What Is Post-Money Valuation and Why It Matters in Startup Funding?

In raising capital, particularly in convertible notes and equity, startups and their founders tend to wander in a labyrinth of financial terminologies. One of the most important yet misunderstood terms is post money valuation. Seed rounds and Series A rounds are different financing preparations, and the knowledge of post-money valuation becomes important to not give up too much equity or retain control of the startup.

In this article, you will get acquainted with everything concerning the post-money valuation, its importance, how it differs from the pre-money valuation, and how to employ it judiciously in making decisions with regard to funding.

Bonus Tip:

Want to find out the value of your business but tired of companies charging a fortune? Don’t worry — use this free business valuation tool and get an accurate estimate in just 10 minutes. Fast, easy, and founder-friendly!

What Is Post-Money Valuation?

Post-Money Valuation is how much a company costs immediately following an investment. Sometimes referred to as including the investment cash, it is basically how investors assign a percentage of ownership of the business to themselves once the funding round has been completed.

Also Learn About: How to find investors?

Why Does Post-Money Valuation Matter?

For founders, investors, and anyone else in charge of a startup’s capital table, knowing your post money valuation is essential. This is the reason:

- Determines Equity Ownership

The percentage of equity that an investor receives is determined by dividing their contribution by the post-money valuation. This directly affects how much of your business you are giving away.

For instance, an investor who invests $500K in a $2M valuation after investment gains 25% ownership.

- Sets the Benchmark for Future Rounds:

Your most recent post-money valuation will frequently be used as a benchmark by future investors. Additionally, if your valuation has increased since the last round, it may indicate that you have little room for growth going forward, which could lead to down rounds or unfavourable terms.

- Effects Control Cap Table

Your control is affected by the dilution problem. Over time, you risk losing majority control if you don’t keep an eye on your post-money valuation. A balanced and healthy cap table is ensured by being aware of this metric.

- Used in Convertible Note and SAFE Agreements

The amount of equity that SAFEs and convertible notes convert into in a future priced round is determined by the valuation after investment cap. A misinterpretation of this could result in unanticipated dilution.

Pre-Money vs. Post-Money Valuation: Key Differences

|

Feature |

Pre-Money Valuation |

Post-Money Valuation |

|

Timing |

Before investment |

After investment |

|

Includes New Capital? |

No |

Yes |

|

Used for |

Negotiating ownership before funding | Calculating final ownership |

| Affects Dilution? | Not directly |

Yes |

|

Appears on SAFE Notes? |

Not typically |

Yes, with caps |

| Simpler for Founders? | Yes |

More precise but more complex |

Example:

- As an example, Startup A is valued at $6 million before funding.

- It raises an investment of $2 million.

- $8 million is the post-money valuation.

- The investor receives $2 million divided by $8 million, or 25% equity.

How Do Investors Feel About Post-Money Valuation?

When deciding how much of a company to invest in, investors use the post-money valuation as a standard. But it’s more than just numbers:

- They frequently aim for a particular ownership percentage (10–25%).

- They receive less equity for the same investment if the post-money valuation is higher.

- Their expected return multiple is set by it. Your exit must be larger to give them the same return if the valuation is higher today.

Therefore, make sure your growth forecast and milestones are both ambitious and credible if you’re requesting a high post-money valuation.

Real-World Example:

Let’s compare two similar startups:

Startup A:

- Pre-money valuation:$4 million

- Investment: $1 million

- Post money valuation = $5 million

- Investor receives:$1 million divided by $5 million equals 20% equity for the investor.

Startup B:

- Pre-money valuation: $9 million

- Investment: $1 million

- Post money valuation = $10 million

- Investor receives:$1 million divided by $10 million, or 10% equity.

The investor receives 10 percent equity or 1 million dollars/ 10 million dollars.

Lesson: If higher pre-money valuation leads to higher post-money valuation then equity dilution of the founders is reduced.

Common Mistakes Founders Make:

Although post-money valuation is important, many founders make mistakes in a few crucial areas:

- Confusion between pre- and post-money:

Unexpected dilution results from many early founders’ ignorance of the distinction. Not understanding that this is post money, which releases more equity than anticipated, they might believe they are raising at a $5 million valuation.

- Neglecting the Effects of Convertible Notes and SAFEs:

Founders are unaware of the dilution that may result from these instruments’ conversion into equity at a post-money valuation cap until it is too late. Your cap table may be severely disrupted if you don’t model this.

- Overestimating Too Early :

If your metrics don’t support it, a high after funding valuation could hurt your chances in the next round. This may result in a down round, which hurts your credibility.

How to Use Post-Money Valuation Strategically?

You can use valuation after investment as a potent tool to influence your fundraising and expansion once you understand how it operates.

- Model Dilution

Use your post money valuation to estimate your ownership before you sign a term sheet. Always think about how future rounds, SAFEs, or options pools will affect things.

- Make Smart Negotiations by Using Valuation

Consider the significance of the valuation figure for ownership rather than just the number itself. If it means getting better terms or investors, you can offer a slightly lower valuation.

- Align It With Milestones

Connect your desired post financing valuation to quantifiable, real-world benchmarks (market share, user growth, and ARR). This helps you prepare for the next funding round and supports your request.

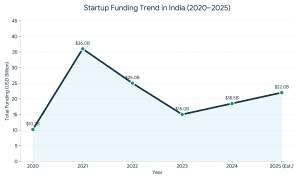

Post-Money Valuation in Today’s Fundraising Landscape:

Investors are more cautious in the current market. The days of exorbitant valuations with little traction are long gone. This implies:

- Valuations Are Under More Scrutiny:

Metrics-driven valuation justification is now required by investors. The days of raising $20 million post-money on an idea alone are long gone.

- SAFEs are more prevalent, but they are also riskier:

Valuation after Investment caps are now present in the majority of SAFEs. The founders were not aware that during Series A or B, these converts might experience significant dilution.

- Capital Is Concentrated

Fewer startups will receive more funding. Clear conversion value ,what does their equity buy,is what investors want to see. Post financing valuation is used to calculate that.

- Tools Make It Easy to Be Informed:

Founders have no excuse for not knowing their numbers, thanks to resources like Carta, Pulley, and free online cap table calculators.

How Valuation After Investment Affects Option Pools?

The effect of valuation after Investment on the employee stock option pool (ESOP) is a frequently disregarded factor. The pre-money valuation frequently includes the 10–15% option pool that investors typically demand be established prior to funding. This indicates that the founders, not the investors, are the source of the dilution. For instance, if an investor wants a 15% option pool after funding a startup with a $8 million pre-money valuation, that pool must be set aside prior to the investment, which lowers the founders’ equity. To ensure that the dilution is distributed equitably, the founders should bargain for the option pool to be included after the money is raised. Being aware of this can help prevent unplanned ownership loss.

Key Takeaways:

- Post money valuation = Pre-money + Investment

- It establishes the amount of equity investors receive.

- It impacts your control, cap table, and upcoming fundraising.

- Common founder errors include overvaluing too soon, ignoring SAFEs and notes, and conflating it with pre-money.

- Make strategic use of it to align with goals, model dilution, and engage in wise negotiation.

- Knowing your after funding valuation is essential in the current environment.

Conclusion:

Mastering the concept of after funding valuation is not just a finance exercise,it’s a leadership decision. It shows investors that you are long-term oriented, understand their expectations, and value the equity of your team.

A vanity metric shouldn’t be used for valuation. It ought to show your present development as well as your potential for the future. Make sure your post financing valuation fits your plan, not just your goals, whether you’re raising money through convertible notes, SAFEs, or equity.

As in the start up environment, being unaware of valuation may make you pay with everything, including control, ownership and even the future of your business.

Also Read: What Types of Investors Do Investment Banks Work With?

Frequently Asked Questions (FAQs):

1. What is post money valuation in simple terms?

The total value of a startup following an investment is known as post financing valuation. The amount of capital invested is one of its components. It aids in figuring out the investor’s post-round ownership stake in the business.

2. How is post financing valuation calculated?

The following formula is used to calculate it:

Post Money Valuation is equal with Pre Money Valuation and Investment Amount

E.g., consider a startup that raises 1m and is pre-money valued at 5m, then its post financing valuation is 6m.

3. What founders need to know about valuation after Investment?

The amount of equity a founder gives up is directly impacted by post financing valuation. Control, upcoming funding rounds, cap table structure, and the conversion of SAFEs or convertible notes into equity are also impacted.

4. How does post money valuation affect investor ownership?

The calculation of investor ownership is:

Investment/Post-Money Appraisal

When an investor invests 1 million dollars in a business at a post financing valuation of 5 million dollars, the investor gets 20 percent ownership of the business.

5. Do SAFEs and convertible notes use post money valuation?

In fact, one typical aspect of current SAFE and convertible note agreements is the presence of post financing valuation caps, which represent the maximum price, in which case those instruments are converted into equity.

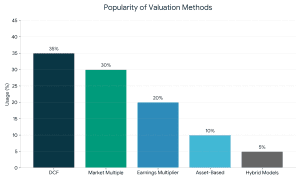

Why Does Business Valuation Matters?

Why Does Business Valuation Matters? Most reliable

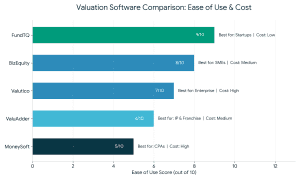

Most reliable  With many options on the market, choosing the right business valuation program is key. Meet the leading tools that we can expect in 2025:

With many options on the market, choosing the right business valuation program is key. Meet the leading tools that we can expect in 2025:

Summary

Summary