Capital fundraising in a hospital is quite different as compared to capital fundraising in a normal business. The hospitals are a highly regulated sector, with high initial cost and have a heavy burden of responsibility to the health of the populace. Owing to this fact, investors, banks and institutions look into hospital funding proposals with additional scrutinies.

In case you are intending to receive funding to set up, expand, or modernize a hospital, this revised roadmap will assist you in making sense of what really works in the current financial ecosystem.

Why Hospital Funding Requires a Strategic Approach

In contrast to an asset-Light startup, hospitals have to invest heavily in land, infrastructure, equipment, and qualified manpower before revenue stabilizes. The cash flows are slow to mature and margins are determined by patient volumes, payer mix and efficiency in their operations.

This is the reason why hospital financing is not merely a matter of money-raising but rather a matter of designing capital intelligently so that the hospital can make it through the initial years and expand in a sustainable manner.

Why Hospital Funding Requires a Strategic Approach

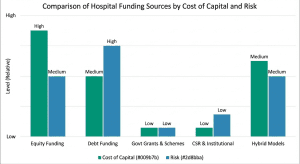

There are various sources of funds available to hospitals based on their size, ownership structure and level of growth.

Funding Sources that are common in hospitals.

- Equity Funding: PE funds (Healthcare) strategic investors, family offices.

- Debt Finance: Banks, NBFCs, project finance, term loans.

- Government Grants and Programs: State healthcare, subsidies.

- CSR and Institutional Funding: Social impact and not-for-profit programs.

- Hybrid Funding Models: A combination of long term debt and equity

Step-by-Step Roadmap to Get Funding for a Hospital

Step 1: Clearly Define Your Funding Requirement

Be Specific in Your Funding Need.

Begin with just one question: Why do you need funding?

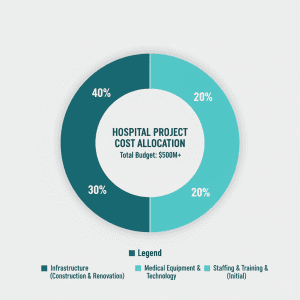

- The funds may be needed to fund:

- Acquisition and construction of land.

- Medical machinery and technology.

- First 12-24 months working capital.

- Specializations or bed capacity increase.

Transparency at this level will eliminate excess borrowing or unnecessary dilution of equity at a later date.

Step 2: Create a Realistic Hospital Business Model.

The business model of a hospital needs to be based on operational realities. Investors and lenders are keen on:x

- Bed occupancy assumptions

- Revenue per bed per day

- Department-wise profitability

- Fixed vs variable costs

Business valuation software can be used to transform these assumptions into structured financial projections so your projections look more credible and can be more easily validated.

Step 3: Conduct a Professional Hospital Valuation

The success of business fundraising is based on valuation. A well-prepared valuation:

- Gives standards of equity to investors.

- Enhances negotiations of loans.

- Shows financial restraint.

Hospitals that have clear valuation reasoning are likely to shut funding sooner and at superior conditions.

Step 4: Prepare a Strong, Investor-Ready Pitch Deck

Your pitch deck must have a clear story and not numbers. It must explain:

- The medical requirement you are dealing with.

- Competitive advantage at your hospital.

- Financial forecasts and break-even schedule.

- How the funds will be used

Using templates of the free pitch deck can save time, however, the customisation to the healthcare metrics is necessary.

Step 5: Choose the Right Funding Partners

Not all capital is equal. Banks are interested in security and payment ability whereas equity investors are interested in growth and profits. These are social impact and compliance that are prioritized by the government bodies.

Aligning the profile of your hospital with the appropriate source of funding will enhance the chances of approval by a significant margin.

Role of Investment Banking Services in Hospital Fundraising

Professional investment banking services value add by:

- Organizing the best debt-equity ratios.

- Finding the correct investors and lenders.

- Due diligence and negotiation management.

- Sustaining documentation and closing of deals.

In mid-to-large project hospitals, the skill advisory can be the boundary between the halted negotiations and the successful funding.

Why Business Valuation Software Matters Today

The hospitals can use modern business valuation software to:

- Calculate various financial scenarios.

- Stress-test assumptions

- Offer supported information to investors.

Common Mistakes Hospitals Make While Raising Funds

Common mistakes would include:

- Excessive forecasting of patients.

- Bypassing regulatory schedules.

- Using generic pitch decks

- Low estimates of working capital requirements.

- Bypassing professional appraisal.

These errors can be avoided and this would save months of delays and renewed negotiations.

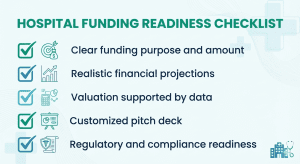

Final Checklist Before Applying for Hospital Funding

You must have before you go to investors or lenders:

- Specific purpose and amount of funding.

- Tactical financial forecasts.

- Valuation supported by data

- Customized pitch deck

- Compliance and regulatory preparedness.

Conclusion:

It is not just about finding funds to finance a hospital but also creating trust in the stakeholders. Hospitals that merge practical planning, professional appraisal, advanced gadgets and organized fundraising plans are much likely to triumph.

The intelligent funding program can also help ensure not only the attraction of funds but also the establishment of a long-term healthcare influence, as well as the stability of operations.