven Ways ot Get Funding for Your AI Startup With Zero Connections

1. Pitch Your Pitch with Free Pitch Deck Templates.

1. Pitch Your Pitch with Free Pitch Deck Templates.

Shareholders desire transparency, perspective, and expansiveness. A refined pitch deck can be the difference. Use AI- and tech startup-optimized templates of free pitch deck to describe:

- Market opportunity

- AI product differentiation

- Business model and monetisation strategy.

- Traction and milestones

2. Use the Power of Online Media and Community.

Platforms such as AngelList, LinkedIn, and Crunchbase enable startups to meet with investors even without any personal ties. Join AI-related communities, communicate your vision, and seek advice from experienced professionals.

3. Think about Investment Banking Advisory Services.

Investment banking services in the field of technology are able to assist in structuring your round of financing, identifying the right investors, and offering credibility. A large number of investors like startups that are guided by advisory services as they are signs of professionalism and minimisation of risk.

4. Cultivate Strategic Partnerships.

Connect with fintech investment bank companies or technology accelerators. They are able to open the doors to funding networks, which you could not otherwise access.

5. Show Traction Early

Investors are more concerned with outcomes more than relationships. Show early adoption, prototype success, or pilot programs. This may contain customer testimonials, AI model accuracy rates or small revenue streams.

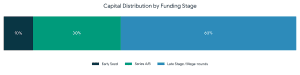

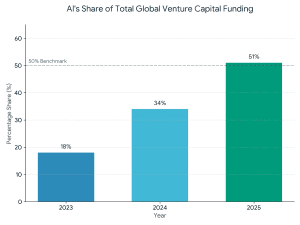

Late-stage rounds dominated AI funding in 2025

6. Pitch to AI & Tech Accelerators.

Funding and mentorship can be offered by such programs as Y Combinator, Techstars and AI-centered incubators. Your startup is also justifiable in future investors when you are an accelerator.

7. Take advantage of Content and Thought Leadership.

By posting AI insights, case studies, or technical blogs, you position your startup as a self-assured, well-educated member of the AI ecosystem. Investors will be more willing to invest in startups that have apparent expertise.

How Investment Banking Can Amplify Your Fundraising

Working with technology investment banking services or fintech investment banking experts can: Even as an early-stage AI company, you can:

- Referrals to high-value investors.

- Maximize your valuation and term sheets.

- Grant due diligence support.

- Place your startup with strategic value within the AI investment ecosystem.

- Imagine that they act like a force multiplier on your fundraising efforts.

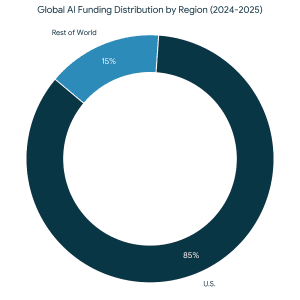

U.S. AI startups dominated investment flows in 2025 — capturing the majority of global funding.

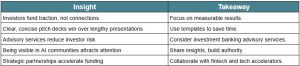

Key Takeaways From 50 Investors

Here’s what we learned after interviewing multiple investors:

FAQs – Frequently Asked Questions

Q1: Is this possible to raise money in an AI startup with no network?

Absolutely. Platforms, accelerators, and advisory services eliminate the need to make connections at the initial phase in case you are concentrating on traction and a good pitch.

Q2: What can investment banking do to assist an AI start-up?

They offer tactical advice, assist in organising the deals, introduce startups to investors, and make your business valid to get more trust.

Q3: Do free pitch deck templates work in raising funds?

Yes. The templates assist in making your AI startup look professional and summarised. Ensure that you tailor them in order to present your own distinctive AI solution.

Q4: What kind of investors are ideal AI startups?

The AI startups are usually of interest to seed investors, venture capitalists, corporate strategic investors, and fintech-oriented investors.

Q5: What do I do to show traction when there is no revenue?

Present prototype success, pilot projects, user base, AI model precision, or initial collaborations. Revenue is not as convincing as metrics.

Conclusion

It is not easy but not impossible to get business funding on your AI start-up without previous connections. With a powerful pitch, preliminary traction, online networking, accelerator program, and advisory services of investment banks, a first-time founder may be able to get capital and grow the AI innovations.

Bear in mind: investors do not invest in a Rolodex alone but the vision supported by the results. The proper approach can make your AI company raise money and flourish in the modern technology industry.

7 Proven Ways ot Get Funding for Your AI Startup With Zero Connections

7 Proven Ways ot Get Funding for Your AI Startup With Zero Connections