The starting point for a medical device firm can be very exciting and, at the same time, daunting. Development and bringing a medical device to the market incur enormous expenses, making securing financing crucial for medical device startups. Whether you are an entrepreneur with novel ideas or an entrepreneur enlarging your business, an understanding of funding sources and strategies needed will be necessary. This blog discusses seven great tips for getting funding for a medical device startup based on solid insights and expert advice.

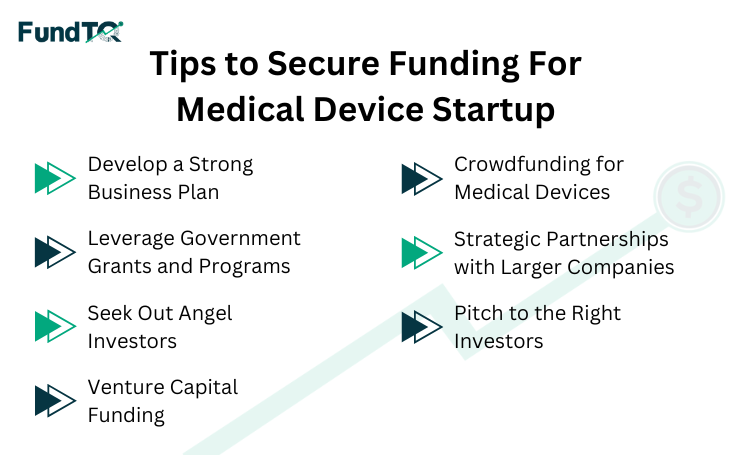

Tips to Secure Funding for Medical Device Startup

Following are the tips:

1. Develop a Strong Business Plan

A business plan has the most critical elements and this is what any investor looks out for during funding for a medical device startup. The business plan needs to outline the product development process, market analysis, finances, and regulatory pathway. One must explain the problem being solved by the device as well as the returns on investment for any investors coming on board.

A full plan also shows you have thought through the necessary knowledge of market demand and steps needed for the device to undergo different phases such as from design to prototyping and approval by FDA. Investors are more likely to consider your proposal a serious one if you have a real and clear strategy on how you intend to go through the complexities of the medical device industry.

Use valuation calculator or pitch deck template to refine your business plan for financial projections. These resources will come in handy in helping you advance a professional and convincing proposal to the investors. Read more for understanding about medical device startup funding.

2. Leverage Government Grants and Programs

Different governments in the world have different grants and funding programs for innovative solutions in medicine. In the USA, the Small Business Innovation Research (SBIR)-funded program and Small Business Technology Transfer (STTR)-funded program do provide great funding options for medical device startups.

These help in the research and development of small companies to incorporate into their market new products. The process of application is tendentially competitive; however, if your medical device meets certain specifications, you can use it as a source of valuable funding.

In 2020 alone, SBIR-STTR programs distributed federal research and development funds worth over $3.5 billion to the small businesses, with several grants focusing on innovation related to medical devices (Source: SBIR.gov).

3. Seek Out Angel Investors

The angel investors are usually highly wealthy individuals who invest their money into early-stage companies in exchange for equity or convertible debt. They are believed to be very flexible in functioning as compared to venture capital firms and, therefore, are also open to taking higher risks that make them the best source for acquiring funding for medical device startups.

You need a pragmatic opportunity other than good ideas to convince angel investors to fund your startup. But you should convince them with a good story about your startup’s potential. Prepare to demonstrate clearly how your device addresses a great medical need and has scalability potential. Angel investors look for very high growth opportunities, so your pitch should be not only about the product but also about the long-term profitability of that product.

In order to raise your chances, you can try visiting the local networks or using online channels such as AngelList because these platforms connect entrepreneurs with angel investors interested in funding medical innovations. Focus your pitch on the scalability of your device and on the potential return, which highly interests angel investors. This option can be great for medical device startup funding.

Also Read: Five Top Funding Sources for Medical Device Startups

4. Venture Capital Funding

Venture capital is a great source of finance for startups that have a high potential for growth. Compared to angel financing, venture capitalists usually give a lot more money but will expect a lot more in return. They are looking for products that can be scaled up very quickly, so medical device startups that have a really good proof of market need and regulatory strategy tend to be much more attractive.

Venture capitalists will require an exit strategy discussion when funding for a medical device startup. Investors will want to know how they will eventually cash in on their alterations, either through acquisition, licensing deals, or IPO.

According to MedTech Innovator, in its report about venture capital investment in medtech startups, investment exceeded $10 billion in 2020. All these point to a new trend of growing interest in financing opportunities for the medical device industry.

5. Crowdfunding for Medical Devices

Crowdfunding is gaining more momentum these days when it comes to funding medical devices startups. The Crowdfunding sites like Kickstarter, Indiegogo, or GoFundMe have come to bring dreams to an entrepreneurial pitch. Most of the time, it can even just use their consumer product where they see a good chance for reaching a broad audience.

However, it should be mentioned that these events are not just arranged and one only requires video, concise and compelling language, and rewards that draw backers, to perform the goal.

Initial steps are creating a community for the product that you intend to market before taking it through the process of crowdfunding. Ask potential customers and medical professionals what they think of the product in order to build anticipation and confidence in your device.

6. Strategic Partnerships with Larger Companies

One method to acquire funding for medical device startups is to create strategic alliances with established companies in the healthcare sector. These partnerships can help in accessing distribution networks, research and development support, and regulatory expertise, in addition to financial backing.

In addition to that, associating with larger corporations can help add credibility to the startup, which could make it much easier to convince other investors to join in. These corporations invest a lot in startups that portray their interests and match their current product portfolio.

You can also find companies within the same vertical area of the healthcare industry as your device or companies that are interested in housebreaking into other product portfolios.

7. Pitch to the Right Investors

Not every investor is the same. Therefore, you must target your medical device startup funding request to investors who would be interested in the medtech space. You need to isolate investors that are interested in healthcare or medical devices.

Customize your pitch to fit his interest and area of expertise so that he gets caught with his regulations, market demand, and possible long-term profitability. If he believes that you understand his intentions, he will likely invest.

Use platforms like FundTQ to meet investors who are searching for medical devices to invest in. The right tools, like the pitch deck itself, may even help you create a good, perfect pitch.

Also Read: How to do Fundraising for Healthcare Startup?

Conclusion

Securing funding for a medical device startup is not easy; however, it is possible to do so with a really good approach-towards the end of all the preparation and testing needed to bring your innovation to market. Whether submitting applications for government grants, looking for angel investors, or engaging in strategic alliance partnerships, it is always very important to have a done and dusted business plan and pitch for the right investors.

Frequently Asked Questions (FAQs)

The first step is to make a comprehensive business plan that details the product, the market analysis, and financial projections.

The government awards grants such as SBIR and STTR to small businesses undertaking brilliantly innovative projects in medical technology. These grants fund activities ranging from the initial application stages to regulatory approvals and product development.

Angel investors look for a startup with a vision, a product that solves an unmet market need, and significant potential for a return on investment.

Crowdfunding does two important things in the midst of fundraising: gradually building up the public interest, awareness, and support for the device while it continues appealing to consumers’ needs.

A strategic partnership typically includes partnerships with larger companies, where they get the financial support and expertise from these bigger companies and also get access to networks and established resources.

Comment (01)