Modern startup valuations often seem like an unsolvable mystery enshrined in gossip and bubble rumors. Startups looking to raise capital need an understanding of how valuations work. Essentially, a value is the amount of money an investor is willing to spend on your total company — but only after parsing it out from a few key components that have a major impact on investor psychology.

In this guide, we will discuss the main parameters underlying startup valuations and provide some of the pitfalls you should avoid in the course of fundraising. The article provides founders the basis to think strategically in pricing: from focusing on business growth factors towards understanding its valuation- which includes EBITDA multiples, comparable deals, or even asset valuations. Whether you are a first-time founder or getting ready to scale, the future success of your startup hinges on understanding the valuation game.

Understanding The Startup Valuations Game

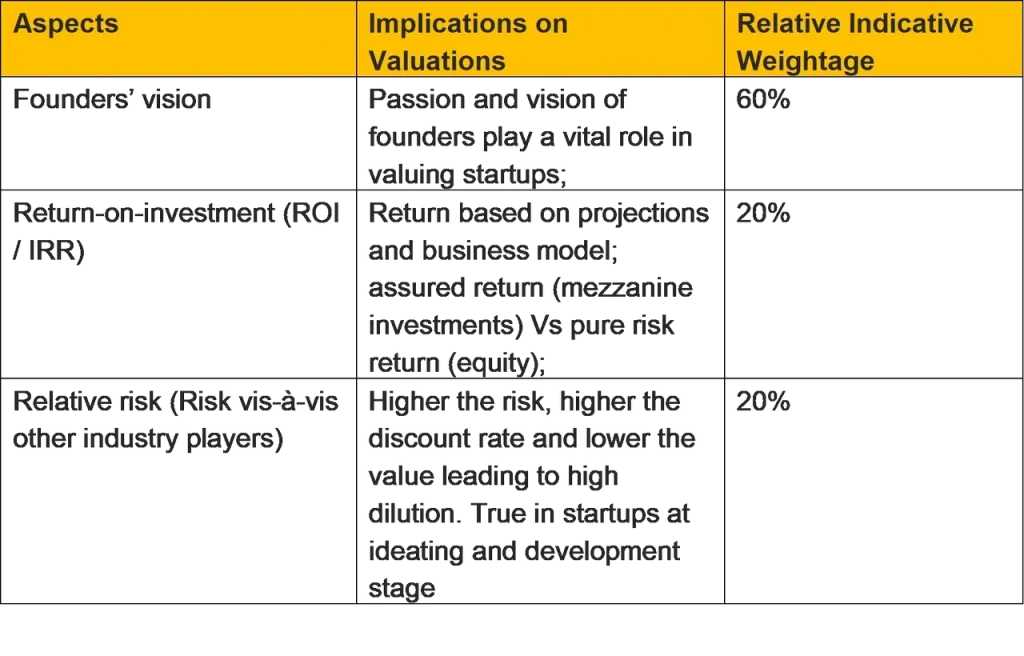

There is a lot of noise around startup valuations. Let us highlight the greater aspects and what to take into consideration while raising funds. The valuation is the amount an investor is willing to pay for your entire business. The valuation will all come down to three broad aspects mentioned below. The aspects are provided indicative weightage as well to make you understand the psychology of an investor:

It is being rightly said that investor invests in founders and not business models. Along with that, what actually makes the business valuable is mitigating the risk of the business failing in the future. It is hereby surveyed that 95% of the businesses fail in their first two years of incorporation. Therefore, it is extremely important to be mindful of 7 major mistakes to avoid when growing big and getting trapped in the valuation game:

- Diverting the vision of the business merely for getting investment from big investor

- Focusing on business than valuation number

- Keep personal connections with customers; valuation should not impact the core business

- Developing and streamlining processes and systems

- Don’t shy away from selling the business even when you reach at the top

- Reliance on the team too much; remember it is your dream; for employees, it’s a job

- Diversification in the industry; there are unexplored spaces across the globe to diversify business models

How Do I Value My Startup?

The major methodology to value the startups

- EBITDA multiple – In the case of profit-generating companies, an investor applies an EBITDA multiple, usually in the range of 7-10x (depending on the size of the business), and multiplies it by the EBITDA. Additionally, there could also be a multiple of sales / Gross Merchandise Value (GMV) for larger fast-growing businesses.

- Comparable Transaction Multiples– An investor might decide to list down all transactions in the near past and compute the multiples in comparable transactions. It is advisable to carry this method for a large set of comparable companies by grouping a wide range of business model.

- Asset valuation – In the case of capital-intensive business models, investors would like to value the underlying assets. The assets can be a database (for WhatsApp and database collating service business models), and traffic (for knowledge-sharing websites). The scoring shall also be done for the quality of such traffic, active and dormant users, a premium domain name (majorly in the developed countries), a recognizable brand name (social media marketing plays a critical role), and other things that can be leveraged to make higher profits and achieve a faster return on investment for the buyer.

Startups should keep in mind a couple of things while self-evaluating their businesses. Do not boast much of the things which you are not sure about. Analyse and assess in detail the industry size and where would you be positioned post-money in the industry. The best could be achieved, in case you could map the peer group on the scale for competition and USP.