In the dynamic landscape of financial technology, Pine Labs emerges as a beacon of innovation and reliability. With a steadfast commitment to technological advancement and customer-centric solutions, Pine Labs has carved a niche for itself as a leading provider of fintech solutions. Founded in 1998 by Lokvir Kapoor, Tarun Upaday, and Rajul Garg, Pine Labs boasts a formidable legacy of expertise and leadership in the fintech domain. From its humble beginnings to its current stature, Pine Labs has continuously evolved, leveraging its diverse revenue streams and strategic acquisitions to stay ahead of the curve in the Pine Labs funding ecosystem.

In a strategic move aimed at expanding its market presence, Pine Labs recently acquired Qwikcilver in 2020, signaling its broader focus on the South East Asian Market. Furthermore, Pine Labs’ impressive funding track record, highlighted by a significant $285 Mn Venture Round in May 2021, reflects investor confidence in its vision and potential. Despite challenges in profitability, Pine Labs has maintained a robust revenue performance, underpinning its impressive valuation of $3 Bn. Bolstered by support from leading investors such as Flipkart, Sequoia Capital India, Paypal Ventures, and Actis, Pine Labs stands poised to continue its journey as a key player in the fintech landscape. Join us as we delve deeper into the remarkable story and achievements of Pine Labs, a true pioneer in the world of financial technology.

Pine Labs Overview

- Leading Fintech Solutions Provider: Pine Labs stands at the forefront of the fintech industry, offering cutting-edge solutions driven by technological innovation and a commitment to problem-solving.

- Established Roots: Founded in 1998 by Lokvir Kapoor, Tarun Upaday, and Rajul Garg, Pine Labs boasts a rich history of expertise and leadership in the fintech domain.

- Diverse Revenue Streams: Pine Labs generates revenue primarily through the sale of products such as its PoS payment devices, complemented by a range of other services tailored to meet the evolving needs of its customers.

- Strategic Acquisition: In a strategic move aimed at bolstering its market presence, Pine Labs acquired Qwikcilver in 2020 for $110 Mn (INR 801 Cr). This acquisition underscores Pine Labs’ broader focus on the South East Asian Market and its commitment to enhancing its offerings through strategic partnerships.

Funding History

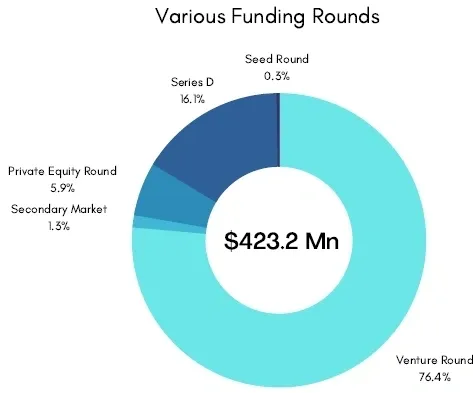

- Impressive Funding Track Record: Pine Labs has successfully secured funding totaling $423.2 Mn over the course of 12 years and 8 rounds, reflecting investor confidence in its vision and potential.

- Significant Venture Round: A major milestone was reached on 17th May 2021, when Pine Labs raised a substantial $285 Mn in their Venture Round. This injection of capital underscores the continued growth trajectory and market demand for Pine Labs’ offerings.

- Financial Performance: Despite fluctuations in profitability, Pine Labs has exhibited a strong revenue performance, registering $173 Mn in revenue in 2018. While it achieved profitability in 2014 and 2017, maintaining profitability has been a challenge in recent years.

- Robust Valuation: Despite profitability challenges, Pine Labs has managed to achieve an impressive valuation of $3 Bn, highlighting its market potential and investor appeal.

- Diverse Investor Base: Pine Labs has attracted investment from leading names in the industry, with Flipkart, Sequoia Capital India, Paypal Ventures, and Actis among its prominent lead investors. This diverse support network underscores Pine Labs’ position as a key player in the fintech landscape.

Also Read: Urban Company Funding

Comment (01)