In the high-stakes world of startups, where funding decisions can be made in days and fortunes won or lost in quarters, investors trust isn’t just a nice-to-have — it’s a strategic asset. Product development, market penetrations, and pitch decks are some of the issues that founders pay attention to. However, it is not analytics and concepts which make an investor write that check. It is faith – in the integrity, skill and dedication of the founder. Differently put, it is faith.

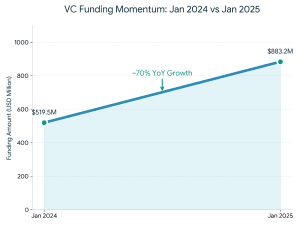

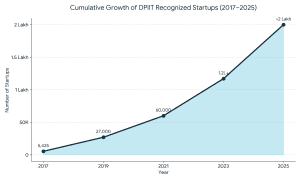

Such trust is even more essential in new ecosystems such as fundraising for startups in India, where venture capital is proliferating, yet trust is hard because of the historical experiences of misreporting, overvaluation, and governance failure. Investors gamble on humans rather than statistics. This blog discusses why trust is fundamental in the relationship between investors and why a person can be perceived as trustworthy, and how to portray that to investors at every fundraising level.

Why Trust Matters to Investors?

Start up investing is not a smooth straight forward process. It entails enormous risk, lack of complete knowledge and reliance on future potentiality. This is the reason why the aspect of trust comes at the heart of decision making process of all those investors:

a. High-Risk Environment

Startups work under a volatile environment. There can be a product pivot, passing market conditions, and faster-scaled competitors. Investors are not in a position to either stop or affect these variables, but they will be able to have control over the people whom they partner with. The inherent risk can be countered by confidence in the decision making of a founder, his resilience and truthfulness.

b. Long-Term Relationships

Venture investments are very long-term ventures-unlike stock market where one probably expects gains at the end of the year. This renders trust as an essential part of the founder-investor relationship. It turns out that investors rather prefer those founders who can be increased to greatness, supported in difficult moments, and hailed during prosperous ones.

c. Uncertainty Based Decision-Making

A lot of investment decisions are done on partial information. In this case, financial diligence is equivalent to emotional due diligence. Integrity usually becomes the show stopper when there are conflicting measures.

Key Traits Investors Look for in Trustworthy Founders:

The venture capitalists, angel investors and even strategic investors have devised intuitive radars of testing founder credibility. The characteristics that they all approve of would be:

A. Transparency

Transparency is more likely to build the Investors trust with founders who are willing to discuss the problems, mistakes, and learning. It is a sign of maturity and sense of risk.

B. Consistency

This message and action should be ensured not only in pitch meetings but also after funding in telephone conversations with a consistent image established. Changing stories are misleading and would destroy confidence.

C. Execution ability

Trust does not only belong to the emotional realm it is an act. Letting a founder state that an MVP will be delivered in three months and a founder delivers it in two, that would prove to be a level of trust.

D. Inclination to take feedback Openness to Feedback

Perfection is not awaited by investors. They do require modest posturing though. Entrepreneurs who accept criticism and go to work on it create a spirit of working together.

E. Integrity of Financials

Fuzzy math is a halo mark. Founders who are trustworthy are conservative on projections, rigorous on accounting and open on burn rates. Clean cap tables and sound post money valuation make it look good.

Tools That Strengthen Trust

Contemporary founders can use tools that can strengthen investor confidence. These are not just good practice, these are the aspects of strategic trust-building.

A. Business Valuation Software

Tools like FundTQ or comparable business valuation software help startups demonstrate professional-grade financial planning and fair valuation. These instruments lower the level of subjectivity and allow objective-based negotiations.

B. Pitch Deck Templates of Investor-Raising

The thing is that clarity, completeness, and professionalism can be guaranteed through well-reviewed pitch deck templates and the absence of common pitch deck mistakes. They assist the founders to develop a story and to state it in a logistic manner.

C. Clean Reporting and Regular Updates

Monthly, or even quarterly updates to investors, even those who are still prospects, generate momentum and participation. Such visible reporting systems, like automated dashboard, are indicators of maturity and discipline in execution.

Common Mistakes That Break Trust:

A. Over promising and under delivering

It is perhaps the greatest and most common pitfall, particularly, in the course of the seed funding. To impress investors, there are cases where founders overstate product launches, customer acquisition or revenue goals in an attempt to get an investor to invest.

After failing to attain those milestones, it does not only show inadequate forecasting but also impairs the reputation of the founder. Aspirants start thinking whether things will change in the future.

What to do instead: Form realistic goal time-bound assessment based end results. It is advisable to under promise and deliver the products quicker than the promise than to promise what you cannot deliver.

B. Hiding Bad News

All startups take a detour – a goal is not met, a team member drops out, there is a bug in the product, or the market rejects it. The most unsatisfactory thing that a founder can do is to hide these problems before investors in the anticipation that things will automatically resolve themselves.

Such transparency gives a shortfall of trust. Investors do not want perfection, they want to be told the truth and to be accountable.

What to do instead: Take initiative to share the challenges, preferably with a solution in place. Credibility is fostered by being transparent even when the times are hard.

C. Unrealistic Financial Projections

When numbers are offered without any vivid assumptions and highly over taunted revenue projections, investors are bound to raise their eyebrows. The process of preparing financial projections must depend on logic, industry averages and market realities rather than wishful thinking.

When projections do not meet the market realities or previous performance, investors will consider manipulation or gullibility-both have a slippery effect on your credibility.

What to use instead: Structured models which can be found in business valuation software or scenarios explaining your assumptions. The main key is transparency in numbers to maintain investors’ trust.

D. Ignoring Competitor Activity

Comparative statements made in relation to the competitors during investor discussions may be perceived as arrogant behaviour or lack of knowledge of the market. There is no startup that exists without other startups around it–investors like to hear how you distinguish yourself, not that you feel there are other startups out there.

When you fail to do this, it will appear that you either forgot to do your homework or you are not ready to adapt.

What to use instead: Recognise and openly give credit to the competitors and examine their strengths and weaknesses and show how your startup has a superior or more distinct value to the proposition.

D.Neglecting Legal and Compliance Issues

Startups often move fast and break things—but ignoring legal or compliance obligations can break investors trust beyond repair. This consists of intellectual property ( IP ) problems, unpaid taxes, or not having founder agreements, inappropriate ESOPs, or non-conformity in company regulations.

These concerns can be lurking behind the scenes and not arouse until it is too late, but when they do, they have the capability of causing due diligence to stall and deal momentum to be crushed.

What you can do instead: Get your IP, company structure, shareholder arrangements and compliance right early. It can be an idea to use legal services or websites providing startup compliance.

How to Build Trust Before, During, and After Fundraising?

Trust is not something that can be established one time but it is an ongoing process. This is how to do it at each of critical phases:

A. Before Fundraising

- Map your story: Make your same story appear throughout your website, LinkedIn, investor notes, and pitch.

- Check your figures: Employ the use of tools or advisors to make sure your numbers are justifiable and within the realms of reason.

- Get warm intros: Trust is best established when you come in through each other, trusted people.

- Write down what you learn: Post-mortems or case studies are a sign of self-reflection and candour.

B. During Fundraising

- Have your data room in place: Be aggressive when it comes to supplying information. Recently a well-organised due diligence folder told much.

- Keep communicating: Before making any conclusive decision, investors tend to stay quiet. Do not push them too hard on matters of keeping them informed.

- Make assumptions clear: In the event that a market forecast or CAC value is made on assumptions, this should be stated.

C. After Fundraising

- Deliver on-boarding packages: Establish Day 1 communication expectation, governing, and update requirements.

- Provide quick victories: Even trivial gains after the capital injection will testify to them that they made a wise choice.

- Be seen: Have consistent check-ins, post strategic decisions and ask for feedback.

- Accept failures quickly: An example of a heartfelt apology and a remedy, is more effective than being silent.

How FundTQ Helps Build Investor Trust?

In the new data era of fundraising, the issue in the use of the right tools can often make an enormous difference in terms of how investors feel about your startup. One such tool making a mark in the ecosystem is FundTQ — an integrated platform designed specifically to support startup founders in navigating fundraising with transparency, structure, and credibility.

Here’s how FundTQ helps enhance investors trust:

A. Valuation that is Realistic and Defensible

FundTQ uses industry-compliant valuation methodologies to offer founders an unbiased and data-backed estimate of their company’s worth. Unlike arbitrary numbers that raise red flags, valuations derived through business valuation software like FundTQ are more likely to be accepted by sophisticated investors during negotiations.

B. Investor-Ready Compliance

From cap table structuring to compliance documentation, FundTQ guides startups through the due diligence process even before the funding round begins. This minimises wastage of time in back and forth and portrays the startup as fund ready boosting the credibility of the investors.

C. Proposal and Budget Template

On the platform, it is possible to access professionally designed templates of pitch decks and financial projection tools. These assets help founders avoid critical pitch deck mistakes and build a narrative aligned with investor expectations.

D. Formal Fundraising Process

FundTQ breaks down the seed funding process into actionable steps, enabling founders to track their fundraising journey from investor outreach to deal closure. This degree of formality indicates to investors that the capital raising is a matter of seriousness to the founder and he/she has made time to understand the process.

E. Investor Communication Dashboard

Once you’re in discussions with investors, FundTQ allows you to share your updates, documents, and financials in a secure, well-organized dashboard. It establishes a single point of truth that is both transparent and effective, and these features strengthen the element of trust.

In essence, FundTQ is more than a platform, it’s a strategic partner in making your fundraising journey more investor-friendly and credibility-driven.

Final Thoughts: Trust is Your Competitive Edge

It is used to go beyond experience and the number of rounds funding raised to actually build trust as the real differentiation in an ecosystem where virtually every pitch deck, AI generated predictions, and hyper-growth tales abound. Startups that build investors trust as a core strategy but not an afterthought that tend to go further, raise smarter capital, and attract long-term allies.

Other than raising funds, trust is also useful in major exits, improved partnership, and adaptive leadership. Trust is something that can become your anchor, and your strength in a space, where making fundraising mistakes, economic crises and rivalry is part of the order of things.

Therefore, be it bootstrapping, or requesting equity instead of debt financing, or when preparing for medical startup funding, founders cannot raise capital upon a vision, but they have to be able to fund it through trust.

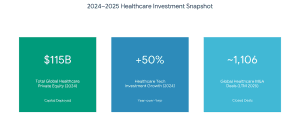

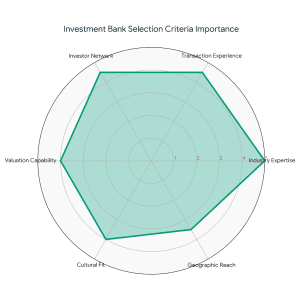

What is Healthcare Investment Banking?

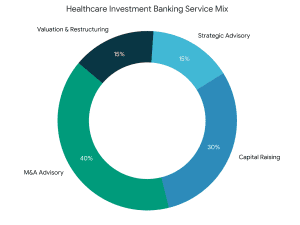

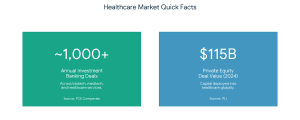

What is Healthcare Investment Banking? Life sciences investment banking provides a varied area of services. Key services include:

Life sciences investment banking provides a varied area of services. Key services include:

What is Investment Banking Services?

What is Investment Banking Services?

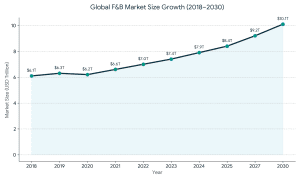

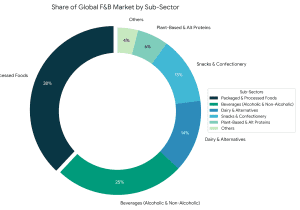

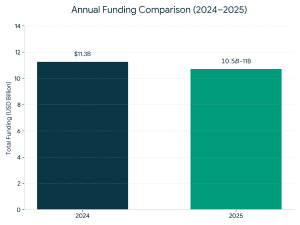

This is a full guide on how to navigate the startup funding in India in 2025 – 2026.

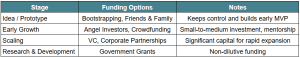

This is a full guide on how to navigate the startup funding in India in 2025 – 2026.  The various funding routes also have trade offs, in matters of control, risk, and scalability, and those entrepreneurs must match them to their business model.

The various funding routes also have trade offs, in matters of control, risk, and scalability, and those entrepreneurs must match them to their business model.

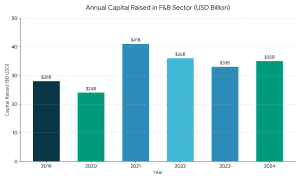

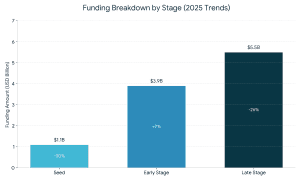

These are the main trends that are going to impact the funding this year:

These are the main trends that are going to impact the funding this year: