How to Get Tech Startup Funding: A Practical Guide for Founders

Launching a tech start up is fun- but to bring an idea into a successful business needs funding. Be it a new AI tool or SaaS solution, or a hardware solution, funding is necessary to grow operations, recruit talent, and roll out your product. This manual demonstrates how to raise money through tech startup funding, and has steps to follow that are relevant to the current tech ecosystem.

Why Tech Startups Need Funding?

Technology startups have a higher initial expense than traditional businesses because of:

- Software development, hardware development, AI development.

- Cloud infrastructure or servers.

- Recruiting engineers, designers and marketing staff.

- Regulatory and compliance standards.

Even the best technological ideas may come to a halt without adequate funding. That is the reason why any founder needs to know how the funding can be made and what the investors expect.

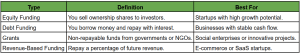

#1 Step: Identify the Right Type of Funding

The initial step in raising tech startup funding is to understand what type of funding suits your startup and its objectives:

- Bootstrapping: Financing operations with own savings or revenue. Ideal for early-stage ideas.

- Friends and Family: Minimal investments made by immediate acquaintances. Useful in development of proof-of-concept or prototype.

- Angel Investors: Seasoned investors that contribute investments in the form of equity. Often provide mentorship.

- Venture Capital (VC): Investments in startups of high potential growth. VCs will fund high amounts but with high equity and quick returns.

- Government Grants and Programs Non-dilutive funding to encourage innovation.

- Crowdfunding: Seek direct financing of potential clients via such platforms as Kickstarter or Indiegogo.

- Corporate Partnerships: Resources or investment by well-known companies in order to collaborate or get early access.

AI Insight: The new AI can assist the founders to find out potential investors, fund raise trends, and even pitch deck optimization to predict what will attract investors according to previous funding records.

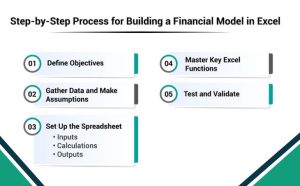

#2 Step: Build a Strong Business Plan

Investors desire to have a road map. The following things should be included in your business plan:

- Problem & Solution: What is your tech a solution to, and why is it special?

- Market Opportunity: Growth trends, competitors and total addressable market.

- Model: How are you going to make money with your startup? Subscription, licensing, free-mium, etc.

- Product Roadmap: Product development milestones and schedules.

- Team Credentials: Why your team can create the vision.

- Financial Projections: Financing requirements, expenses and revenue.

Pro Tip: AI tools such as business plan generators can assist you to organise your plan in the most effective way and can simulate growth conditions to investors.

Learn About: Technology investment banking services

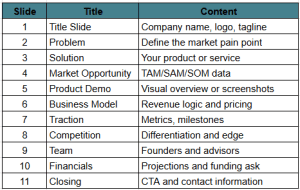

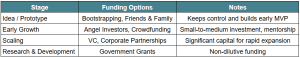

#3 Step: Craft a Winning Pitch Deck

Your startup’s first impression is a pitch deck. An AI-intensive solution will be able to study the existing successful pitches in order to maximise content and visuals. Key slides include:

- Introduction and Problem: Straight forward and clear.

- Solution: The value positioning of your product.

- Market Opportunity: Factual and valid.

- Traction: Start-user, revenue, partnerships.

- Business Model: How you raise money.

- Team & Advisors: Be competent and reliable.

- Funding Ask Finance: Be clear as to how the funding will expedite growth.

Tip: Keep it under 15 slides. Your deck can also be automatically generated by AI tools into graphs, charts and competitor analysis.

#4 Step: Demonstrate Traction

Startups with the potential of success are invested in by investors. Traction can include:

- The increase or the usage metrics of the users.

- Revenue or pre-orders

- Beta program success

- Joint ventures or alliances.

Small, initial traction can do major wonders to investor confidence. AI analytics can monitor user behaviour, growth patterns, and retention, and thus it is simpler to provide definite displays of traction.

#5 Step: Leverage Networks and Platforms

Funding is a matter of who you have connections with rather than what you have accomplished. Network expansion strategies:

- Startup Incubators and Accelerators: Y Combinator, Techstars and others offer mentorship and funds.

- Angel Networks VC Platforms: AngelList, Crunchbase, and LinkedIn may help you find investors.

- Tech Conferences and Meetups: Pitch events, Hackathons, and workshops are also good in terms of exposure.

AI Insight: AI-powered tools will assist to find investors best suited to your startup business, location, and funding round and save time and chances of success.

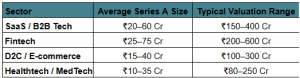

#6 Step: Choose the Right Funding Option

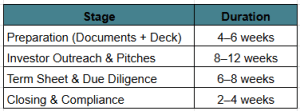

Here’s how to match funding types with startup stages:

Choosing the right option prevents unnecessary equity loss and aligns your growth trajectory with investor expectations.

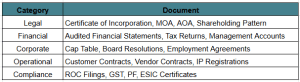

#7 Step: Avoid Common Pitfalls

- VC too soon: Prioritise traction.

- Failure to take legal and financial structuring: Unambiguous contracts and equity arrangements will avoid conflicts.

- Disregard of investor feedback: Relevant ideas, although financial assistance may not be as timely.

- Weak story telling: The investors must relate to your vision both emotionally and logically.

#8 Step: Leverage AI to Boost Funding Success

Artificial intelligence will be able to assist where conventional technology fails:

- Investor Research: AI is used to conduct a scan of databases with investors who are likely to finance your industry.

- Pitch Deck Optimization: Predictive technology proposes slides, images, and messages that resonate.

- Financial Forecasting: AI thinks over various scenarios to reinforce predictions.

- Market validation: AI software processes user response, trends, and sentiment to justify market demand.

AI can be used strategically to save time and reduce risk and enhance investor credibility.

Final Thoughts

Funding tech startups is not a random event. Focus on:

- Competence in your stage of start-up.

- Selecting the appropriate financing sources.

- Developing an effective business strategy and traction measures.

- Preparing a persuasive pitch deck.

- Using AI and networks to their advantage.

This is an efficient and confidence-based way for founders to get tech startup funding in order to transform innovative ideas into scalable and successful businesses.