“Your vision is a story. It is how you revolutionize it, how well you imagine it, how amazingly you narrate it, and how often you innovate it.”

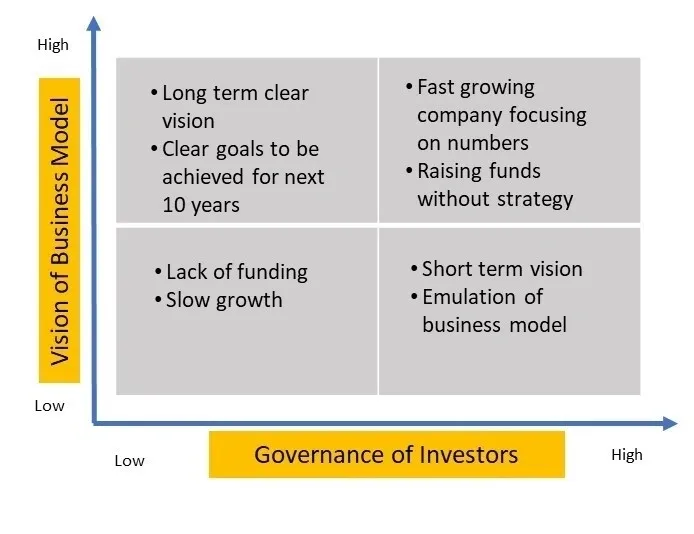

“The strength of the vision of your business model governs who will rule the game or the investors“

Are You Bringing A Revolution Or Playing A Safe Game?

Are we giving enough to satisfy the appetite of investors? As Myles Munroe, a speaker and an author correctly highlighted a striking difference between self-employed and an entrepreneur. Self-employed are the people working for themselves whereas, entrepreneurs are people who have a long-term vision and goals to achieve that vision.

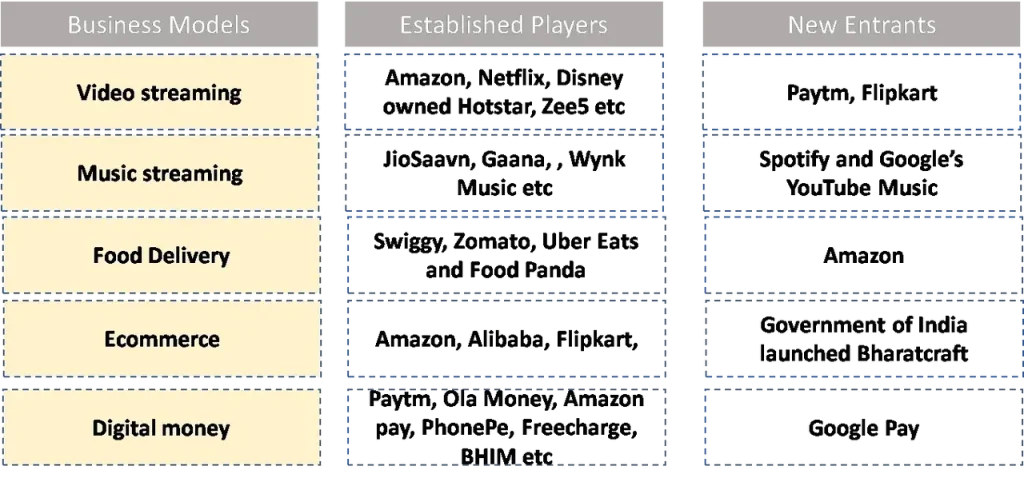

So are the startups we innovating appropriately? Or are we going overboard with existing startup business models making money. We are experiencing a world with entry of new players in the existing business models itself. Everyone is making the hay while the sun is shining. Indian economy is flourishing with entry of aggregators, and every new business model is based on aggregation of products or services.

To move a step further, there is an aggregator model and then there is a grand-aggregator model (aggregator of aggregators) such as Trivago, aggregator of hotel aggregators and Cabto, aggregator of ride sharing aggregators. Are we awarding the players having the first mover advantage. Those who carried out extensive R&D to build demand, who took the risk in an unknown economy. However, startups really need to rejuvenate themselves to think beyond what is available. Does the business model you are choosing fall within your vision or are they just doing it because the industry is well tested and they can provide a new feature and make it look different? There is a bundle of instances I would highlight here:

And there are many other case studies such as Rigo, Truecabs, Cabby in Ride sharing; Spinny in used-car selling and others.

Are You Prepared Or Are You Just Ready?

As an entrepreneur one needs to keep in mind that is there any problem one is trying to resolve or is one tweaking the loopholes in existing startup business models. We need to empathize with the business models which closed down in their early years of operation. Research shows that nearly 90% of business models fail within their first 5 years of operation.

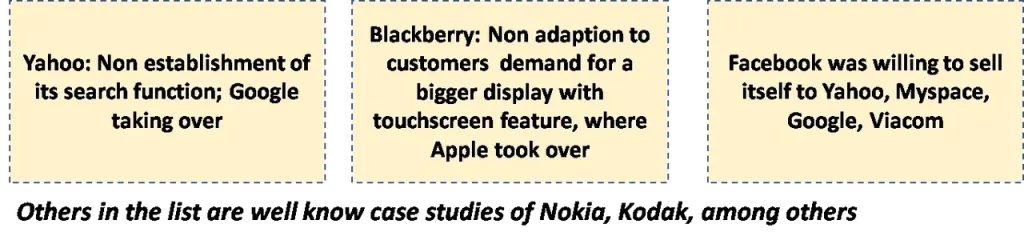

The major set-backs experienced by business models in the past were by the following:

The reasons stated by most news agencies for failure of business models are failing to innovate, lack of funding, lack of uniqueness, among others. No indian startup ever got shortlisted for Forbes’ 25 most innovative companies or Forbes Top 25 Innovative Growth companies. Why don’t we see rise of meta-level startups such as Google, Linkedin, Facebook, Whatsapp and Twitter.

Entrepreneurs need to think that are they just trying their hands on entrepreneurship or they have a vision and a dream to accomplish.

Investors Herd Mentality And Are We Living In An Investor-Biased World?

The point to ponder here is that all the businesses which failed had atleast one series of funding, which means someone believed in their story? That means if the business models were not unique and innovative, why would an investor invest money at the first place.

As an investor, did you think if you are investing in a business lead by an entrepreneur or a self employed? Are investors fell prey to fancy stories of manipulation and articulation narrated by some of the media companies today which showcase the startups as unique, adventurous while showcasing founders as superheroes.

Fund raising in startups has become a “game of confusion” which needs clarity at the earliest. To do this, thoroughly evaluate the entrepreneur’s vision by asking key questions: Is he ready for the next 10 years? Does he have a diversification plan or is it just a cash burn strategy relying on investors? Does he believe in his story? How prepared is he? Is he putting in the effort to achieve his goal or just burning the midnight oil?

Additionally, there is a slew of new era investors including many individual investors trying to make a buck out of demand-driven startup business models. So, when choosing investors, ask yourself: Is he the right fit? Has he helped his portfolio companies grow or led them to failure? Does he stand by his portfolio companies through thick and thin?

Fundraising: Let’s Clear The Air

Lets reiterate that there are no free lunches and lets learn from the demise of VG Siddhartha. When an entrepreneur raises funding, one is making him vulnerable and accountable to unknown band of investors. It’s a game where you end up diluting to the effect that the investors (strangers to you) take up majority of the stake in your own company. To exemplify this, Jeff Bezoz has 12% stake in Amazon, Flipkart founders had 5% stake, Ola founders have nearly 12% stake in their own company and others.

The flip side of this appears in stories like Uber’s co-founder Travis Kalanick resigning from his own company and Naresh Goyal stepping down and being barred from bidding for Jet Airways, which he founded in 1993. Cofounders of Flipkart resigned / stepped down after Walmart bought controlling stake, among other reasons.There are also other cases, such as Jack Dorsey’s resignation from Twitter and Andrew Mason stepping down from Groupon (now rebranded as nearbuy). In the wake of this, Oyo’s founder declined SoftBank’s offer to infuse USD1.1bn, fearing a loss of control. Therefore, it is of utmost importance to be more learned and mature while raising funds (startups) and providing funds (investors). While concluding this, we can state:

“Nothing can fail your business if you have a vision for next 10 years and you narrate the story of your vision well to those who could believe in you. Just remember business models might fail, dreams donot.”

Also Read – Business Continuity Plan