Raising funding or planning an exit? Your valuation can make or break the deal. In 2025, investors are more cautious, and overvalued startups are struggling. Here’s how to calculate your business valuation accurately using modern tools — with real examples and comparisons.

Here with the help of this blog,you will learn about the way to use internet-based calculators for determining and taking advantage of your company valuation.

What Is Business Valuation?

Business valuation refers to finding out the financial value of a business. It demonstrates how much your company might cost in the current market. Here, financial numbers, facts about the market, potential for growth, the company’s assets, liabilities, and intangibles like its reputation and important ideas are assessed.

In fact, this number serves as a base for better decision-making. No matter if you’re seeking capital, arranging a partnership, or planning to acquire another business, your company’s valuation matters a lot.

Why Does Business Valuation Matters?

Why Does Business Valuation Matters?

Here are the reasons why all entrepreneurs should use valuation:

- If the business valuation is correct, it helps investors figure out what they are investing in.

- Start by assessing your current market position and then plan your company’s movements for better expansion, increased sales, or possible diversification.

- If you are either buying or selling, understanding valuation is very important in the negotiation.

- When conducting and arranging an estate, or dealing with tax audits, you might have to obtain a professional valuation.

- Using valuation, you can notice the consequences of your choices on the company’s development.

With startup valuation tool, this process becomes accessible and actionable for businesses of all sizes.

Common Business Valuation Methods:

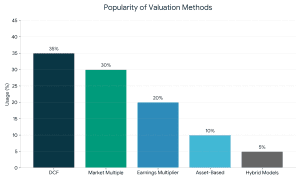

Most reliable business valuation tool integrates one or more of the following standard methods:

Most reliable business valuation tool integrates one or more of the following standard methods:

1. Income Approach (Discounted Cash Flow – DCF)

Forecasts cash flows that will happen in the future and adjusts them to the present time. The method is best suited to startups and growing companies that have reliable revenues.

2. Market Approach:

Assess your company in the same way as other businesses that were just recently sold. It is focused on several factors such as revenue and EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortisation).

3. Asset-Based Approach:

The net asset value is obtained by taking away the total liabilities from total assets. This way of dealing with debt is good for businesses that possess significant assets.

4. Earnings Multiplier Method:

Earnings are multiplied with industry standards to find the company’s value. Industries everywhere use it without much difficulty.

Modern Company valuation calculator often uses a blended approach to improve accuracy and relevance.

Best Online Business Valuation Calculators (2025)

With many options on the market, choosing the right business valuation program is key. Meet the leading tools that we can expect in 2025:

With many options on the market, choosing the right business valuation program is key. Meet the leading tools that we can expect in 2025:

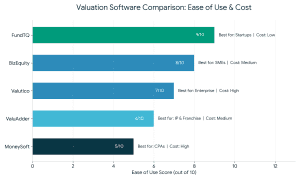

1. Business Valuation Calculator – FundTQ:

FundTQ has become well known in India’s valuation software industry, being popular among both startups and small and medium-sized businesses. This approach mixes DCF, earnings multipliers, and learning from what other firms in similar industries do.

Pros:

- The app was given free access to those using it in its first phase.

- It is easy to use for people without financial backgrounds.

- Structures for the financial world in India

Cons:

- There is not a lot of history to connect data from.

- For you if: You are starting from scratch with your organization and don’t have the budget for major expenses

Valutico is an enterprise-grade business valuation tool built for financial professionals. It gives you access to more than fifteen types of valuations and lets you compare your business with rivals internationally.

Pros:

- Financial analysis that is thorough and well created

- Such competencies benefit those working in investment banking, PE, and M&A.

Cons:

- Premium pricing

- You must have financial knowledge to handle your business well.

- This report is most recommended for big organizations, financial experts, and consultants.

3. MoneySoft

Financial experts such as CPAs and financial advisors use MoneySoft because it’s a desktop app for valuation. With it, users can prepare scenarios, manage taxes, and create financial forecasts.

Pros:

- Advanced financial modeling instruments

- This is especially useful for following regulations and planning your taxes.

Cons:

- Not cloud-based

- This is created mainly for those with experience in hacking.

- Accountants, CFOs, tax professionals will find this system most useful.

4. BizEquity

With BizEquity, the process of valuing small and medium-sized enterprises is simple and done quickly through the internet. Most financial advisors and insurance companies rely on this information to help their clients.

Pros:

- There are white-label options available on the cloud platform.

- Valuing clients’ accounts in a speedy manner

Cons:

- It is not always possible to customise the tool for difficult scenarios.

- This is mostly useful for advisors and insurance brokers, as well as small companies.

5. ValuAdder

You can use ValuAdder to assess your business using more than 15 types of valuation methods, such as those for intellectual property and franchises. One of the reasons it’s known is because of how easy it is to automate reports.

Pros:

- Scenario testing

- The industry favours businesses based on intellectual property or licenses.

Cons:

- Outdated interface

- It is more challenging to master the skills with cryptography.

- Mainly Beneficial For: People who run a franchise and IP consultants, especially advanced users.

Also Read: 7 Reasons Why Business Valuation Is Important For Investors?

Step-by-Step: How to Use a Valuation Calculator

To give an example, we will show you how to use the business valuation calculator on FundTQ.

Step 1: Choose Your Industry and Business Type:

The first thing to do is choose the field and kind of business you are interested in.This supports the software’s ability to select proper standards for setting prices.

Step 2: Enter Financials:

The second step is to enter the company’s financial information.

Add in your business’s revenue, its expenses, and the profits it makes.

Step 3: Set Growth Expectations:

Provide information on growth in the upcoming years, rates of customer churn, and other predictions.

Step 4: Review Valuation Summary:

Review the Valuation Summary when you have completed all the tasks above.Through several models, FundTQ can give you an estimated price with a low, medium, and high figure.

Step 5: Download Report:

Access a PDF file you can share that has graphs, a description of the approach used, and the breakdown of your value.

Most business valuation software follows a similar flow—simple inputs, clear results.

Advice to Ensure Your Valuation Is On Point:

- Use the Latest Financial Data:Work with the latest data for your finances; using past data won’t give you correct answers. Update quarterly.

- Stay Realistic with Projections: Setting false goals could impact the outcome and misguide people tracking the company’s progress.

- Include Intangible Assets: Remember to have brand power, patent holdings, loyal customers, and a positive reputation in your SEO efforts.

- Understand Multipliers:Find out what the usual Earnings Before Interest, Taxes, Depreciation, and Amortizatio. or revenue multiples are in your type of business.

- Cross-Verify Using Multiple Tools: You should not just use the same calculator every time. Make your graphs by picking a few of the best cases rather than many detailed cases.

Modern business valuation software often provides side-by-side comparisons to help you see multiple perspectives.

Also Read: Typical Ticket Size Raised Through Investment Banks

What Investors Look for in a Valuation?

While explaining your valuation to investors, always keep in mind that the value goes beyond a figure. They’re evaluating:

- Credibility of Method Used: Is the way you value businesses logical and does it make use of appropriate models?

- Market Opportunity:Is the business active in an industry that is getting larger or smaller?

- Revenue Quality:The quality of revenue is better when it is recurring rather than coming in one time only.

- Scalability:Can the organisation expand its operations without having to pay much more?

- Exit Potential:Does the business plan include the possibility of the investor earning a good profit within 5–10 years?

Using professional business worth estimator helps make your case with data, not just ambition.

Should You Use a Valuation Calculator for Fundraising?

Absolutely,but it’s important to stay aware of these things.

Online Valuation software for startups like FundTQ are great starting points for:

- Creating your investor pitch

- Measuring your achievements

- Checking how the business can react to various events

But for series A and the following stages, investors generally ask for formal valuations, audited financial statements, and reports from other parties. Take advantage of calculators as a starting point, yet make sure to check with a professional when you are playing with huge amounts.

Conclusion:

Figuring out your business’s true value can now be easily achieved. With the rise of intuitive and powerful Pre-money valuation calculator, entrepreneurs now have access to tools that were once limited to investment bankers.

When you decide on the platform that matches your present situation and plans, choose FundTQ that aims at knowing your value and gives you the strength to achieve success and achieve your goals.

Comments (02)