Funding in Organic Food Companies – How to Raise Smart Capital for Sustainable Growth

The organic food industry is no longer a niche but it is now a rapidly expanding global market based on health consciousness, sustainability aspirations and conscious consumerism. With the increasing demand, investments in organic food start-ups and established brands have emerged as one of the major necessities that start ups and established brands seek to grow their operations, maintain their supply chain, and venture into new markets.

This guide is split up into how to get funding in organic food companies, organic food companies can attract strategic capital, what investors seek, and how to make your business successful in the long term. This article will make it clear and real-life whether you are a startup founder, MSME owner, or you have a growth-stage brand.

Why Funding Is Critical for Organic Food Companies

Organic food companies have their own problems unlike the conventional food companies. The increased sourcing costs, certifications, eco-friendly packaging, and increased supply chains translate to the need to have the appropriate funding.

The main reasons why organic food companies require financing:

- Certified organic production on a large scale.

- Investing in sustainable sourcing and farming.

- Cold chain and logistics construction.

- Distribution (retail, D2C, exports) expansion.

- Consumer education and brand building.

- Having regulatory and certification requirements met.

Organic food companies can not only survive on strategic funding, but also grow profitably and responsibly.

Market Opportunity: Why Investors Are Interested in Organic Food

Strong market fundamentals are leading to increased support of organic and clean-label food brands by investors.

Strong market fundamentals are leading to increased support of organic and clean-label food brands by investors.

The main industry statistics (India and global):

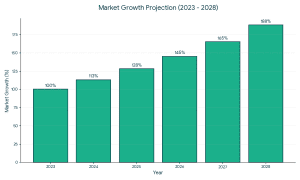

- The organic food market is expected to increase at a rate of ~13–15% CAGR per annum in the global market in the coming 10 years.

- The organic food market in India is fuelled by the increased urban demand, exports and government support.

- Product lines such as organic staples, packaged foods, baby food, dairy alternatives, and functional foods are gaining a lot of ground.

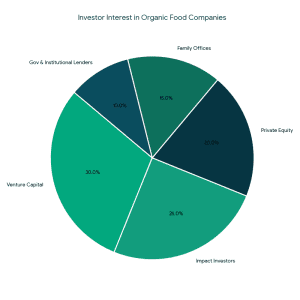

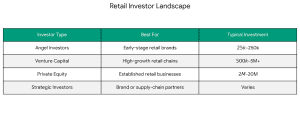

Increase in organic food companies renders financing appealing to:

- Venture capital firms

- Impact investors

- Private equity funds

- Family offices

- Institutional and governmental lenders.

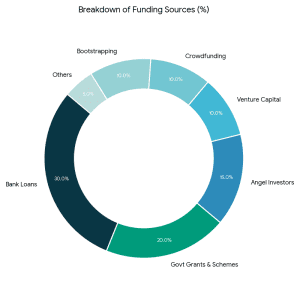

Types of Funding Available for Organic Food Companies

Types of Funding Available for Organic Food Companies

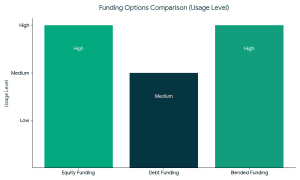

Choosing the right funding structure is as important as raising capital itself.

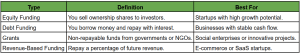

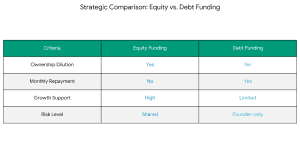

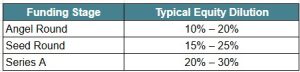

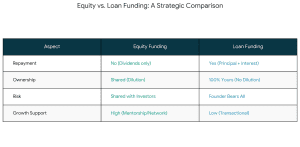

1. Equity Funding

1. Equity Funding

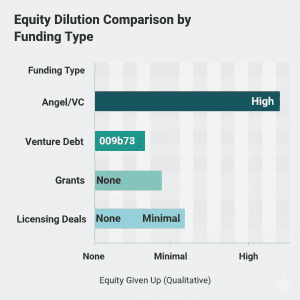

Equity financing refers to selling a part of your company to investors.

Best for:

- Organic food startups in their early and growth stages.

- Highly differentiated and scalable brands.

Common equity investors:

- Angel investors

- Venture capital funds

- Impact and ESG-investors.

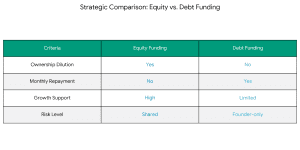

2. Debt Funding

Debt funding involves loans that have to be repaid at interest.

Best for:

- Working capital needs

- Machinery, processing units or warehouse expansion.

Options include:

- Bank loans

- NBFC funding

- Government-backed schemes

- Supply chain financing

3. Blended & Strategic Funding

Most organic food businesses today are mixed financing, i.e. equity, debt and grants. This brings about dilution minimisation and the availability of adequate capital to grow.

What Investors Look for in Organic Food Companies

The founders should meet the expectations of the investors to raise funds successfully in organic food companies.

The founders should meet the expectations of the investors to raise funds successfully in organic food companies.

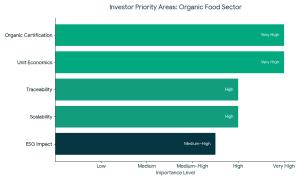

Key evaluation criteria:

- Certified organic sourcing and traceability.

- Well-established network of farmers/suppliers.

- Crystal-cut unit economics and margins.

- The distribution and production model can be expanded.

- Consumer trust and brand positioning.

- ESG and sustainability influence.

- Standards of regulatory compliance and food safety.

Investors do not fund products only, but they fund systems, processes and the long-term vision.

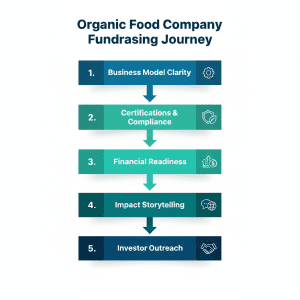

How to Prepare Your Organic Food Business for Funding

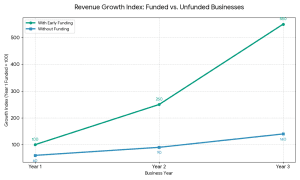

Preparation is the biggest differentiation between funded and unfunded companies.

Preparation is the biggest differentiation between funded and unfunded companies.

1. Build a Strong Business Model

Clearly define:

- Customer segments and target market.

- Pricing and margins

- Distribution channels (B2B, D2C, retail, exports)

2. Ensure Compliance & Certifications

Investors would like to see companies with:

- Organic certifications (india organic, USDA, EU organic etc.)

- FSSAI compliance

- Audit ready systems Quality control.

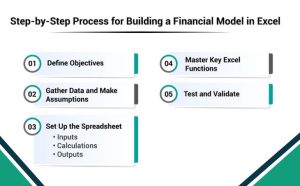

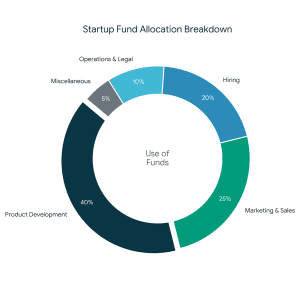

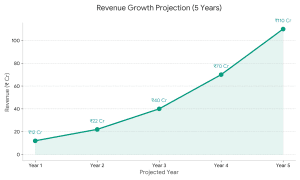

3. Financial Readiness

You should have your financials of:

- Clean bookkeeping

- Revenue projections

- Cash flow visibility

- Clear use of funds

4. Impact Storytelling

Impact investing is closely related to organic food funding.

Highlight:

- Farmer empowerment

- Environmental benefits

- Reduced chemical usage

- Green efforts in packaging.

Strategic Funding vs. Traditional Funding

Not all capital is equal.

Not all capital is equal.

Traditional funding focuses on:

- Short-term returns

- Financial metrics only

Strategic funding offers:

- Industry expertise

- Market access

- Supply chain support

- Long-term growth alignment

In the case of organic food firms, strategic funding can provide better benefits as compared to capital investments.

Role of Funding Advisory Platforms in Organic Food Funding

Managing investors, paperwork and negotiation is sometimes tricky – particularly among agricultural or food entrepreneurs.

It is here that funding support mechanisms such as FundTQ-style advisory models can be of value by:

- Finding the appropriate funding mix.

- Reaching interested investors.

- Efficiency in the structuring of equity and debt.

- Enhancing investor preparation.

- Shortening fundraising time and risk.

Professional funding assistance allows organic food companies to concentrate on development rather than the documentation.

Common Mistakes to Avoid While Raising Funding

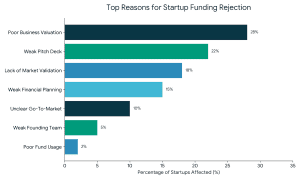

Most organic food startups fail because of some mistakes, which can be avoided:

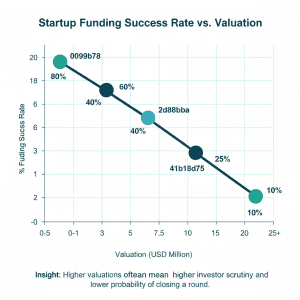

- Early overvaluation of the company.

- Weak financial planning

- Ignoring unit economics

- The wrong kind of capital is raised.

- Absence of compliance records.

By shunning these traps it will enhance your possibility of successful funding and sustainability.

Key Takeaways

- Companies that produce organic foods need strategic funds because of the increased sourcing and compliance expenses.

- Totally certified, scalable and impact-driven organic food corporations are what the investors like.

- There are equity, debt, government schemes and blended finance funding options.

- Good unit economics and traceability enhance success in funding.

- Long-term operational and market value is added by strategic funding partners.

Final Thoughts:

Funding in Organic Food Companies is the process of raising funds, whether in equity, debt, or a combination of both, to facilitate production, processing, certification, distribution, and growth of organic food businesses. Strategic financing assists organic food firms to cope with increased input prices, comply with certification, grow sustainably and create lasting growth of the investor and invitee alignment.

Frequently Asked Questions (FAQ)

Q. What is funding in organic food companies?

Investment in organic food companies is the act of attracting financial resources to execute organic farming, food processing, certification, branding and market development. Such funding can be provided by investors, lenders, or government programs on sustainability and clean food systems.

Q. Why do organic food companies need strategic funding?

Costs of production, supply chain and stringent certification are more in case of organic food companies. Strategic funding does not just offer capital but also industry experience, supply chain financing and long-term expansion alignment.

Q. What types of funding are available for organic food companies?

Companies of organic food can increase:

- Angel investor and venture capital funding of equity.

- Funding of debts using banks, NBFCs and government schemes.

- Hybrid financing of equity, debt and grants.

- The correct combination will vary with the level of development and capital requirement of the company.

Q. What do investors look for when funding organic food companies?

Investors usually consider:

- Organic certification and regulations.

- Traceability and sustainable sourcing.

- Business and distribution models that are scalable.

- Good financial discipline and unit economics.

- ESG and the environment.

Q. What is strategic funding in organic food businesses?

Strategic funding is the capital provided by investors or other institutions that provide more to the money, including industry contacts, expertise in operations and long term support in the market.

Q. How do organic food companies get funding?

Companies in organic food are funded with the help of making compliant financials and obtaining organic certifications, proving sustainable sourcing, and approaching the appropriate mix of investors, lenders, or government schemes based on their stage of growth.

Types of Funding Available for Organic Food Companies

Types of Funding Available for Organic Food Companies

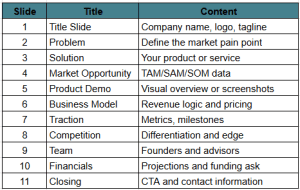

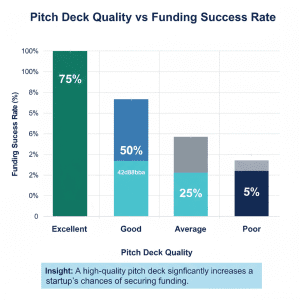

2. Weak or Incomplete Pitch Deck

2. Weak or Incomplete Pitch Deck 3. Lack of Market Validation

3. Lack of Market Validation 4. Weak Financial Planning and Projections

4. Weak Financial Planning and Projections 8. Not Investor-Ready or Poor Timing

8. Not Investor-Ready or Poor Timing

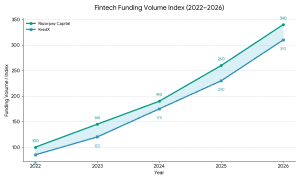

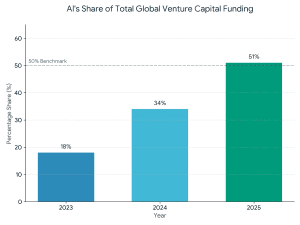

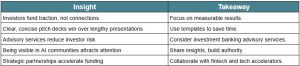

7 Proven Ways ot Get Funding for Your AI Startup With Zero Connections

7 Proven Ways ot Get Funding for Your AI Startup With Zero Connections 1. Pitch Your Pitch with Free Pitch Deck Templates.

1. Pitch Your Pitch with Free Pitch Deck Templates.

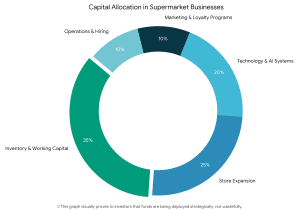

7. Retail Company Financial Model

7. Retail Company Financial Model