How to Raise Funding for a Medical Startup: Complete Guide

The healthcare sector is on the rise, and the current technological advancements in the field of biotechnology, telemedicine, digital health, and diagnostics driven by AI redesign the healthcare provision. But when it comes to medical startups, the situation is different. And a list of challenges associated with medical startups includes maximal R&D expenses, addressable regulatory challenges, and the long runway to profitability. That’s why medical startup funding is critical to transforming your healthcare vision into reality.

Whether you are a provider of a medtech product, a digital health app or a biotech platform, this primer will put you through what you should know on how to raise money on your medical start up in 2025.

Why Do Medical Startups Need Funding?

Starting a medical company and growing it needs a lot of money. In contrast to the traditional tech startups, medical enterprises have to encounter:

Research and Development (R&D): Prototyping requires upfront investments between clinical trials, lab tests, and prototyping.

Time to Market:medical products may require a long time to become commercially viable and there is a challenge of sustaining themselves without outside support.

Regulatory Approvals: Obtaining regulatory approvals of these authorities such as CDSCO (India), FDA (U.S.) or EMA (EU) is a time- consuming and expensive process.

Recruitment of Experts: Be it medical-related personnel, regulatory consultants and lawyers, costs are high when employing expertise.

The best medical concepts can never become a reality without funding and even the most revolutionary medical ideas will never be available to patients, given lack of enough Medical Startups funding.

Also Read: Funding Sources for Medical Device Startups

Types of Funding Available for Medical Startups:

1. Bootstrapping

Bootstrapping can be defined as personal saving or re-investment of early revenues. This will exert complete control over you and has no equity dilution but would be appropriate mostly at an initial stage.

Optimal Uses: MVP creation, basic research and confirmation.

2. Grants and Government Programs

There are a number of government organizations that provide non dilutive grants to medical start-ups involved in solving public health problems or which are involved in innovation.

Examples:

India: There is provision of seed and equity assistance in BIRAC (Biotechnology Industry Research Assistance Council).

International: SBIR/STTR (U.S), Horizon Europe (EU).

Advantages: There is no equity loss; they can be accompanied by mentorship and networking.

Disadvantages: Good job opportunities but it is competitive in the process needed to apply to it and time-absorbing.

3. Angel Investors

Angel investors are people with high net worth that invest in startups at the early stage in exchange for an ownership share. Investors in medical industries usually have a background in that industry and can provide knowledge of the industry.

Hint: Try to focus on angel networks with a life sciences/medtech focus (e.g. Indian Angel Network, HealthTech Angels).

4. Venture Capital (VC)

Venture capitalists fund medical startups at scale, and are only interested in growth-ready based ones with intellectual property or proven traction.

- Advantages: Capitals, networks and strategic advice.

- Disadvantages: Dilution of equity and extreme growth pressure.

- The prominent healthcare VCs in India and world are the following:

- India India Life Sciences Fund, Bharat Innovation Fund

- Global: OrbiMed, Sequoia Healthcare, Sofinnova Partners

5. Strategic Partnerships

Hospitals, health insurance companies, and pharmaceutical companies will usually invest in or joint venture with possible medical startups.

Scenario: A chain of hospitals purchasing the coinvestment in a remote patient monitoring-based startup.

6. Crowdfunding

In a more efficient way, the crowdfunding equity can also be used (Tyke or SeedInvest) or reward-based campaigns (Kickstarter, Indiegogo) that can give the funds collected and confirm demand on the market.

Use Case: Suitable to medical gadgets or health-related products that could be sold directly to the consumer.

Read More: How to do Fundraising for Healthcare Startup?

How to Prepare for Medical Startup Funding?

1. Conduct a Business Valuation

Find out what you start up is worth before you go out to investors. Investors will be interested in knowing how they came to the conclusion of valuation.

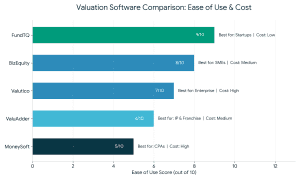

Make use of such tools as:

- Business valuation software – FundTQ

- Equidam

- BizEquity

- MyValuator

When it comes to very young startups, pay attention to the size of the potential market, IP property, and experience of the team of people who are launching it.

2. Compile a Good Presentation

An attractive pitch deck must include:

- Problem-solution

- Market opportunity

- Product overview

- Clinical validation or scientific validation

- Business model

- Go-to-market tactics

- Estimates of finances

- Regulatory strategy

- Ask & utilization of funds

Your introduction needs to be fine tuned to medical investors who realise that longer time frame, as well as regulator risk, is a factor.

3. Proof Your Concept

Present data that your product is effective and has a true solution. Examples include:

- Hospital pilot projects

- Buyer letters of intent

- Finished feasibility studies or clinical trials

- Validation removes the risk aspect on the side of the investor.

4. Learn the Regulatory Environment

Your financing strategy should take into consideration timing and expenses regarding authorization by such organizations as:

- CDSCO -Central Drug Standard Control organization (India)

- FDA- Food and drug Administration (USA)

- CE Marking- EU

When there is a roadmap toward compliance, investors will feel confident.

Where to Find Investors for Medical Startups?

Finding an appropriate investor is fifty percent of the game. Start here:

1. Start-up Accelerators and Incubators

Such programs provide seed capital, mentoring and access to investors.

India Examples:

- BIRAC’s BioNEST

- KIIT-TBI (medtech)

- Social health innovations- Villgro

Global Examples:

- Y Combinator (Healthcare batch)

- IndieBio

- JLABS Johnson and Johnson

2. VC Firms in healthcare

Conduct quality research of the VCs portfolio as well and pitch only to those that have made prior investments in healthcare or even medtech.

3. AngelList & LinkedIn

Promote a good reputation and interface with prospective investors. Strategically use filters in order to reach out to sector-wise and geographic-wise investors.

4. Events and Demo Days

Sell your idea:

- BioAsia

- TiE Global Summit

- HealthTech India Summit

The cool thing about all these platforms is that you can develop visibility and warm introductions.

Common Mistakes to Avoid

- Possibility of Overvaluation: It is also possible to over- Value without product-market fit and put a potential investor off.

- Understating Regulatory Costs: Omission of the regulatory strategy may be a warning sign.

- Unclear Go-to-Market Plan: You need to make a vague point on how you will get customers.

- Ignoring Clinical Validation: In the majority of medical startups, the possibility of testing and/or proving concepts is a must.

- Bad Financial Predictions: Unrealistic and baseless financial predictions can kill the interest of the investor.

Tools to Help You Raise Medical Startup Funding

Make use of these resources to expedite the fundraising process:

1. Business Valuation Software

- Business Valuation Tool By FundTQ

- These platforms assist you in utilizing industry-accepted models to demonstrate the worth of your startup.

2. Pitch Deck Templates

- Pitch Deck Templates by FundTQ

- Slidebean

- Startup Decks on Canva

- Sequoia’s Pitch Deck Template (medical customization)

- These aid in organizing your narrative and producing decks that are suitable for investors.

3. Predictive Financial Model Templates (for SaaS & MedTech)

- Excel Templates for CFI

- As appropriate, incorporate R&D expenses, regulatory schedules, and reimbursement plans into your models.

How FundTQ Helps with Medical Startup Funding?

FundTQ is an effective fundraising enablement tool that makes the capital-raising process seamless as far as early-stage medical startups are concerned. Tailored specifically for sectors like healthcare, medtech, and biotech, FundTQ connects founders with curated investors who have a strong interest in medical startup funding. The platform provides more than platform-level matchmaking capability, with functionality to create investor-ready-made pitch decks and bespoke financial models, taking into account clinical development pathways, regulatory approval processes, market entry plans, and the like. FundTQ assists startups to ensure that they have due diligence level documentary preparation as they make a very strong, compliant, and professional pursuit case before the investor. Regardless of whether you are looking into angel investment, venture capital, or venture partners, the FundTQ company will help you simplify the whole process and increase the likelihood of a successful medical startup funding round tremendously.

Final Thoughts

It’s both a science and an art to raise for medical startups funding in 2025. There has never been a better moment to look for funding as long as you are ready because healthcare innovation is attracting the attention of investors worldwide. Make demonstrating clinical value, long-term scalability, and regulatory readiness your top priorities.Adopting that traction into grant realities, you begin angel or VC stage funding. Avoid the common pitfalls in the absence of the correct resources and ingenuity in fund-raising.

Whether we’re talking about an AI-based healthcare solution, a diagnostic platform, or a life-saving device, funding will be important for expanding your impact. With the right strategy, your medical startup funding may save some lives and move your idea onto the innovation platform.

Why Does Business Valuation Matters?

Why Does Business Valuation Matters? Most reliable

Most reliable  With many options on the market, choosing the right business valuation program is key. Meet the leading tools that we can expect in 2025:

With many options on the market, choosing the right business valuation program is key. Meet the leading tools that we can expect in 2025: