How to Get Strategic Funding for Food Sector Businesses (Complete Guide)

Food is one of the most robust and fast-growing sectors across the world. Organic agriculture and food processing, D2C brands and cloud kitchens: entrepreneurs are actively looking to raise funds in the Food Sector Businesses to grow operations, scale distribution, and better brand positioning.

As someone with 8+ years of experience in the investment banking services sector and consulting startups in food, FMCG, and agribusiness sectors, I have personally observed what makes fund-able food businesses and those that can never raise capital.

This complete guide will walk you through:

- Types of funding available

- How investors evaluate food businesses

- Strategic startup fundraising process

- Documents you must prepare

- Common mistakes to avoid

- Expert insights on valuation & scaling

Why the Food Sector Attracts Strategic Investors

Why the Food Sector Attracts Strategic Investors

The food industry offers:

- Consistent consumer demand

- High scalability potential

- Good exit (M&A and IPO) opportunities.

- Increase in the demand of organic and health products.

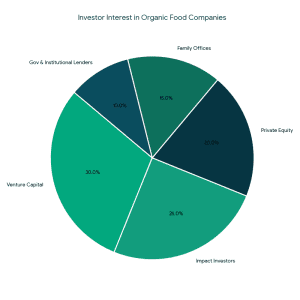

Specifically, Investment in organic Food Industry has also grown considerably with the growing health consciousness and sustainability trend.

Investors are now investing in more than restaurants they are:

- Organic food brands

- Plant-based startups

- Food tech platforms

- Cold chain logistics

- Agri-processing units

- D2C packaged food brands

What Is Strategic Funding For The Food Sector?

What Is Strategic Funding For The Food Sector?

Strategic funding refers to capital raised by investment by investors who do not just bring money.

They bring:

- Distribution networks

- Industry expertise

- Operational support

- Market access

- Brand positioning support

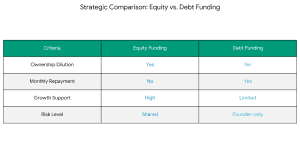

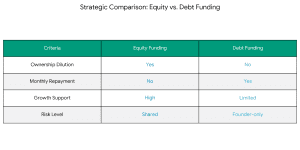

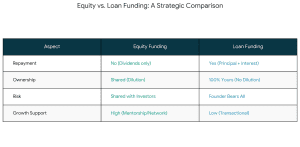

In contrast to the traditional loans, the strategic investors are interested in equity, long-term growth, and value creation.

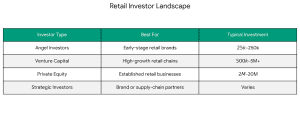

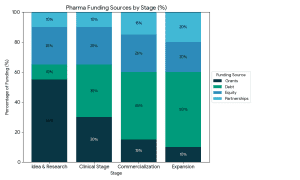

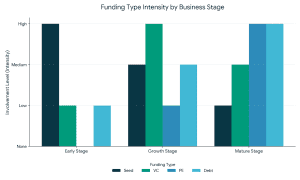

1. Seed & Angel Investment

Best for:

- Early-stage startups

- MVP stage food brands

- D2C organic food companies

The amount of startup fundraising that is usually backed by angels is 25L-2Cr (depending on location).

2. Venture Capital (VC Funding)

Suitable for:

- Brands of growing packaged foods.

- Food tech platforms

- Organic food startups that are scalable.

VCs typically invest when:

- Revenue traction is visible

- Unit economics are becoming better.

- There is a high fit of a founder-market.

3. Private Equity (PE)

Best for:

- Mature food processing factories.

- Local brands are expanding in the country.

- Companies that have 20Cr+ turnover (varying).

PE firms give much attention to profitability and growth potential.

4. Bank & Institutional Debt

Ideal for:

- Machinery purchase

- Working capital

- Factory expansion

Debt however needs fixed cash flow and security.

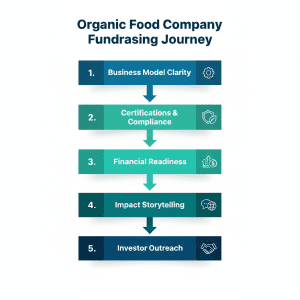

Step-by-Step Process to Raise Funding For Food Sector

Step 1: Validate Product-Market Fit

Prior to pitching investors, inquire:

- Is there repeat purchase?

- Are premium prices being charged to customers?

- Is gross margin sustainable?

Businesses that fail in the food industry do not fail due to lack of funds instead of them failing in market validation.

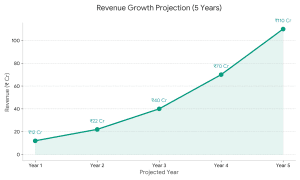

Step 2: Prepare Financial Projections

Investors expect:

- 3–5 year projections

- Revenue model clarity

- EBITDA margin roadmap

- Working capital cycle analysis.

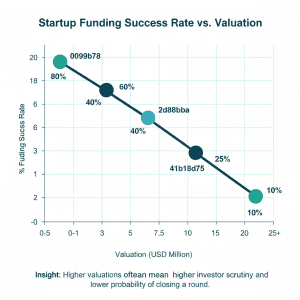

Estimate: Use a professional business valuation calculator to estimate:

- Pre-money valuation

- Equity dilution

- Investment requirement

This prevents unrealistic valuation viewpoints in the context of startup money-raising.

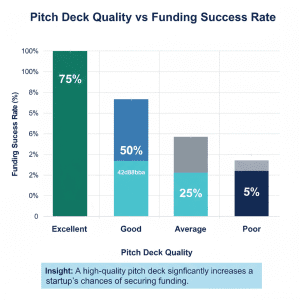

Step 3: Prepare an Investor Ready Pitch Deck.

Your pitch deck must include:

- Problem statement

- Solution

- Market size (TAM/SAM/SOM)

- Business model

- Revenue traction

- Unit economics

- Competitive landscape

- Growth strategy

- Financial projections

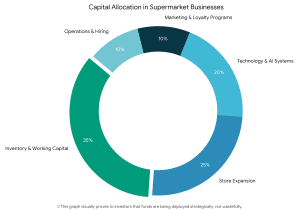

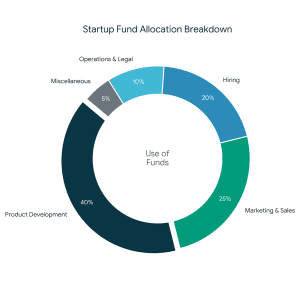

- Funding ask & utilization

The pitch deck templates that are of high quality with a focus on food startups enhance rates of conversion by investors significantly.

Step 4: Due Diligence Preparation.

Investors will verify:

- FSSAI licenses

- Supply chain agreements

- Vendor contracts

- Founder background

- Compliance & taxation

- Financial statements

Due diligence is simplified and the probability of deal closures is enhanced with the help of professional investment banking services.

How Investors Evaluate Food Businesses

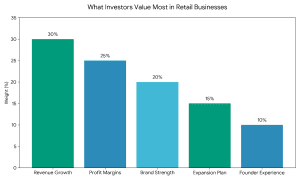

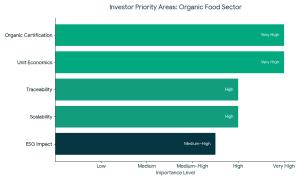

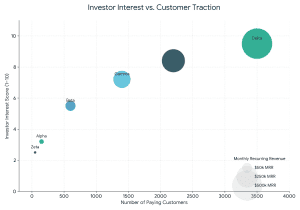

As an adviser to food startups, investors are interested in:

As an adviser to food startups, investors are interested in:

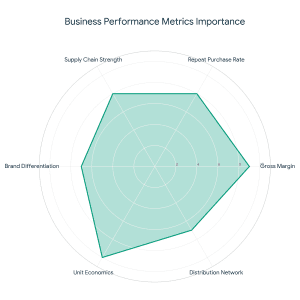

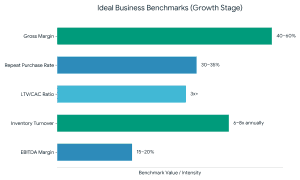

1. Gross Margin

The average gross margins of healthy food brands are 40-60% (depending on models).

2. Repeat Purchase Rate

Repeat rate of 3035 or more in D2C brands will be appealing.

3. Distribution Strategy

- Offline retail presence

- Modern trade partnerships

- Positioning based on online marketplace.

4. Supply Chain Strength

Of particular importance in Funding in Organic Food Companies, which is a place where the authenticity of the sources counts.

5. Brand Differentiation

Premium Valuation Organic, preservative-free, plant-based, gluten-free positioning tend to appeal to higher values.

Funding in Organic Food Companies: Why Investors Love It

As an adviser to food startups, investors are interested in:

1. Gross Margin

The average gross margins of healthy food brands are 4060% (depending on models).

2. Repeat Purchase Rate

Repeat rate of 3035 or more in D2C brands will be appealing.

3. Distribution Strategy

Offline retail presence

Modern trade partnerships

Positioning based on online marketplace.

4. Supply Chain Strength

Of particular importance in Funding in Organic Food Companies, which is a place where the authenticity of the sources counts.

5. Brand Differentiation

Premium Valuation Organic, preservative-free, plant-based, gluten-free positioning tend to appeal to higher values.

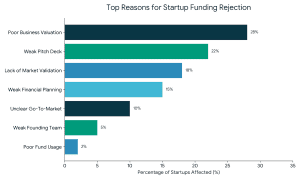

Common Mistakes While Raising Funding For Food Sector

- Overestimating valuation

- Weak unit economics

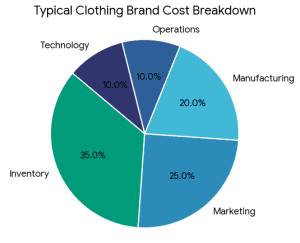

- Poor inventory management

- Not taking into account the working capital cycles.

- Standard pitch deck templates which are not customized.

- Attacking investors without warm introductions.

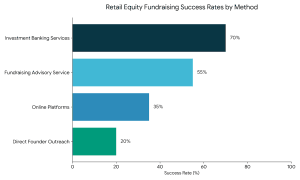

How Investment Banking Services Add Value

Professional investment banking can:

- Plan the fundraising process.

- Prepare financial models

- Conduct valuation analysis

- Find the suitable investor type.

- Negotiate term sheets

- Deal execution.

Food sector fundraising is relationship based. It does not have the same importance as strategic positioning compared to mass investor outreach.

Key Metrics You Must Track Before Fundraising

The most important metrics that you should monitor prior to fundraising.

- Cost of Acquiring Customer (CAC)

- Lifetime Value (LTV)

- Gross margin

- Burn rate

- Inventory turnover ratio

- Break-even timeline

Even the most effective startup fundraising will not work without a powerful grip on these numbers.

Even the most effective startup fundraising will not work without a powerful grip on these numbers.

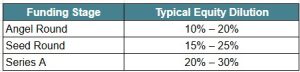

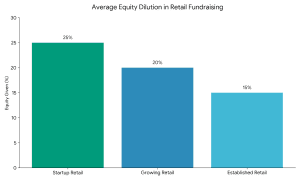

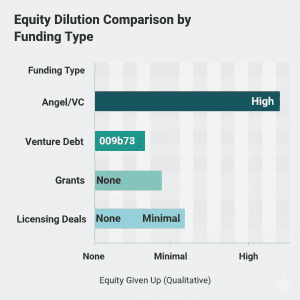

How Much Equity Should You Dilute?

The founders at an early stage tend to dilute:

- 10–20% in seed round

- 15–25% in Series A

A business valuation calculator is a tool to consider with care so as not to over dilute the company to the point that future funding round is restricted.

Final Thoughts:

You should raise funding if:

- You have validated demand

- Margins are scalable

- You want rapid expansion

- You must have strategic alliances.

Avoid funding if:

- Unit economics are broken

- You have no operational control.

- Cash flow is unstable

Conclusion:

Finding Money in Food Sector companies will not be as simple as a thought. It demands:

- Financial discipline

- Market validation

- Strategic positioning

- Professional documentation

- Strong negotiation

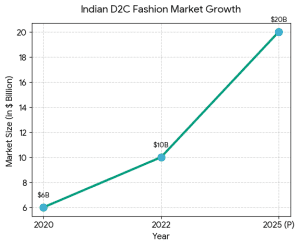

As more people are interested in Funding in Organic Food Companies and scalable D2C food brands, it is a good moment to raise capital now, assuming your fundamentals are sound.

When you go about the startup fundraising process in a strategic manner, utilise investment banking services appropriately, and make all the necessary preparation in terms of proper valuation tools and pitch deck templates, your food business will be able to attract the right investors and grow in a sustainable manner.

Frequently Asked Questions (FAQs)

1. What is the best way to get funding for food sector startups?

The best way to secure Funding For Food Sector startups is by validating product-market fit, preparing financial projections, building investor-ready pitch deck templates, and targeting strategic investors aligned with your food category.

2. How do investors evaluate food businesses?

Funding For Food Sector startups can be obtained best when you validate product-market fit, develop financial predictions, create investor-ready pitch deck templates and identify strategic investors who fit your food category.

3.Is funding available for organic food companies?

Investors evaluate:

- Gross margin

- Repeat purchase rate

- Supply chain efficiency

- Unit economics

- Brand differentiation

- Scalability potential

Professional investment banking facilitates the finances appropriately in advance of meetings with investors.

4. Is funding available for organic food companies?

Organic Food Companies are increasing their funding because of the increasing demand in sustainable and health oriented products. Certification authenticity, margin sustainability and traceable sourcing are the priorities of investors.

5. Do I need a pitch deck to raise funds?

Yes. Strong pitch deck templates significantly increase startup fundraising success rates by presenting financial clarity, growth road-map, and competitive advantage.

What Is Strategic Funding For The Food Sector?

What Is Strategic Funding For The Food Sector?

What Is the Best Way to Fund a Clothing Brand?

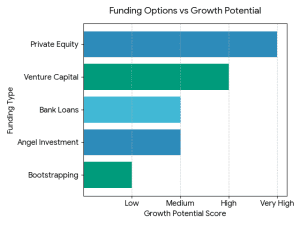

What Is the Best Way to Fund a Clothing Brand? It does not have a single, universal answer. The optimal financing source will be based on:

It does not have a single, universal answer. The optimal financing source will be based on:

2. Financial Modeling & Projections

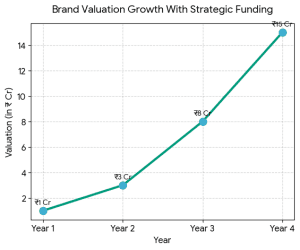

2. Financial Modeling & Projections The Indian fashion and D2C market is growing because:

The Indian fashion and D2C market is growing because:

Why Strategic Funding Is Better Than Just Capital

Why Strategic Funding Is Better Than Just Capital

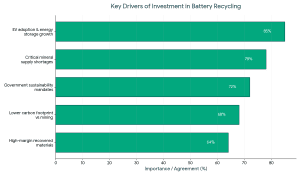

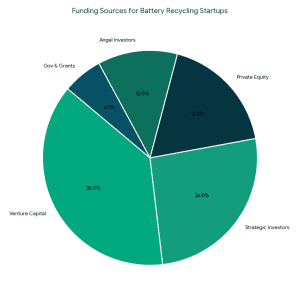

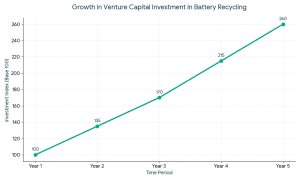

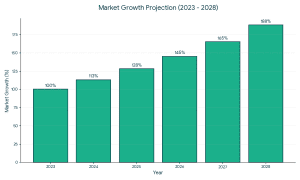

Consequently, the investment in battery recycling startups has taken precedence in clean-tech centric funds and ESG investors, as well as industry actors with a strategic agenda.

Consequently, the investment in battery recycling startups has taken precedence in clean-tech centric funds and ESG investors, as well as industry actors with a strategic agenda.

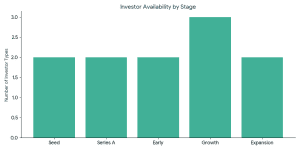

1. Angel Investors for Battery Recycling

1. Angel Investors for Battery Recycling VCs typically invest when:

VCs typically invest when: The ideal investors in battery recycling startups usually have the following characteristics:

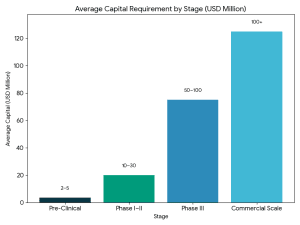

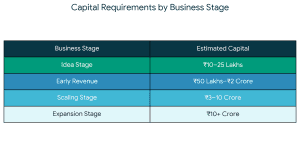

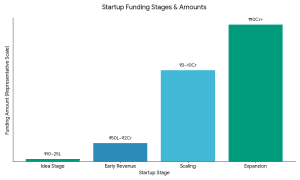

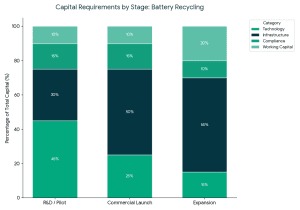

The ideal investors in battery recycling startups usually have the following characteristics: Capital requirements vary by stage:

Capital requirements vary by stage:

Strong market fundamentals are leading to increased support of organic and clean-label food brands by investors.

Strong market fundamentals are leading to increased support of organic and clean-label food brands by investors. Types of Funding Available for Organic Food Companies

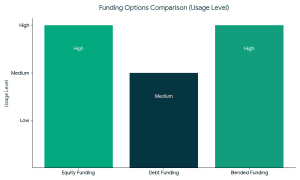

Types of Funding Available for Organic Food Companies 1. Equity Funding

1. Equity Funding The founders should meet the expectations of the investors to raise funds successfully in organic food companies.

The founders should meet the expectations of the investors to raise funds successfully in organic food companies. Preparation is the biggest differentiation between funded and unfunded companies.

Preparation is the biggest differentiation between funded and unfunded companies. Not all capital is equal.

Not all capital is equal.

2. Weak or Incomplete Pitch Deck

2. Weak or Incomplete Pitch Deck 3. Lack of Market Validation

3. Lack of Market Validation 4. Weak Financial Planning and Projections

4. Weak Financial Planning and Projections 8. Not Investor-Ready or Poor Timing

8. Not Investor-Ready or Poor Timing