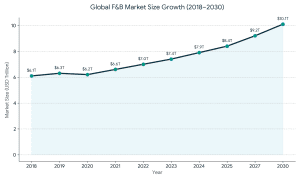

The food and beverage (F&B) sector is a very dynamic sector in the present day economy. Since the dawn of plant-based protein startups and the existing global brands, the food companies are constantly changing to satisfy the demand and preferences of the consumers and to keep pace with the market trends. In the case of founders and executives, it can be viewed as a need to operate in this fast-paced environment with the use of strategic financial expertise, which is where investment banking firms come in. Food businesses are linked with capital and mergers and acquisitions (M&A) are managed by specially designed food and beverage investment banking companies that offer valuation and strategic advisory services. The right investor can open the growth, maximisation, and long-term success.

What is Investment Banking Services?

What is Investment Banking Services?

Investment Banking Services are defined as specialised financial services that are provided to corporations, governments, and other large institutions. The main goal of these investment banking services is that they help these bodies to raise capital, facilitate major transactions, and manage their finances. Investment banks are basically intermediaries between the entities that need capital and those that can provide it.

Investment banking workflow for food & beverage companies

An investment banking firm that is primarily focused on the food industry can provide expertise and significant services that help the F&B companies. Ranging from small startups to large multinational corporations, their financial and strategic objectives are met with the help of these investment banks. These services are crucial and important for everything from business fundraising and securing a startup funding to orchestrating large-scale merger and acquisition.

For instance: A firm with experience in restaurant funding knows the intricacies of franchise models, while one specialises in CPG (Consumer Package Goods) understands brand valuation and distribution networks. This deep sector knowledge helps in crafting a compelling story for investors and negotiating the best possible terms.

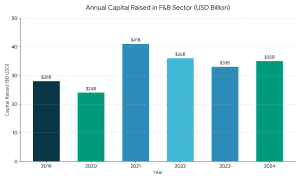

Global Capital Raised by Food & Beverage Companies

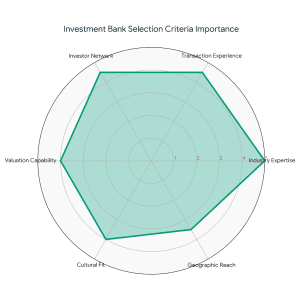

Key Criteria for Selecting an Investment Banking Partner in the Food Industry:

- Expertise in the specified industry is a must for choosing the right investment banking partner. A firm having dedicated F&B practice with a proven track record of successful deals in your specific sub-sector, whether it’s organic snacks, plant based proteins, or craft beverages.

- The type of transaction is a significant factor while looking for a firm, considering it is an important aspect.

- Reputation and network of the firm forms yet another important criteria for choosing the right investment banking partner. A strong reputation and an extensive network of strategic buyers, private equity firms and institutional investors are valuable to creating a competitive process and securing the best of valuations.

- Cultural fit is yet another important aspect. Communication methods and styles and work ethics should align with that of the principal firm.

Key Factors When Selecting an F&B Investment Banking Partner

The Top 5 Investment Banking Firms Serving the Food and Beverage Industry

1. FundTQ – Global Reach with Mid-Market Strength

FundTQ is a boutique investment banking firm that specialises in the F&B industry particularly in the emerging founder owned business. Prominent investment banking firm that specialises in the F&B industry, particularly in the middle market. Business valuation calculator along with ready-to-use templates are offered by FundTQ catering to wider needs of clients. Besides offering traditional advisory services, FundTQ also provides business valuation software as well as ready-to-use pitch deck templates. Consequently, these tools help entrepreneurs and startups prepare for fundraising discussions and, in turn, enhance their effectiveness in investor meeting.

Key Differentiators:

- Tailored support for startups and high-growth food and beverage companies.

- Combination of advisory expertise and digital tools, including valuation software and pitch deck templates.

- Proven track record in closing deals in deep tech and consumer sectors.

Ideal Client Profile: Startups, growth-stage food brands, and founder-led businesses looking for capital or clarity on valuation.

2. Alantra

Alantra comes in with a good international experience having a specialised food and beverage advisory team.They particularly excel in international dealings and are thus the preferred partners to food companies that wish to venture or acquire international clients.

- Core Services: Buy side and sell side M&A, Debt advisory and equity capital markets.

- Ideal Clientele: Mid-market firms that seek international expansion by way of mergers or acquisitions.

3. Intrepid Investment Bankers

- Competitive Advantages: Strategic counsel and implementation.

- Ideal Clients: Food companies in need of funding as well as strategic advice on how to grow.

4. Greenwich Capital Group

Fortune 500 food companies have direct operating experience, which is a team that reinforces investment banking services by this organisation. Their services comprise a range of business, such as snack food, dairy products, private label and distribution.Major services consist of M&A advisory, private placements, and financial advisory in general. They possess a first hand operational insight, which provides them with a different view of the supply chain, manufacturing and regulatory compliance.

- Major Services: M&A advisory, private placements and the expanded financial advisory.

- Ideal Clients: Snack, dairy, and distribution entrepreneurial firms as well as those supported by private equity have mined the market.

5. Mesirow

- Key Differentiators: Strong specialization in mid-market transactions.

- Ideal Clients: Established family-owned or privately held food companies planning succession, recapitalisation, or M&A.

Comparative Overview of Leading Food Industry Investment Banks

How Food Companies Benefit from Specialised Investment Banking Advisory

Specialised Food and Beverage industry Merger and Acquisition experts are not just the one who facilitate transactions but they are overall strategic partners. These specialised food and beverage investment banks provide deep understanding and help companies navigate the complexities. Overall dynamics of M&A, capital raising and other financial events. For a food business such firms or organisations add valuation expertise which helps in accurately valuing a company based on industry specific metrics like brand equity, distribution channels, and intellectual property.

Moreover, these firms give the principal companies access to capital by connecting them with a curated list of investors who, in addition, have a deeper understanding of F&B and are genuinely interested in the sector. Consequently, this support becomes critical for small businesses and startups, especially those seeking business fundraising.

Also Read: Can I Get a Free Business Valuation Report Online?

Advising on market positioning and identifying potential synergies with acquirers and curating a growth strategy or in simple terms an effective and strategic planning. This is important for a brand that is looking to expand its footprint or multi unit growth for a restaurant.

Bottom Line

Finding the right investment banking firm is a strategic and crucial move that defines the future of the food business. The firms that we discussed here (FundTQ, Intrepid, Alantra, Greenwich Capital Group and Mesirow) are all strong candidates, each with unique specialisation. When making your choice for food and beverage investment banking, consider your specific needs, the nature of your transaction, cultural fit and other business goals.

A right partner can be the key to securing the necessary startup funding and other business goals. A right investment banking firm can provide guidance, and the network that is needed to unlock maximum valuation and growth to your company.

Frequently Asked Questions (FAQ)

- What type of food companies typically engage investment banks?

Food producers, processors, restaurants, and distributors engage investment banks for major financial events like M&A, sales and capital raises. - What are the standard fees for M&A advisory in the food industry?

Fees typically combine a monthly retainer with a success fee. Often following a sliding scale formula based on the transaction value. - How do boutique firms compare to global investment banks?

Boutique firms offer more specialised expertise and senior level attention for middle-market food companies. While global banks offer broader services and a worldwide network for large, complex deals. - What factors should entrepreneurs consider while selection a banking partner?

Industry experience, sub-sector specialisation, firm’s investors network and cultural fit.

What is Investment Banking Services?

What is Investment Banking Services?

![The Best Healthcare Investment Banking Firms [Updated List]](https://fundtq.com/wp-content/uploads/2025/10/Add-a-heading-730-x-452-px-150x150.jpg)