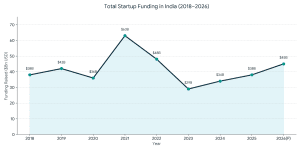

The fundraising of startups in India in 2026 will not be about finding capital anymore, but rather about making the right decisions of funding at the right stage and source. As the world has one of the largest startup ecosystems in India, the competition has become brutal, the scrutiny in the eyes of investors is aroused, and the focus on sustainable growth is increased.

Be it validating an idea, growing revenue, or going international, knowing the options of modern fundraising methods can have a direct effect on the survival and long-term success of a startup. It is a start-up fundraising guide that details how to fund your startup in India with 9 time-tested fundraising strategies, when to apply them, and how founders can approach investors in 2026.

What Is Fundraising for Startups in India?

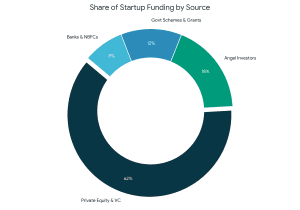

Fundraising refers to the process of raising money to enable startups to develop products, recruit talent, get customers, and grow operations. There are equity, debt, grants and hybrid financing models of startups in India, depending on the stage, traction, and business model.

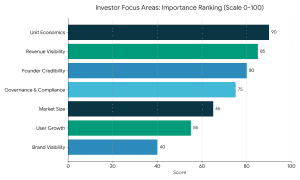

Quick Insight: 2026 investors are less focused on growth metrics and more on unit economics, founder credibility, governance, and revenue visibility.

Ways of Fundraising for Startups in India (2026 Guide)

Ways of Fundraising for Startups in India (2026 Guide)

1. Angel Investors

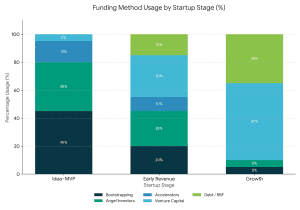

Angel investors are individuals of high net worth who take part in the early startup companies as equity investors. In addition to capital, they too tend to be mentors, open networks, and strategists. Angel networks such as Indian Angel Network and Mumbai Angels are organized groups of people in India that assist seed and pre-seed startups.

Best for:

- Idea to MVP stage

- First external funding

- Founder-led businesses

Founder Tip:

In 2026, founders will need a track record of successful execution as well as articulate go-to-market plans.

2. Venture Capital (VC) Funding

Venture capital firms make investments in high traction and scalability opportunities. VC financing promotes aggressive expansion but contains governance, reporting, and exit demands. Best VC funds that finance Indian startups are Sequoia Capital India and Accel.

Best for:

- Seed to Series C stages

- Scalable, tech-enabled models.

- Rapid market expansion

What VCs expect in 2026:

- Clean cap table

- Strong unit economics

- Stable revenue or usage increase.

3. Government Schemes for Startup Funding

The Government of India still contributes significantly to startup financing with grants, credit facilities, and equity. Most of the major programs involve Startup India, Atal Innovation Mission, and SIDBI.

Advantages:

- Lower dilution

- Subsidized loans or grants

- Founder-friendly terms

Best for:

Deeptech, industrial, social impact, and innovation startups.

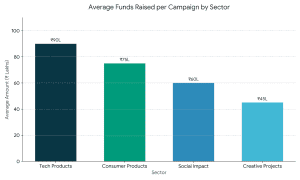

4. Crowdfunding Platforms

Crowdfunding enables startups to obtain small sums of money with a vast following using the web. It is effective with consumer brands, social ventures and creative products. Popular Indian platforms are Ketto, Wishberry and FuelADream.

Best for:

- Product validation

- Community-driven brands

- Early customer acquisition

5. Startup Accelerators and Incubators

Accelerators and incubators offer seed capital, mentoring, and access to investors. These programs are very selective and at the same time very valuable to the first-time founders. Such programs as Y Combinator, Techstars, and T-Hub are notable.

Best for:

- Pre-seed startups

- Founders in need of organization.

- Early investor visibility

6. Bank Loans and NBFC Financing

Finance via banks and NBFCs provides the founders with the opportunity to finance their businesses without dilution of capital. By 2026, there will be increased financial institutions that have startup-specific products. ICICI Bank and NBFCs are institutions that offer working capital and growth loans.

Best for:

- Revenue-generating startups

- Asset-light businesses

- Short-term capital needs

7. Bootstrapping

Bootstrapping refers to starting a business with self-funds or company income. Most of the successful Indian startups such as Zerodha started in the same manner.

Advantages:

- Full ownership

- Good financial discipline.

- Increased trust with future investors.

Best for:

SaaS, services, and profitable models.

8. Revenue-Based Financing (RBF)

Revenue-based funding enables start ups to pay back capital with a percentage of monthly revenue without equity dilution. D2C and SaaS startups are fond of Indian platforms, such as Klub and GetVantage.

Best for:

- Predictable cash flows

- Growth marketing spend

- Founder-friendly funding

9. Corporate Venture Funds

Strategic venture arms are ventures that are invested in by large corporations to foster innovation and partnerships. They are Reliance Jio, Tata Capital, and Google Ventures.

Best for:

- Strategic alignment

- Market access

- Enterprise credibility

How to Choose the Right Fundraising Option:

Ask yourself:

- What stage is my startup at?

- Is equity or non-dilutive capital required?

- Am I able to control investor expectations?

- What is my 3–5 year growth plan?

- No one best funding route exists, just the one that suits your start-up objectives.

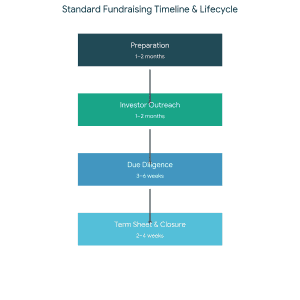

startup fundraising timeline in India

Frequently Asked Questions – FAQs

- How can a startup in India be best funded easily?

There are typically angel investors, government grants or bootstrapping in the early stage of startups. - Are startups able to raise funds without the issue of equity?

Yes. These can be through bank loans, revenue-based funding and government grants. - What is the duration of start up fund raising in India?

Usually 3-6 months, provided there is readiness, traction and alignment of the investor.

Key Takeaways

- Startup fundraising in India takes time, planning, and commitment.

- The investors of 2026 appreciate sustainability and not hype.

- Founders are expected to combine sources of funds at various phases of growth.

- Good fundamentals draw in improved capital on improved terms.

Need Expert Fundraising Support?

In case you need valuation, pitch decks, or investor strategy assistance, professional fundraising advisory can greatly increase your win rate.

Ways of Fundraising for Startups in India (2026 Guide)

Ways of Fundraising for Startups in India (2026 Guide)

Comments (07)