Five Top Funding Sources for Medical Device Startups

One of the most important challenges facing a medical device startup is securing funding. Depending on how inventive, it may take millions of dollars to develop, research, prototype, comply with regulations, and go through scaling phases in creating a new medical device. This article will examine five top medical device startup funding sources available to medical device startups-from which you might determine the best fit for your venture.

Why Funding is Crucial for Medical Device Startups

The process of medical device startup funding is complicated. It needs the right suites and resource applications to reach targets such as regulatory approval, market entry, and profitability. For start-ups, the most vital aspect is availability of sound and reliable funding, the platform upon which its case may be successfully built in the future.

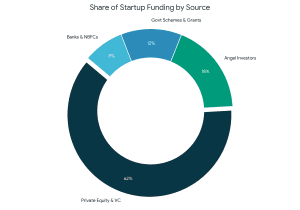

1. Angel Investors

Angel investors are individuals who tend to early-stage funding in medical device startups as they venture financing in trade for an equity stake. They do not only provide financing but are usually involved in mentoring and often have deep connections in the industry. Angel funding is exciting because it helps close the gap between an initial idea and a minimum viable product (MVP).

Take, for instance, the famous angel investor Esther Dyson, who has invested in several medical devices and calls for investing in health innovation. Angel investors generally look for start-ups that have an excellent business model and a good potential for scaling.

Pro Tip: AngelList does a nice job of linking your startup to potential investors. Emphasize your business plan, especially addressing unmet healthcare needs with your device.

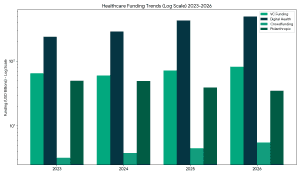

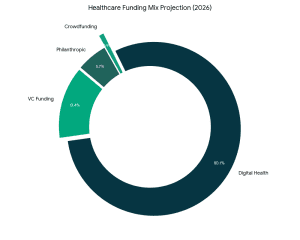

2. Venture Capital (VC) Firms

Once a medical device startup has shown considerable promise, venture capital is typically considered the next step. These are investor groups that are high risk and high return proponents, which makes them valuable for any medical device startup ready for scaling.

New Enterprise Associates (NEA) is an example of a firm with a very large portfolio of investments in healthcare as well as medical technology companies. VCs are generous with the offerings but require previously negotiated equity and control over business decisions.

Key Insight: VCs will invest in the start-up if the business has shown promise in a route to regulatory approval and has a large addressable market. Clinical trial results or early revenues will help increase chances.

Also Read: Private Equity vs Venture Capital: Key Difference

3. Government Grants

Grants in India by the government are assimilated as a source of funding that is non-dilutive in nature since startups do not give up equity for the support that they can get from such grants. Apart from these, there are many agencies that provide grants for health and medical innovations; the major agencies include the Department of Biotechnology (DBT), the Ministry of Health and Family Welfare, and the Science and Engineering Research Board (SERB). The initiative is supposed to drive improvements in public health while making it easier on the pockets of startups.

So, the time would be wasted while applying for a government grant; however, taking this subsidy would mean your startup is credible and trustworthy. It shows the promise of your project, which, in turn, leads to attracting other investments and opportunities as well.

The Small Business Innovation Research (SBIR) program provides a steady stream of grants for healthcare startups. To dive deeper into government funding strategies, read our blog on fundraising for healthcare startups.

4. Crowdfunding Platforms

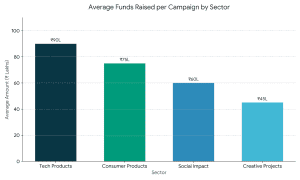

Crowdfunding has turned out to be the most common and most reachable Funding for medical device startups. In fact, there are many well-known platforms like Kickstarter, Indiegogo, and MedStartr which allow such startups to showcase their brilliant creations for an audience as wide as possible, especially to potential customers moving as sparingly as small investors.

Most influenced by the consumers would be devices like those ‘home-use medical instruments’ or the wearable health monitors/cards. Crowdfunding campaigns do more than provide the cash; they also help determine favorable market conditions for their products.

Success Story: Scanadu has thus far raised more than $1.6 million on Indiegogo in its effort to develop health diagnostics tools. The point is demonstrated by the very successful case of a great crowdfunding pitch.

Pro Tip: Make a powerful story for your campaign to convince funders. Present a critical medical challenge and visualize the solution on a prototype of your device to attract potential supporters.

5. Strategic Partnerships with Industry Players

So this can be a very important thing for startups to ally with some established medical device company or healthcare provider; such partnerships usually come with funding opportunities, access to manufacturing resources, and market knowledge.

For example, Johnson & Johnson’s Innovation arm, JLABS, has put together some funding, mentoring, and office space into the mix of incentivizing startups to indulge with a partner. Most of the time, these partnerships would blanket towards aligning your innovation with that of the partner’s strategic goals-

Key Tip: As you begin to approach potential partners, emphasize how your technology’s development will fit into their existing portfolio and open new markets.

Navigating the Challenges of Medical Device Startup Funding

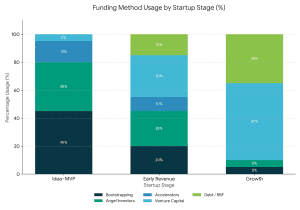

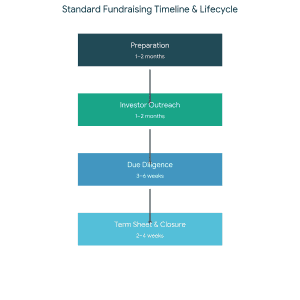

Every source of financing has associated inconveniencies: Angel investors and VCs want equity; government grants bring in huge amounts of paperwork; and citizen participation is the life of crowdfunded projects. Each phase of development and each specific need of the startup must be considered to arrive at a proper mix for funding.

Medical device startups are faced with heavy regulation, making both costs and timescales blow up even further. It is therefore imperative that some funding be set aside for steering through those obstacles.

Whether applying for a grant or pitching to a VC, the right tools can make all the difference. FundTQ contains a business valuation calculator that can assist you in determining what your startup would be worth, making funding discussions that more interesting. In addition, pitch deck templates guarantee that each of your presentations is professional and captivating, increasing your chances of securing funding for medical device startups.

Find such resources and many more on FundTQ.

Navigating differently strategically will enable funding medical devices to get financial stability and make lifesaving innovations available to the market. With every funding you disburse in this journey, ensure it aligns with the end vision of the organization.

FAQs on Medical Device Startup Funding

Angel investors, along with crowdfunding, make early-stage startups more comfortable. They typically don’t just fund, but mentor. Crowdfunding helps validate the product and build a customer base.

The qualifying factor would be that your startup must fit into the funding priorities of that agency. The NIH, for example, is concerned with projects that will further public health. You must describe in a strong application the technical plans, projected outcomes, and how your device meets the unmet health need.

Usually, it would be a startup with good team credentials, a clear regulatory pathway, large addressable markets, and a strong business model. Clinical evidence or initial traction in the market is often key.

The figure depends wholly on the extent of the engagement of your campaign as well as the audience. However, an effective campaign raises from ₹40 lakh to ₹8 crore. Providing a clear vision, creative visuals, and honest use of funds can do wonders for the results.

Certainly the case and advisable to do so. You may start with angel funding, apply for a government R&D grant, and then move to venture capital for scaling up. Diversification in funding provides risk mitigation and enhanced financial stability.

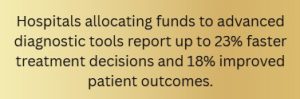

One of the success points of fundraising lies in an understanding of all the financial metrics driving investment. Studies show that hospitals investing in upgraded diagnostic tools improve patient response time by nearly 20%, strengthening investor confidence in measurable outcomes. Investors typically evaluate healthcare startups based on burn rate, projected revenue growth, patient acquisition cost, and long-term sustainability.

One of the success points of fundraising lies in an understanding of all the financial metrics driving investment. Studies show that hospitals investing in upgraded diagnostic tools improve patient response time by nearly 20%, strengthening investor confidence in measurable outcomes. Investors typically evaluate healthcare startups based on burn rate, projected revenue growth, patient acquisition cost, and long-term sustainability.

1. Understand Your Financial Needs and Goals

1. Understand Your Financial Needs and Goals

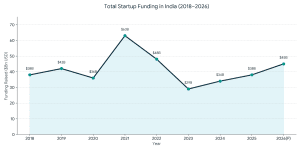

Ways of Fundraising for Startups in India (2026 Guide)

Ways of Fundraising for Startups in India (2026 Guide)