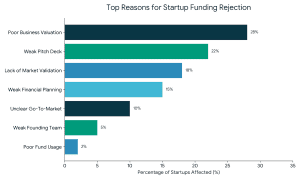

Fundraising is one of the most significant-and difficult-steps of a startup life cycle. Although creative, enthusiastic founders, and expanding markets, the proportion of startups that raise funds remains small. The first step to correct the situation and make the business investor-ready is to understand why startups cannot attract funding. I have spent more than 10 years as an expert in the finance and startup ecosystem and have analysed hundreds of failed and successful fundraising campaigns. The patterns are clear. It is not necessary that most funding gets rejected. Let’s break down the top reasons why startups fail to raise funding, and more importantly, how to fix them.

Top Reasons Startups Fail to Raise Funds: [Fix]

1. Poor Business Valuation

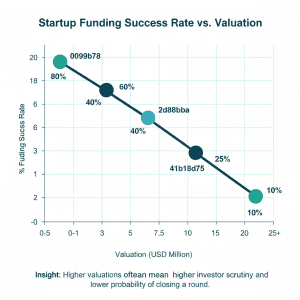

An unrealistic business valuation is one of the most frequent causes of failure in raising money in startups.

Why It Fails

- Overvalued stocks drive away investors.

- No information to support revenues forecasts.

- Founders mix up potential and proof.

When investing in startups, investors consider traction, revenue, market size, and risk. In case your valuation does not match industry standards, it will automatically be a weak pitch.

How to Fix It

- Take a Startup Valuation Calculator to approximate a data-driven valuation.

- Compared to other startups in your industry.

- Value change depending on stage of funding (pre-seed, seed, Series A)

👉 Pro Tip: A fair valuation is a sign of maturity and market knowledge and not the lack of it.

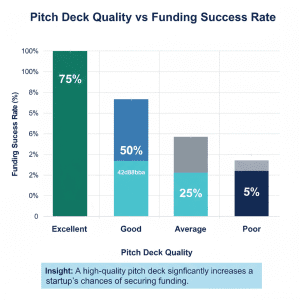

2. Weak or Incomplete Pitch Deck

2. Weak or Incomplete Pitch Deck

Another significant cause of failure of startups to attract funding is a poorly designed pitch deck.

Why It Fails:

- Excessive wording, lack of clarity.

- Lacking important slides (traction, financials, go-to-market strategy).

- Inconsistent storytelling

Hundreds of decks are discussed by investors. Unless you’re talking about value in the first 2-3 minutes, it is over.

How to Fix It

- Automated pitch deck templates, investor friendly.

- Follow a proven structure:

– Problem

– Solution

– Market opportunity

– Traction

– Business model

– Financials

– Team - Keep it pictorially tidy and fact based.

Pitch deck optimisation is frequently provided by modern fundraising services, and they should be used where necessary.

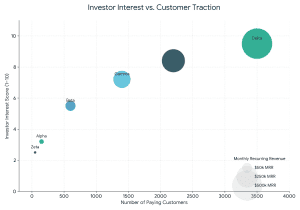

3. Lack of Market Validation

3. Lack of Market Validation

A lot of founders have the view that a great idea is all. It’s not.

Why It Fails

- Investors do not invest ideas, but proven businesses.

- Common red flags:

- No paying customers

- No user growth metrics

There is no actual market feedback.

This is one of the fundamental reasons why startups are not able to raise financing, particularly at seed and Series A levels.

How to Fix It

- Confirm demand MVPs or pilot programs.

- Display traction: users, sales, interaction, retention.

- Don’t use assumptions, use real metrics.

Even little pushes large promises aside.

4. Weak Financial Planning and Projections

4. Weak Financial Planning and Projections

Poor financial clarity is also another important factor that causes of why startups fail to raise funding.

Why It Fails

- Impractical forecasts on revenue.

- None of the knowledge about burn rate.

- Lacking unit economics (CAC, LTV, margins).

Investors would like to understand the flow of money in your business- and how their finances will be spent.

How to Fix It

- Establish open financial models.

- Given cash flow, runway and expenses are to be explained clearly.

- Make projections and the business-valuation meet.

Financial preparedness can be greatly enhanced by subcontracting professional fundraising.

5. Unclear Go-To-Market Strategy

Any product that has no single route to the customers is a dangerous investment.

Why It Fails

- “We’ll market later” mindset

- No business acquisition plan.

- Lack of knowledge of the target audience.

Such uncertainty is one of the biggest causes of ” why startups fail to raise funding” particularly in competitive markets.

How to Fix It

- Develop your perfect customer profile (ICP)

- Discuss how you get and keep users.

- Demonstrate channels of scalable acquisition.

Investors require transparency, not speculation.

6. Weak Founding Team or Skill Gaps

Investors do not only invest in ideas, but also in people.

Why It Fails

- No-support sole founders.

- Lack of technical or financial knowledge.

- No advisory board or mentors

A weak team increases the risk of its execution which directly involves funding decisions.

How to Fix It

- Assemble a balancing founding team.

- Add experienced advisors

- Point out appropriate previous achievements.

An effective team will be able to cover the early uncertainty.

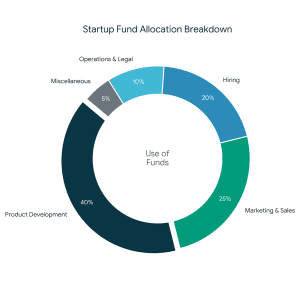

7. No Clear Use of Funds

The explanation of how the money will be used is one of the least considered reasons why startups fail to raise funding.

Why It Fails

- Vague spending plans

- Capital milestones absent.

- Lack of rationality on the investment.

The question that is put before investors is: What happens after I invest?

How to Fix It

- Split budget (product, promotion, recruiting)

- Connect funding with growth targets.

- Demonstrate how capital increases scale.

Clarity builds trust.

8. Not Investor-Ready or Poor Timing

8. Not Investor-Ready or Poor Timing

Startups fail sometimes not due to being bad- but rather due to being early.

Why It Fails

- Pitching before traction

- Targeting the wrong type of investors.

- Ignoring market conditions

This is a subtle yet actual cause of failure to raise funding by startups.

How to Fix It

- Target investors that matched your stage and industry.

- Traction milestone time fundraising.

- Create months to come to raise.

Preparation is power.

Final Thoughts:

The knowledge of why startups fail to fund has shaped the strategic advantage of the founders. The biggest mistakes are not when there are no ideas- but when there is insufficient preparation, validation and clarity.

Key Takeaways

- Pricing Realism Use a Startup Valuation Calculator.

- Use automated pitch deck templates.

- Focus on traction, not hype

- Enhance financial planning and storytelling.

- Think of professional fundraising providers.

Raising money is not an accident, it is a process. Plug the holes, narrate a better tale and investors will hear.

FAQs – Frequently Asked Questions

1. Why does a startup fail to fund even when there is a good idea?

The majority of startups do not get financed since investors employ execution, traction, and validation in preference of ideas. A good idea lacking market demand, business valuation, and a go to market strategy elevates the risk of investment, and thus there is no likelihood of getting investment.

2. Why do startups fail to raise funding the most?

Unrealistic valuation is the greatest cause of failure by startups to raise funds. Startups that are overrated and which lack underlying revenues, traction, or other such metrics usually tend to lose investor confidence at an early stage of the pitch process.

3. Is business valuation important in startup fundraising?

Valuation of business is essential. Valuation helps investors to evaluate risk, dilution of ownership, and potential of returns. When a Startup Valuation Calculator is used, founders will be able to show a data-based and plausible valuation that will be within the market norms.

4. Will a bad pitch deck lead to a loss of funding opportunities by startups?

Yes. One of the best fundraising killers is a weak pitch deck. The structure is improper, it lacks clarity, or it does not contain the financials, and the investors become disengaged very fast. Automated pitch deck templates will make sure that your deck is up to investor expectations and storytelling.

5. Are investors investing in startups that are non-revenue generating?

Yes- but only when there is great traction, i.e. user growth, pilot customers, strategic alliance or the market validation. Unrevenue startups should be supported by data rather than assumptions.

7. Are fundraising services worth hiring by startups?

Yes, particularly when it comes to first-time founders. Professional fundraising services assist in valuation, pitch decks, targeting investors, and modeling finances, eliminating expensive errors and increasing the conversion rate.

2. Weak or Incomplete Pitch Deck

2. Weak or Incomplete Pitch Deck 3. Lack of Market Validation

3. Lack of Market Validation 4. Weak Financial Planning and Projections

4. Weak Financial Planning and Projections 8. Not Investor-Ready or Poor Timing

8. Not Investor-Ready or Poor Timing