The pharma industry ranks as one among the most capital-intensive industries throughout the globe. Many stages, drug discovery and clinical trials, regulatory approvals and commercialization, require substantial investments. However, there is a reluctance of many founders to dilute ownership at an early stage. Need a guide to get funding in pharma sector without equity, this guide steps down funding channels, funding strategies, and investment banking knowledge specific to pharma, biotech, and medical device startups.

Why Funding Is Critical in the Pharma Industry

Pharma businesses are characterised by:

- High R&D costs

- Long development cycles

- Compliance with regulations.

- Infrastructure that is capital-intensive.

This renders the process of business funding of small businesses in pharma totally different as compared to tech or consumer startups. Proven founders and healthcare investment banking consultants either concur that the selection of the funding structure is as crucial as the funding amount itself.

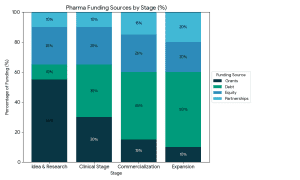

Stages of Pharma Funding: From Idea to Expansion

Stages of Pharma Funding

1. Idea & Research Stage

Funding is available to support:

- Drug discovery

- Proof of concept

- Pre-clinical research

Non-dilutive sources of funds:

- Government grants

- Research subsidies

- Academic partnerships

With free pitch deck templates, many founders are able to present early research to grant committees and institutional partners.

2. Clinical & Validation Stage

It is here that expenses are highly inflated by:

- Clinical trials

- Regulatory documentation

- IP protection

Intelligent financing sources not based on equity dilution:

- Venture debt

- R&D tax credits

- Strategic partnerships

At this point, it is important to use a highly organized startup financial model to show the cash flow planning and trial timelines.

3. Manufacturing, Commercialisation Level.

When approvals are close, funds are directed towards:

- Manufacturing scale-up

- Distribution

- Marketing

This is the point at which Investment Banking Advisory Services are more relevant in the structuring of large, non-equity financing rounds.

4. Expansion & Global Scaling

Pharma companies raise capital to fund at maturity:

- New product lines

- International expansion

- M&A opportunities

Investment banking services that are offered by the professionals are used in negotiating the favourable debt instruments and structured funding solutions.

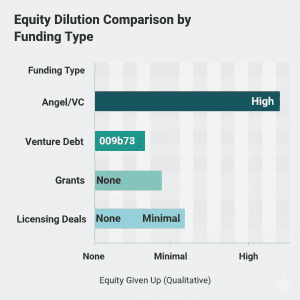

How to Get Funding for Pharma Sector Without Giving Up Equity

Equity Dilution Comparison

1. Venture Debt and Structured Loans.

The venture debt enables the pharma companies to raise capital on the basis of:

- IP valuation

- Future revenue potential

- Regulatory milestones

This is gaining popularity in the Fundraising for Healthcare companies that desire to maintain founder control.

2. Government/ Institutional Grants.

- Active support of many governments is:

- Drug innovation

- Rare disease research

- Improvement of medical technology.

This qualifies as one of the best methods of obtaining business funding to small business in pharma without dilution.

3. Strategic Co-Development and Strategic licensing.

Alternatives to the sale of equity in pharma startups include:

- License molecules

- Share development rights

- Sign revenue-sharing contracts.

It is normally recommended by experts of healthcare investment banking services to mid-stage companies.

4. Asset-Backed Financing

Funding can be done on your patents, IP, and manufacturing facilities, this works better with:

- Medical device startups

- Manufacturers of specialty pharma.

The pathway has been common in medical device startup ecosystem financing across the world.

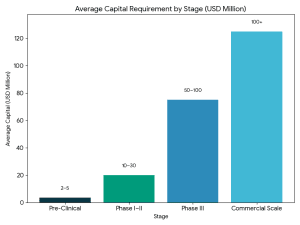

Medical Device & Healthcare Startup Funding Insights

Average Capital Requirement

Although pharma and medtech are similar, medical device startup funding can be advantageous due to:

- Faster regulatory pathways

- Earlier revenue generation

- Lending facilities that are secured by hardware.

Healthcare investment banking investment banks are often organized to provide blended financing plans of such startups.

Role of Investment Banking in Pharma Fundraising

Professional Investment Banking Advisory Services assist founders:

- Recognize non-dilutive sources of capital.

- Create institutional pitch decks.

- Develop defensible financial projections.

- Negotiate better debt terms

Most pharma founders do not adequately realise the value that experienced investment banking services can add in complicated fundraising rounds.

Top Ways to increase funding success.

- Prepare an actual Startup Financial Model.

- Professional Free Pitch Deck Templates.

- Underline regulatory preparedness.

- Display fund milestone utilization.

- Collaborate with specialists in Fundraising healthcare, Ex. FundTQ.

Final Thoughts:

Founders need to go beyond the conventional VC funding in order to successfully secure funding to grow the pharma sector. The proper combination of grants, debt, strategic partnerships, and professional investment banking advisory services will enable the pharma firms to grow sustainably without loss of ownership and control.

Whether you are a drug discovery startup or you are trying to raise some startup capital to fund a medical device, it is all about aligning your funding strategy with your level of development and future vision.