In the current competitive and capital-intensive business world, the availability of the right funding at the right time may either make a company grow or get stuck. Investment Banking Services in Delhi NCR come into the limelight at this point, to assist in raising capital, conducting strategic transactions, and achieving a maximization of enterprise value by startups, SMEs, and large enterprises.

Delhi NCR has become one of the strongest financial and starting ecosystems in India. Global investors, PE/VC firms and multinational corporations are located close to them meaning that businesses here have a unique chance to get big wins- so long as they engage the appropriate investment banking partner.

Why Delhi NCR Is a Hub for Investment Banking & Fundraising

Delhi NCR is home to:

- 1000+ startups and growth companies.

- Top PE & VC firms.

- Institutional investors, family offices, and NBFCs.

- Good legal, regulatory, and financial environment.

This renders Investment Banking Services in Delhi NCR essential to businesses that require:

- Growth capital

- Strategic partnerships

- Mergers & acquisitions

- Debt restructuring or structured finance.

What Are Investment Banking Services?

Investment banking services are professional financial advisory and fundraising solutions that aim at assisting businesses to raise funds and to carry out complicated financial operations.

The main services in investment banking are:

- Equity Raise (VC, PE, Angel Investors)

- Debt Syndication/ Structured Finance.

- Mergers and acquisitions (merger and acquisition advisory).

- Financial Modeling and Business Valuation.

- Structuring of transactions and Negotiation.

- Regulatory Support and Due Diligence Support.

These services can greatly enhance the rates of funding and valuation when provided by a team of professionals.

Get Funding for Business with Expert Investment Banking Services in Delhi NCR

Fundraising is not a pitching game, it is a game of strategy, storytelling, financial fidelity, and investor fit.

How the Investment Bankers Assist you to Raise Capital:

- Find the correct investors in your industry and phase.

- Develop investor-ready research documents and financial models.

- Maximum valuation positioning of your business.

- Coordinate the full process of fundraising, outreach to close.

- Make the best interest negotiation of term sheets.

You may be a startup with seed funding needs or a well-established business that is intending to raise Series B or PE financing, Investment Banking Services in Delhi NCR offer a structured and professional implementation.

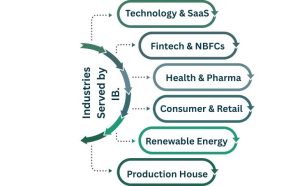

Industries Served by Investment Banking Firms in Delhi NCR

Main investment banks in the region serve a broad variety of industries such as:

- Technology & SaaS

- Fintech & NBFCs

- Healthcare & Pharma

- Production and Engineering.

- Real Estate & Construction

- Consumer & Retail Brands

- Renewable Energy & EV

This is a sector experience that increases investor trust and speed quickens the closing of a deal.

Why Choose Professional Investment Banking Services in Delhi NCR?

- Local Expertise and Global Reach.

The investment bankers of Delhi NCR have a great local market knowledge and the ability to access international sources of capital.

- Higher Funding Success Rate

Deals arranged professionally appeal to long-term investors who are serious.

- Time & Cost Efficiency

Bankers are in charge of the full fund raising process whereas founders are concerned with operations.

- Compliance & Risk Mitigation

Secures compliance with SEBI, RBI, FEMA, and laws.

Why Trust Professional Investment Banking Advisors?

1. Experience

1. Experience

Leading companies have implemented hundreds of fundraising and M&A deals in industries.

2. Expertise

These teams consist of chartered accountants, MBAs, former bankers and finance specialists.

3. Authoritativeness

Good contacts with the VCs, PEs, banks, and institutional investors.

4. Trustworthiness

Clear fee system, secrecy, and client centric advisory.

All these aspects have rendered Investment Banking Services in Delhi NCR a reliable growth partner, and not a service provider.

Why Trust Professional Investment Banking Advisors

- Faster access to capital

- Improved valuations

- Strategic investor relationships.

- Long term sustainable growth.

- Effective exits or expansions.

Frequently Asked Questions (FAQs)

1. What are Investment Banking Services in Delhi NCR?

Investment banking services in Delhi NCR are fundraising, M&A advisory, debt syndication, valuation, and strategic financial consulting of the business in various fields.

2. How can investment banking services help me get funding for my business?

They assist in finding the right investors, drafting financial reports, making an official (professional) pitch of your business, discussing terms, and closing a funding source effectively.

3. Who should use investment banking services?

Startups, SMEs, mid sized companies, and big business seeking:

- Growth capital

- Strategic investors

- Mergers or acquisitions

- Debt restructuring

4. How long does it take to raise funds through investment banking services?

Usually, 3-6 months, which is based on the business preparedness, sector, and capital.

5. What is the cost of investment banking services in Delhi NCR?

Typical costs are retainer fee + success-based fee, which are appropriately determined by deal size and complexity.

6. Are investment banking services only for large companies?

No. There are numerous companies that operate in the business of startups and SMEs, providing tailored fundraising and advisory services.

7. How do I choose the right investment banking firm in Delhi NCR?

Look for:

- Experience in handling transactions.

- Sector expertise

- Strong investor network

- Transparent fee structure

- End-to-end execution capability.

Conclusion:

When you want to have your business financed, expand operations, or make strategic deals, it would be a prudent, expansion-oriented move to team with professionals who provide Investment Banking Services in Delhi NCR.

Through the appropriate advisory assistance, business organizations can access capital, create value and make big wins in the competitive market.