What Is The Best Way To Fund A Clothing Brand | Complete Guide

Starting a fashion brand is artistic. Scaling it is financial. When you are trying to find the most effective way to finance a clothing brand, this entire guide will show you how to find strategic funding used in clothing business, which capital structure to use, and how to position your brand to achieve long-time profitability.

Be it a D2C clothing company, a sustainable fashion brand or a high end designer, when you get access to the appropriate investment banking services, it can turn your growth endeavours around.

Why Strategic Funding for Clothing Business Matters

The fashion industry is capital intensive. Regular inflow of capital is important in sourcing fabrics and inventory management, marketing and retail expansion.

Strategic funding is not all about collecting money. It involves:

- Organized capital planning.

- Business appraisal.

- Investor targeting

- Financial modeling

- Growth advisory

Strategic financing of clothing business unlike traditional loans ties capital to your expansion road-map.

What Is the Best Way to Fund a Clothing Brand?

What Is the Best Way to Fund a Clothing Brand?

It does not have a single, universal answer. The optimal financing source will be based on:

It does not have a single, universal answer. The optimal financing source will be based on:

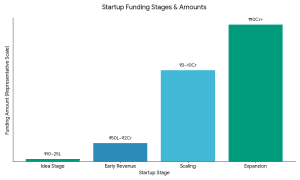

- Brand stage (idea, MVP, scaling, expansion)

- Revenue traction

- Gross margins

- Marketplace distribution model (D2C, retail, marketplace)

- Working capital requirements.

The best funding options are as listed below:

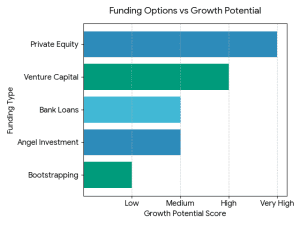

1. Bootstrapping (Early Stage Validation)

- Self-funding is effective at:

- Prototype development

- A small number of collection launches.

- Market testing

It retains the ownership but restricts scalability.

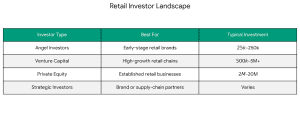

2. Angel Investment

Angel investors will generally invest in:

- Startups in fashion at the early stage.

- D2C brands that are highly branded.

- Environmentally friendly clothing businesses.

It is also in India, where cities such as Mumbai, Bengaluru, and Delhi are active in terms of providing support to fashion and lifestyle brands through the angel networks.

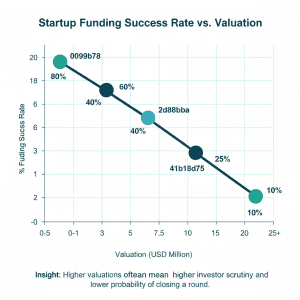

3. Venture Capital (High Growth Brands)

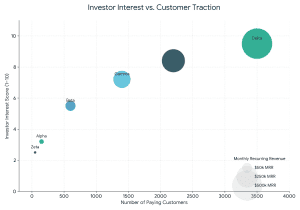

If your clothing brand shows:

- Strong unit economics

- Repeat customers

- High LTV/CAC ratio

- 3x–5x annual growth

You can appeal to such VC companies as Sequoia Capital India or Accel India.

This fits in with brands which have national or global expansion.

4. Bank loans and current capital.

In the case of fashion companies that require high inventory to operate, organized bank loans such as the State Bank of India can be used to finance:

- Seasonal stock

- Machinery

- Manufacturing units

Nevertheless, collateral and credit history are important.

5. Private Equity (Established Brands)

Securities are typically bought and held within a portfolio owned by a single investor or collective of investors (such as a family or investment firm). Private Equity (Established Brands): Securities are usually purchased and held in a portfolio owned by an individual investment or group of investors (a family or investment firm).

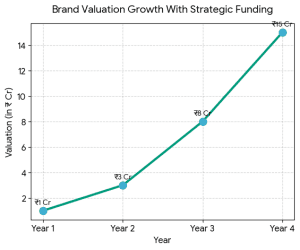

Provided that your clothing business generates:

- ₹10+ crore revenue

- EBITDA stability

- Strong brand recall

Funding by the private equity can be faster:

- Store expansion

- International distribution

- M&A opportunities

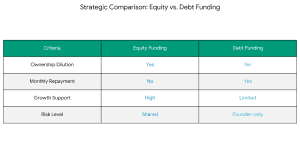

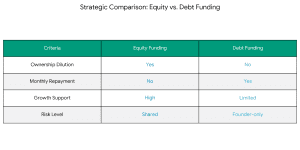

Strategic Funding vs Traditional Funding

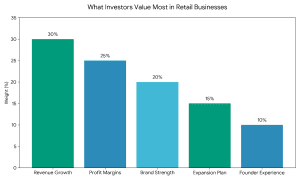

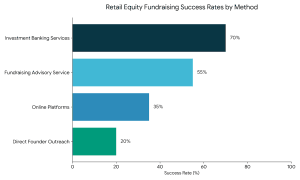

Strategic funding integrates investment banking services, valuation advisory, and capital structuring.

How Investment Banking Services Help Clothing Brands

Professional investment banking services offer:

1 Business Valuation

Experts calculate: using a business valuation calculator.

- Revenue multiples

- EBITDA multiples

- DCF valuation

- Comparable brand analysis

This makes sure that you do not water down equity.

2. Financial Modeling & Projections

2. Financial Modeling & Projections

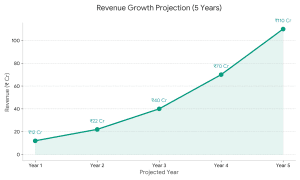

Investors expect:

- 3–5 year projections

- Break-even analysis

- Working capital cycle

- Inventory turnover ratios

Effective financial modelling enhances the probability of funding.

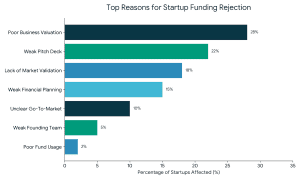

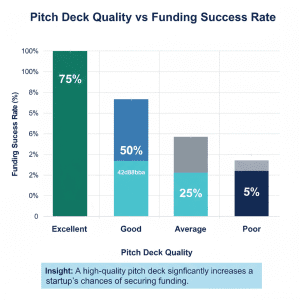

3. Pitch Deck Preparation

Professionally designed pitch deck templates are:

- Market size

- Problem & solution

- Product differentiation

- Competitive landscape

- Financial projections

- Funding ask & use of funds

An outstanding pitch makes the investor really interested.

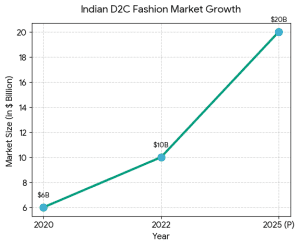

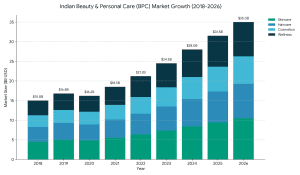

Startup Funding in India: Why Fashion Is Attractive

The Indian fashion and D2C market is growing because:

The Indian fashion and D2C market is growing because:

- Rising disposable income

- E-commerce penetration

- Influencer-driven commerce

- Sustainable fashion trends

Government programs such as Startup India have enhanced access to startup funding in India particularly to consumer brands.

Step-by-Step Guide to Secure Strategic Funding for Clothing Business

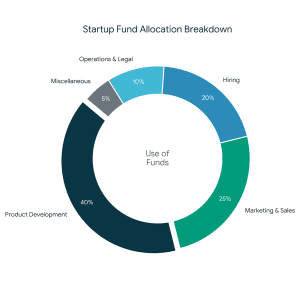

Step 1: Capital Requirement: Defining Capital Requirement.

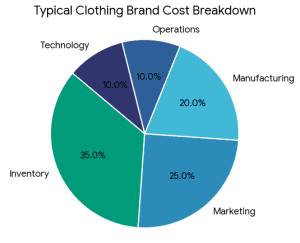

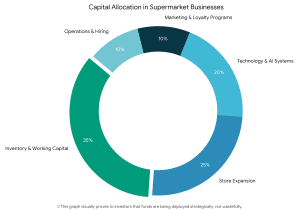

Break down funding need into:

- Inventory purchase

- Marketing budget

- Hiring

- Warehousing

- Technology

Step 2: Business Valuation.

- Instruct a business valuation calculator or employ valuation experts.

- The problem of overvaluation is frightening to investors. Underestimation is detrimental to founders.

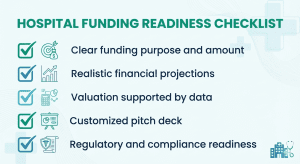

Step 3: Prepare Investor-Ready Documentation

You need:

- Pitch deck

- Financial model

- Cap table

- Business plan

- Legal compliance documents

Step 4: Identify the Right Investors

Fashion is not understood by every investor.

Target:

- Consumer-focused VCs

- Angel investors that are lifestyle-oriented.

- D2C funds

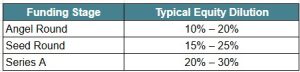

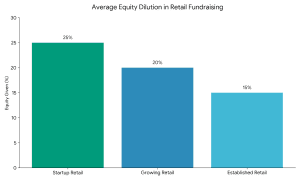

Step 5: Negotiate Smartly

Key negotiation areas:

- Valuation

- Equity dilution

- Board rights

- Exit clauses

- Liquidation preference

Professional investment banking services are essential in this place.

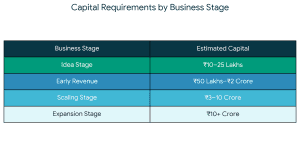

How Much Funding Does a Clothing Brand Need?

Approximate funding requirement:

Actual requirement depends on production model and growth strategy.

Why Strategic Funding Is Better Than Just Capital

Why Strategic Funding Is Better Than Just Capital

Strategic funding provides:

- Industry connections

- Supply chain partnerships

- Distribution support Retail distribution support

- Brand-building advisory

- Exit planning

It will turn your clothing business into an investable, scalable asset.

Final Thoughts

Attaining strategic funding of clothing business does not merely entail walking to investors. It demands:

- Accurate valuation

- Strong financial planning

- Presentation of pitch by the professionals.

- Targeted investor strategy

To achieve sustainable scaling, you can collaborate with professionals that provide investment banking services, valuation advisory, and financing to increase your scaling chances significantly. Fashion is creative. Funding should be strategic.

Frequently Asked Questions (FAQs)

Q1. What is the best way to fund a clothing brand in India?

The most suitable method is dependent on your stage. Angel funding should be considered by early-stage brands and venture capital or private equity under Indian structure startup funding frameworks by scaling brands.

Q2. What is my clothing brand valuation?

One can take help of a business valuation calculator or visit valuation specialists who use revenue multiple or DCF techniques.

Q3. Do investors invest in small fashion business startups?

Yes, particularly when you demonstrate good branding, niche positioning and scaled D2C opportunities.

Q4. What documents are required for strategic funding?

Pitch deck, financial projections, cap table, compliance documents, and valuation report.

If you are planning to raise strategic funding for clothing business, now is the time to structure your growth roadmap professionally and attract the right capital partners.

2. Financial Modeling & Projections

2. Financial Modeling & Projections Why Strategic Funding Is Better Than Just Capital

Why Strategic Funding Is Better Than Just Capital

2. Weak or Incomplete Pitch Deck

2. Weak or Incomplete Pitch Deck 3. Lack of Market Validation

3. Lack of Market Validation 4. Weak Financial Planning and Projections

4. Weak Financial Planning and Projections 8. Not Investor-Ready or Poor Timing

8. Not Investor-Ready or Poor Timing

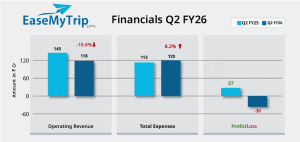

Image Source: Entrackr

Image Source: Entrackr